all online car title loans

The Ultimate Guide to All Online Car Title Loans: Fast Cash, Completely Digital

Meta Description: Need cash fast? Explore our complete guide to all online car title loans. Learn how to get a loan from home, with options for bad credit, no credit check, and no store visit. Get instant approval and understand the process, risks, and state-specific rules for Texas, California, Florida, and more.

Introduction: Your Car, Your Financial Lifeline

Life is full of unexpected financial hurdles. A medical emergency, a crucial home repair, or an unforeseen bill can leave even the most careful budget stretched thin. When you need access to cash quickly and traditional lenders like banks turn you down due to bad credit or slow processes, you need to consider alternative solutions.

This is where the modern evolution of an old concept comes in: all online car title loans.

Gone are the days of mandatory trips to a brick-and-mortar storefront. Today, the entire process—from application to approval to funding—can be handled digitally from the comfort and privacy of your own home. This guide will demystify online car title loans, explaining how they work, their benefits and risks, and what you need to know to make an informed decision. We’ll cover everything from online car title loans no credit check to state-specific information for online car title loans Texas and online car title loans California.

What Exactly is an Online Car Title Loan?

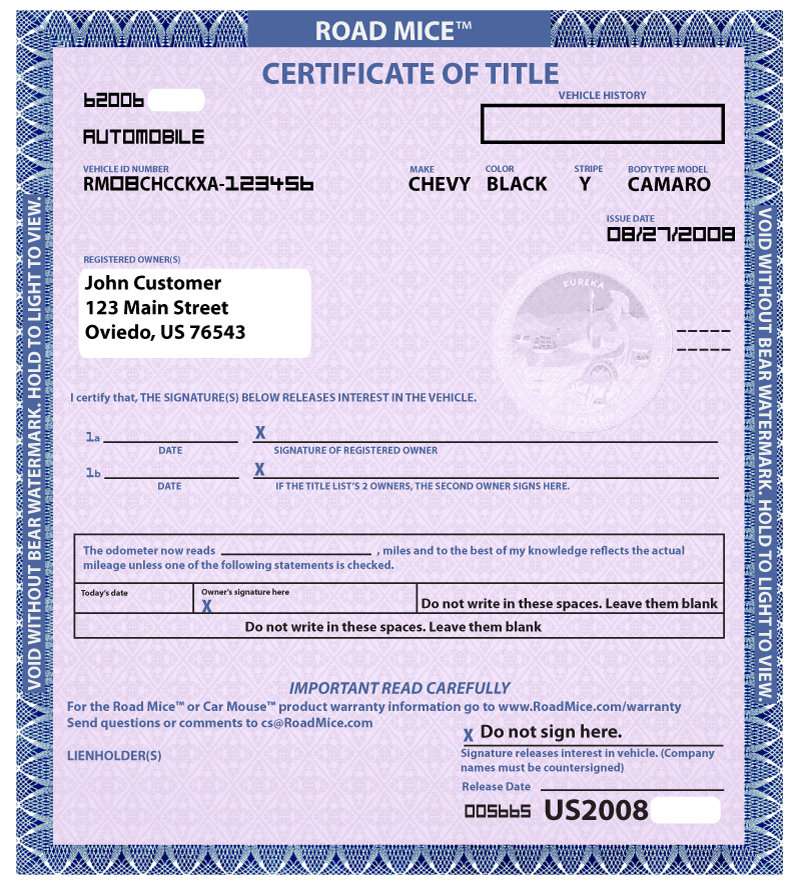

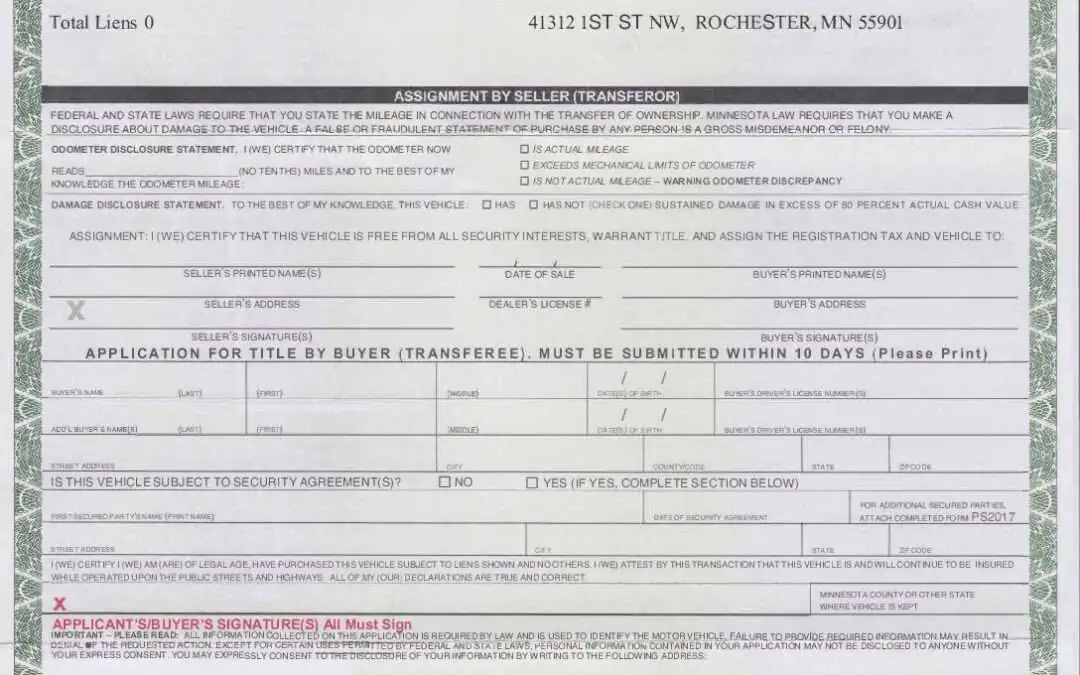

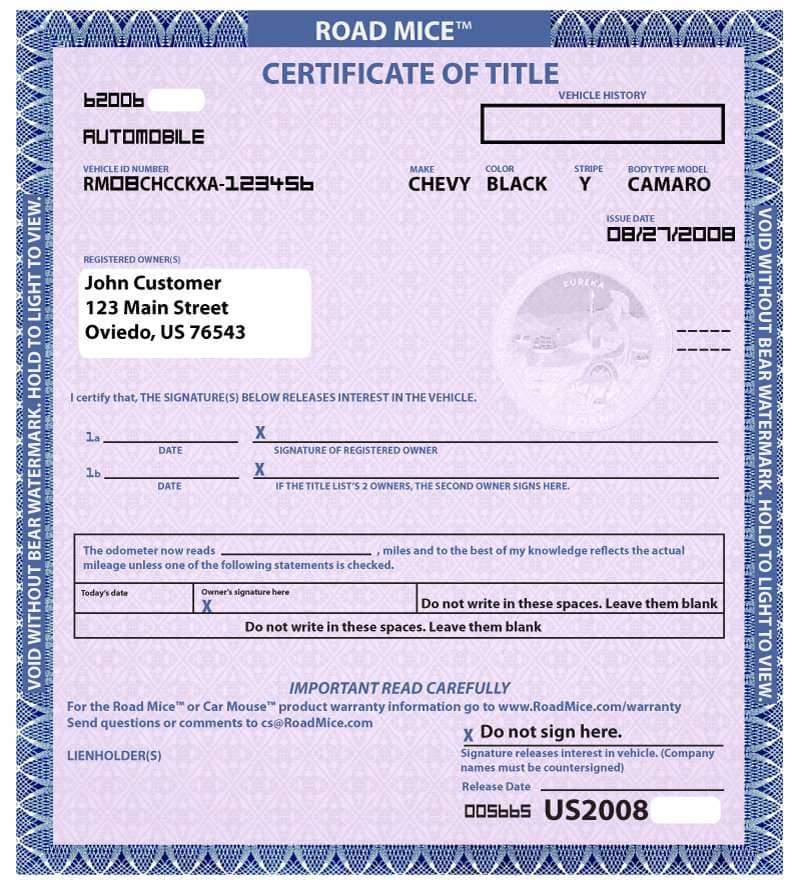

A car title loan is a short-term, secured loan where you use your vehicle’s title as collateral. The lender holds onto the title (the “pink slip”) while you repay the loan. Once the loan is paid in full, the title is returned to you.

An online car title loan simplifies this process by moving it to a digital platform. You provide information and documents electronically, get approved remotely, and often receive funds via direct deposit, all without ever setting foot in an office.

