Best car title loan online

Discover Your Best Car Title Loan Online: Fast Cash Solutions When You Need Them Most

Navigating unexpected financial challenges can be incredibly stressful, leaving you searching for quick, reliable solutions. If you own your car outright, a car title loan could be the answer you’re looking for. When it comes to finding the best car title loan online, you need a trusted partner who offers transparency, competitive rates, and a seamless process. This comprehensive guide will walk you through everything you need to know, helping you make an informed decision and secure the financial relief you deserve, all from the comfort of your home.

What is a Car Title Loan and How Does It Work?

At its core, a car title loan is a short-term, secured loan where you use your vehicle’s clear title as collateral. This means you temporarily hand over your car’s title to the lender, and in return, they provide you with a lump sum of cash. The best part? You get to keep driving your car while you repay the loan! It’s a fantastic option for individuals who need quick access to funds but might not qualify for traditional bank loans due to credit history or other factors.

The process is surprisingly straightforward, especially when you opt for an online car title loan. Here’s a breakdown:

- Application: You start by filling out a simple online application form. This usually requires basic personal information, details about your vehicle, and sometimes proof of income.

- Vehicle Valuation: The lender assesses the value of your car. This can often be done remotely through photos or a quick online appraisal, determining how much you can borrow.

- Loan Offer & Agreement: Based on your car’s value and your ability to repay, the lender provides a loan offer, outlining the principal amount, interest rate (APR), and repayment terms. You’ll review and sign a loan agreement.

- Title Lien: The lender places a lien on your car’s title, meaning they are listed as a lienholder. You retain possession and use of your vehicle.

- Fund Disbursement: Once everything is signed, the loan funds are quickly deposited into your bank account, often on the same day or within 24 hours.

- Repayment: You make regular payments (typically monthly) consisting of principal and interest, according to your agreed-upon schedule.

- Title Release: After you’ve successfully repaid the entire loan amount, the lien is removed, and your car’s title is returned to you, clear and free.

This mechanism makes car title loans a popular choice for those facing urgent financial needs, offering a fast track to cash without sacrificing mobility.

Why Opt for the Best Car Title Loan Online? Convenience Meets Speed

In today’s fast-paced world, convenience and speed are paramount. Choosing to get your car title loan online offers distinct advantages over traditional in-person applications:

- Unmatched Convenience: Apply from anywhere, at any time. Whether you’re at home, at work, or on the go, a few clicks are all it takes. No need to drive to a physical location, wait in lines, or adjust your schedule. This saves you valuable time and effort.

- Blazing Fast Processing: Online lenders are streamlined for speed. From submitting your application to receiving funds, the entire process can often be completed within hours. This is crucial when you’re dealing with time-sensitive emergencies.

- Privacy and Discretion: Applying online is a private affair. You can complete all steps without feeling rushed or having to discuss your financial situation in a public setting.

- Wider Selection of Lenders: The online landscape allows you to easily compare offers from multiple lenders nationwide. This dramatically increases your chances of finding the best car title loan online for your specific needs, with the most favorable terms and rates.

- Simplified Documentation: Many online platforms have optimized their document submission process, allowing you to upload photos or scans of your required paperwork directly from your smartphone or computer.

- Accessibility: For those in remote areas or without easy access to brick-and-mortar lenders, online title loans bridge the gap, making financial assistance available to a broader audience.

Compared to traditional loans from banks or credit unions, which often involve lengthy application processes, stringent credit checks, and multiple in-person visits, an online car title loan offers a refreshing alternative – faster, less complicated, and designed for immediate relief.

Finding the Best Car Title Loan Online: Key Factors to Consider

With numerous online lenders vying for your attention, how do you truly identify the best car title loan online? It’s not just about the first offer you receive. A careful evaluation of several critical factors will ensure you choose a responsible and beneficial loan.

1. Interest Rates (APR) and Fees

This is arguably the most crucial factor. Car title loans typically have higher Annual Percentage Rates (APRs) than traditional bank loans due to their short-term, high-risk nature. However, rates can vary significantly between lenders.

- Compare APRs: Always compare the total APR, not just the monthly interest rate. The APR includes all interest and fees over the loan’s term, giving you the true cost of borrowing.

- Understand Fees: Inquire about all potential fees: application fees, processing fees, late payment fees, and even prepayment penalties. The best lenders will be transparent about all costs upfront. Look for lenders with minimal or no hidden fees.

2. Loan Terms and Repayment Flexibility

The terms of your loan determine how and when you’ll repay it.

- Loan Duration: Title loans can range from a few weeks to several months, or even a year or more. A longer term might mean lower monthly payments, but it could also mean higher overall interest paid. Choose a term that aligns with your financial capacity.

- Repayment Schedule: Understand the frequency of payments (weekly, bi-weekly, monthly) and ensure it fits your income cycle.

- Flexible Options: Some lenders offer more flexible repayment options, such as the ability to extend the loan (roll over) or modify the payment plan if you encounter difficulties. While extensions can be costly, knowing the option exists can provide peace of mind.

3. Lender Reputation and Reviews

Trust is paramount when dealing with your financial future and your vehicle’s title.

- Research Online Reviews: Check independent review sites (e.g., Trustpilot, Google Reviews, BBB) to see what past customers say about their experiences. Look for patterns in feedback regarding customer service, transparency, and fairness.

- Better Business Bureau (BBB) Rating: A high BBB rating indicates a lender’s commitment to customer satisfaction and ethical business practices.

- Industry Standing: How long has the lender been in business? Are they well-established and recognized in the title loan industry?

4. Transparency and Clarity of Contract

The best car title loan online comes with a transparent contract that leaves no room for ambiguity.

- Read the Fine Print: Carefully review the entire loan agreement before signing. Ensure you understand every clause, especially those pertaining to interest rates, fees, repayment schedules, and default consequences.

- Ask Questions: Don’t hesitate to ask your lender to clarify anything you don’t understand. A reputable lender will be happy to explain all terms thoroughly.

- No Hidden Fees: Reiterate that you’re looking for a lender with absolute clarity on all costs.

5. Application Process and Funding Speed

While speed is a general advantage of online loans, efficiency can vary.

- Ease of Application: Is the online application straightforward and user-friendly?

- Required Documents: Are the document requirements reasonable and clearly stated?

- Funding Time: How quickly can funds be disbursed after approval? The fastest lenders can get money to you within hours.

6. Customer Service and Support

Even with a smooth online process, you might have questions or need assistance.

- Accessibility: Is customer support easily reachable via phone, email, or chat?

- Responsiveness: Do they respond quickly and helpfully to inquiries?

- Knowledgeable Staff: Are the support staff well-informed and able to address your concerns effectively?

7. State Regulations and Licensing

Car title loan regulations vary significantly by state.

- Licensed Lenders: Always verify that the lender is properly licensed to operate in your state. Unlicensed lenders may not adhere to consumer protection laws.

- Regulatory Compliance: The best lenders operate in full compliance with all state and federal regulations, providing peace of mind.

8. No Prepayment Penalties

Life happens, and you might find yourself in a position to repay your loan earlier than expected.

- Flexibility to Pay Early: Look for lenders who do not charge penalties for early repayment. This allows you to save on interest if your financial situation improves.

By diligently considering these factors, you can confidently choose the best car title loan online that aligns with your financial needs and provides a responsible solution.

The Application Process for Your Best Car Title Loan Online: A Step-by-Step Guide

Securing a car title loan online is designed to be as simple and efficient as possible. Here’s what you can expect when you apply:

Step 1: The Initial Online Inquiry

- Visit the Lender’s Website: Start by navigating to the website of your chosen online title loan provider.

- Fill Out a Short Form: You’ll typically find a brief online inquiry form asking for basic information:

- Your full name and contact details (phone, email).

- Your residential address.

- Vehicle make, model, year, and mileage.

- Your vehicle identification number (VIN).

- A brief estimate of your monthly income.

- This initial step helps the lender pre-qualify you and get a preliminary idea of your car’s value and potential loan amount.

Step 2: Submit Required Documentation

Once your initial inquiry is processed, you’ll be asked to provide more detailed documentation. The beauty of online applications is that you can often upload pictures or scanned copies directly from your smartphone or computer.