How Does an Online Car Title Loan Work? (The 5-Step Digital Process)

- Online Application: You start by filling out a simple form on the lender’s website. This typically asks for your personal information, details about your vehicle (make, model, year, mileage), and the loan amount you’re seeking. This step is where you search for terms like online car title loans near me – the “near me” now refers to lenders licensed to operate in your state, not a physical location.

- Vehicle Valuation: The lender uses the details you provide to perform an automated valuation. Some lenders may require a quick virtual inspection, which can be done via video call or by you submitting photos of your car. This is a key differentiator for loans advertising “online car title loans no inspection.

- Review & Approval: The lender assesses your application and vehicle value. For loans marketed as online car title loans no credit check, the approval decision is based almost solely on the value of your car and your ability to repay, not your credit history. You’ll then receive a loan offer detailing the amount, fees, APR (Annual Percentage Rate), and repayment terms. Online car title loans instant approval is often possible at this stage.

- E-Signature and Verification: If you accept the offer, you’ll sign the loan agreement digitally. You may also need to provide a copy of your driver’s license, proof of insurance, and a clear photo of your car’s title. For “online car title loans with no income verification,” this step might be skipped, but most legitimate lenders will require some proof of ability to repay.

- Funding: Once the contract is signed and verified, the lender will disburse the funds. The fastest method is through direct deposit into your bank account, which can sometimes happen the same day or within 24 hours.

Who is a Candidate for an Online Car Title Loan?

These loans are designed for specific situations and borrowers:

- Individuals with Bad or No Credit: Since the loan is secured by your vehicle, your credit score is often a secondary factor.

- Those Needing Cash Urgently: The online process is designed for speed, providing a solution for financial emergencies.

- People Who Own Their Vehicle Outright: You must be the sole owner of the car with no existing loans or leases against it.

- Borrowers Seeking Convenience: The ability to handle everything online (“car title loans completely online”) is a major draw for those with busy schedules or limited mobility.

The Significant Advantages of Going Fully Online

Choosing an all online title loan over a traditional storefront model comes with several compelling benefits:

- Unmatched Convenience: Apply anytime, anywhere—on your lunch break, late at night, or from your living room. There are no store visits required.

- Speed and Efficiency: The digital process cuts down on paperwork and processing time, leading to faster approvals and funding.

- Privacy and Discretion: You can explore your financial options without discussing your situation face-to-face with a stranger.

- Broader Comparison Shopping: It’s easier to quickly compare offers from multiple online car title loan companies to find the best terms for your situation.

- Streamlined Process: Digital document submission and e-signatures make the entire experience smooth and efficient.

Understanding the Risks and Responsibilities

Car title loans are a serious financial commitment. It is crucial to understand the risks before you proceed.

- High Costs: Title loans are known for their high APRs, which can sometimes exceed 100% or even 200%. The convenience of an online auto title loan does not negate this fact.

- Risk of Repossession: This is the biggest risk. If you fail to repay the loan according to the terms, the lender has the legal right to repossess your vehicle and sell it to recoup their money.

- Debt Cycle Potential: The short-term nature and high fees can make it difficult to pay off the principal, potentially trapping borrowers in a cycle of renewing or “rolling over” the loan, incurring additional fees each time.

- Predatory Lending Practices: While regulations exist, some unscrupulous lenders may target vulnerable individuals. Always work with a licensed, reputable company.

A State-by-State Look at Online Car Title Loans

Regulations for title loans vary dramatically by state. Some states have strict caps on interest rates and fees, while others have very few restrictions. Some states, like New York and Pennsylvania, effectively ban them altogether.

- Online Car Title Loans Texas: Texas has limited regulation on title loans. There are no caps on interest rates for loans over a certain amount, making it critical to shop around and read the fine print carefully.

- Online Car Title Loans California: California law caps title loans at \$2,500–\$25,000 with terms between 12-60 months. Rates are still high but are regulated.

- Online Car Title Loans Florida: Florida is a major market for title loans. Regulations include a maximum loan amount of $5,000 for military members and certain disclosure requirements, but APRs can still be very high.

- Online Car Title Loans Ohio: Ohio has implemented stricter reforms, capping APRs at a maximum of 30% for loans under \$5,000, making it one of the more borrower-friendly states.

- Online Car Title Loans North Carolina (NC): North Carolina has usury laws that effectively prohibit high-interest title loans.