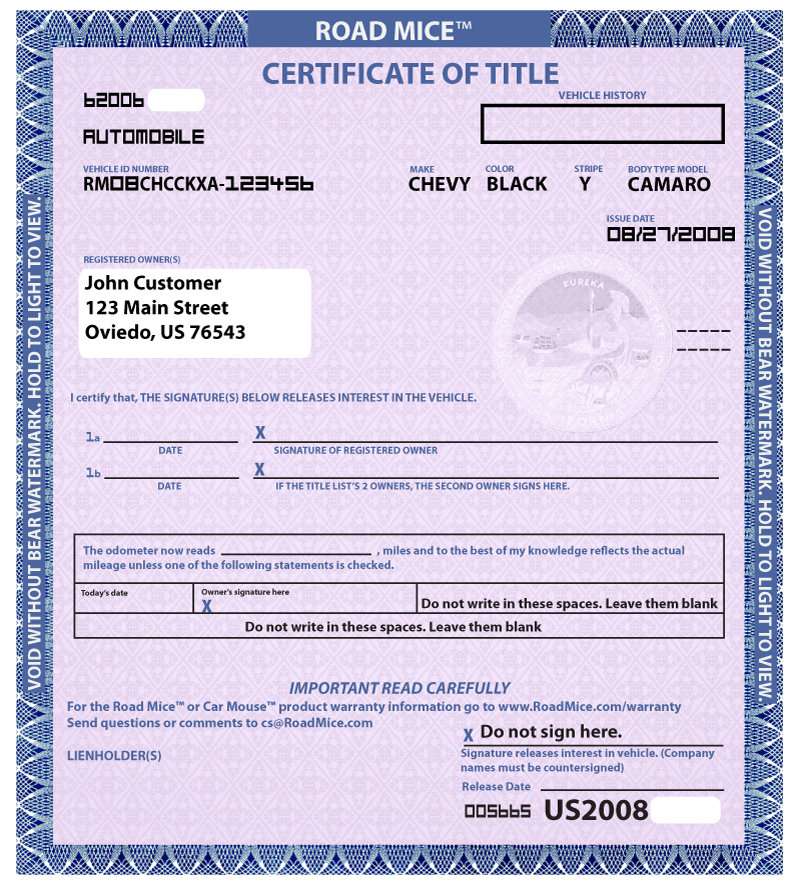

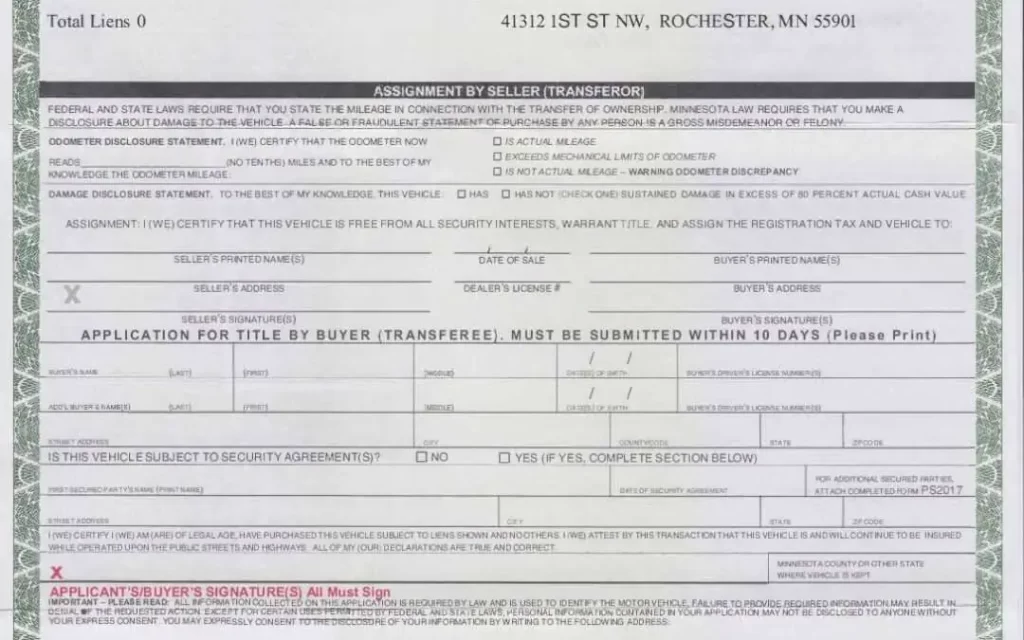

- Clear Vehicle Title: The most crucial document. It must be in your name and free of any existing liens.

- Government-Issued ID: A valid driver’s license or state ID to verify your identity.

- Proof of Income: Pay stubs, bank statements, or other documents showing a regular income source. This demonstrates your ability to repay the loan.

- Proof of Residency: Utility bill, rental agreement, or other document showing your current address.

- Vehicle Registration and Insurance: Current registration and proof of active insurance (collision and comprehensive are often required).