- Online Car Title Loans Arizona, Arkansas, Illinois, Virginia: Each of these states has its own specific set of rules governing maximum loan amounts, fees, and APR caps. A reputable lender will automatically adhere to your state’s laws.

Always confirm that any lender you consider is licensed to operate in your state.

Exploring Your Alternatives

Before committing to a title loan, consider these alternatives, which may offer more favorable terms:

- Personal Loans (Credit Unions/Banks): Especially from a local credit union, which often offers smaller, short-term loans with better rates to members, even with less-than-perfect credit.

- Payment Plans: Contact the company you owe money to (e.g., hospital, utility company) and ask about setting up a payment plan.

- Side Hustles or Selling Items: Generating extra income or selling unused items can provide cash without incurring debt.

- Borrowing from Family/Friends: While sensitive, this option typically comes with little to no interest.

- Credit Counseling: A non-profit credit counseling agency can help you review your finances and develop a debt management plan.

How to Choose a Reputable Online Title Loan Lender

Not all online title loan companies are created equal. Protect yourself by choosing a reputable lender.

- Check State Licensing: Verify the lender is licensed in your state. This is non-negotiable.

- Read Reviews: Look for customer reviews on independent sites to gauge others’ experiences.

- Transparency: The lender should be upfront about all fees, the APR, and the repayment schedule. There should be no hidden charges.

- Secure Website: Ensure their website uses “https://” and has a padlock icon in the address bar, indicating your data is encrypted.

- Clear Contact Information: A legitimate business will have a physical address and customer service contact details readily available.

Frequently Asked Questions (FAQs)

Q1: Can I get a car title loan if I have bad credit?

A: Absolutely. This is one of the primary features of online car title loans for bad credit. Lenders are primarily concerned with the value of your vehicle and your ability to repay the loan, not your FICO score.

Q2: Is a credit check required?

A: Many lenders offering online car title loans no credit check will not perform a hard inquiry on your credit report. They may do a soft pull or none at all, as the loan is secured by your asset.

Q3: What if I don’t have a job? Can I still get a loan?

A: Some lenders offer online car title loans with no income verification or no proof of income. They may accept alternative forms of income like disability benefits, social security, pensions, or rental income. However, you must demonstrate some form of ability to repay the loan.

Q4: How much money can I borrow?

A: The loan amount is typically a percentage of your car’s current market value, often between 25% and 50%. For example, if your car is worth $10,000, you might qualify for a loan of $2,500 to $5,000.

Q5: How quickly can I get the money?

A: The fully online process is very fast. If you apply and are approved early in the day, you could receive funds via direct deposit on the same day. Most borrowers receive their money within 24 hours of approval.

Q6: Do I get to keep my car?

A: Yes. You retain physical possession of your car and can drive it as usual throughout the loan period. The lender only holds the title as collateral.

Q7: What happens if I can’t repay the loan?

A: If you default on the loan (fail to make payments), the lender has the legal right to repossess your vehicle to sell it and recover the money owed. It is vital to communicate with your lender immediately if you anticipate a problem making a payment.

Q8: Are online title loans safe?

A: Dealing with a licensed, reputable lender that uses secure, encrypted technology for its website and document handling is generally safe. The financial risk, however, is high due to the potential for repossession and high costs.

Q9: What documents do I need to apply?

A: You will typically need:

- A government-issued photo ID (Driver’s License).

- The clear, lien-free title to your vehicle in your name.

- Proof of auto insurance.

- Recent photos of your vehicle (often front, back, sides, and odometer).

- Proof of income or residency may also be required.

Q10: My title has a lien from an old loan. Can I still apply?

A: No. To qualify for a title loan, you must own the vehicle outright. The title must be in your name and free of any other liens or loans.

Conclusion: Empower Yourself with Knowledge

All online car title loans offer a powerful combination of speed, convenience, and accessibility, especially for those with credit challenges. They can be a legitimate tool for navigating a short-term financial crisis. However, this convenience should not overshadow the significant responsibilities and risks involved, primarily the potential loss of your vehicle.

The key to a positive experience is education and caution. Use this guide to understand the process, honestly assess your ability to repay, thoroughly research lenders, and always read the fine print. By being an informed borrower, you can use an online car title loan effectively as a strategic financial bridge to better stability, rather than a path to deeper debt.

Showing the single result