- Photos of Your Vehicle: You might be asked to upload several clear photos of your car from different angles, including the odometer reading, to assist in the valuation process.

Step 3: Vehicle Assessment and Loan Offer

- Remote Valuation: The lender will use the information and photos you provided to assess your vehicle’s market value. Some may use online tools like Kelley Blue Book or Edmunds, while others might conduct a quick virtual inspection.

- Receive Your Loan Offer: Based on your car’s value and your repayment ability, the lender will present you with a firm loan offer. This document will clearly outline:

- The principal loan amount.

- The Annual Percentage Rate (APR).

- All associated fees.

- The total cost of the loan.

- The repayment schedule (e.g., monthly payments, due dates).

- The total amount you will repay over the loan term.

- Review Carefully: Take your time to review the offer. Ensure you understand every term and condition. Don’t hesitate to ask questions if anything is unclear.

Step 4: Sign the Loan Agreement

- E-Signature: If you’re satisfied with the offer, you’ll digitally sign the loan agreement. This is a legally binding contract, so your thorough review in Step 3 is vital.

- Lien Placement: At this stage, the lender will typically process the placement of a lien on your car’s title. This effectively means they become a temporary lienholder until the loan is repaid.

Step 5: Receive Your Funds

- Fast Disbursement: Once the agreement is signed and the lien processed, the funds are quickly disbursed to you. Most online lenders offer:

- Direct Deposit: Funds are electronically transferred to your bank account, often within hours or by the next business day.

- Wire Transfer: Another fast option for direct fund transfer.

- Check: Less common for online loans, but sometimes an option.

- You retain possession of your car and can continue driving it as usual.

Step 6: Make Repayments

- Scheduled Payments: You’ll begin making payments according to the agreed-upon schedule. Most lenders offer convenient online payment portals, direct debit options, or phone payments.

- Communication is Key: If you anticipate any difficulty in making a payment, contact your lender immediately. Reputable lenders are often willing to work with you to find solutions.

This streamlined online process ensures that getting the funds you need is straightforward, transparent, and incredibly fast, reinforcing why an online car title loan can be the best solution for urgent financial needs.

Benefits of Getting a Car Title Loan Online

Choosing the best car title loan online comes with a host of advantages that make it a compelling option for many individuals facing financial urgent situations.

- Rapid Access to Emergency Cash: This is perhaps the greatest benefit. When unexpected expenses hit – a medical emergency, urgent home repair, or critical car repair – time is of the essence. Online title loans are designed for speed, often providing funds within hours, far quicker than traditional bank loans.

- You Keep Driving Your Car: Unlike pawning your car, a title loan allows you to retain full use of your vehicle. This means your daily routine, commute to work, and family responsibilities remain uninterrupted, which is a significant practical advantage.

- Bad Credit is Not a Barrier: For many, a less-than-perfect credit score is a major hurdle for traditional loans. Car title loans are primarily secured by your vehicle’s equity, making them much more accessible to individuals with poor or no credit history. Lenders focus more on your car’s value and your ability to repay, rather than just your credit score.

- Flexible Loan Amounts: The amount you can borrow is directly related to the equity in your car. This means you can often secure a larger loan amount than you might with an unsecured personal loan, provided your car has sufficient value. Most lenders offer anywhere from a few hundred to several thousand dollars.

- Less Extensive Paperwork: While you do need to provide documentation, the online process often simplifies it. You can conveniently upload digital copies, eliminating the need for printing, faxing, or mailing physical documents.

- Convenience and Privacy: As discussed, applying and managing your loan online offers unparalleled convenience. You can handle everything from your home, maintaining your privacy throughout the process.

- Simple Application Process: The application forms are generally straightforward, focusing on essential information about you and your vehicle, making it easy to complete even if you’re not tech-savvy.

- No Obligation to Accept: When you receive a loan offer, you’re under no obligation to accept it. This allows you to shop around, compare terms from different providers, and ultimately choose the best car title loan online that suits your needs without pressure.

- Potential for Lower Rates: By being able to compare multiple online lenders, you increase your chances of finding a more competitive interest rate than you might with a single local lender.

These benefits highlight why an online car title loan can be an incredibly useful financial tool for bridging short-term cash gaps and addressing immediate financial needs efficiently and discreetly.

Potential Risks and How to Mitigate Them

While the best car title loan online offers significant advantages, it’s crucial to approach any financial commitment with a clear understanding of potential risks. Being informed allows you to borrow responsibly and mitigate potential downsides.

Potential Risks:

- High Interest Rates (APR): Title loans typically carry higher interest rates compared to traditional bank loans or credit union offerings. This is due to the short-term nature and the higher risk lenders take, especially with less emphasis on credit scores. If not managed properly, the cost of the loan can become substantial.

- Risk of Losing Your Car: This is the most significant risk. Since your car’s title serves as collateral, defaulting on your loan payments means the lender has the legal right to repossess your vehicle. Losing your primary mode of transportation can lead to further financial and personal hardship.

- The Debt Cycle: If you struggle to repay the loan on time, some lenders may offer “rollovers” or “extensions.” While seemingly helpful, these extend the loan term and add more fees and interest, potentially trapping you in a cycle of debt where you’re primarily paying interest without reducing the principal.

- Hidden Fees: Although less common with reputable online lenders, some less transparent providers might have hidden fees that inflate the overall cost of the loan.

How to Mitigate These Risks:

- Borrow Only What You Can Repay: This is the golden rule. Before applying, honestly assess your financial situation and determine an amount you can realistically repay within the loan term, without stretching your budget too thin. Don’t borrow the maximum amount simply because it’s offered.

- Thoroughly Understand All Terms and Conditions: Before signing anything, read the loan agreement meticulously. Pay special attention to the APR, total repayment amount, payment schedule, and all fees (late fees, processing fees, default penalties). If anything is unclear, ask the lender for clarification until you fully understand.

- Research and Choose Reputable Lenders: Prioritize lenders with strong positive reviews, transparent practices, and a solid reputation. Check their licensing and standing with consumer protection agencies like the Better Business Bureau. The best car title loan online comes from a trustworthy provider.

- Have a Clear Repayment Plan: Before you even apply, map out how you will make each payment. Factor in your income and expenses to ensure the loan payment is manageable. Consider setting up automatic payments to avoid missing due dates.

- Communicate with Your Lender If Issues Arise: If you anticipate difficulty making a payment, contact your lender immediately. A responsible lender may be willing to work with you on a payment plan modification or offer alternatives to avoid default and repossession. Open communication can often prevent the worst-case scenario.

- Avoid Rollovers and Extensions: While they might offer temporary relief, understand that rollovers significantly increase the total cost of your loan. If you’re considering one, first explore all other avenues or discuss alternative solutions with your lender.

- Consider Alternatives First: Before committing to a title loan, explore other options if possible. These might include personal loans from credit unions, advances from your employer, borrowing from friends or family, or using a credit card (if the APR is lower than the title loan). Title loans are an excellent solution for emergencies, but it’s wise to consider all avenues.

By being proactive, informed, and responsible in your borrowing habits, you can effectively navigate the potential risks associated with car title loans and utilize them as a helpful financial tool rather than a burden.

Who Can Benefit from an Online Car Title Loan?

An online car title loan isn’t for everyone, but for specific individuals and situations, it can be the ideal financial solution. If you find yourself in one of these scenarios, exploring a title loan might be your best option:

- Individuals Facing Unexpected Emergencies: Life throws curveballs. A sudden medical bill, an urgent car repair, a critical home repair, or an unforeseen travel expense can quickly deplete savings. Title loans provide rapid access to cash to cover these immediate, unbudgeted costs.

- Those with Imperfect or No Credit History: Traditional banks heavily rely on credit scores. If you have bad credit, limited credit history, or have faced bankruptcy in the past, qualifying for conventional loans can be challenging, if not impossible. Car title loans offer an alternative, focusing on your car’s equity and your income, rather than just your credit score.

- People Needing Quick Cash Without Selling Assets: You might need cash, but selling your car, jewelry, or other valuables isn’t a desirable or practical option. A title loan allows you to leverage your car’s value without parting with it.

- Anyone Seeking a Fast and Convenient Loan Process: If you need funds quickly and don’t have the time to navigate complex bank applications, paperwork, and waiting periods, the streamlined online title loan process is a significant advantage. It’s designed for speed and ease.

- Individuals Who Own Their Vehicle Outright: The primary requirement for a car title loan is a clear car title – meaning you own your vehicle free and clear, without any outstanding loans or liens on it. If this describes you, you have a valuable asset that can unlock quick funds.

- People with a Stable Income Source: While credit score is less of a factor, lenders still need to be confident in your ability to repay the loan. Having a verifiable and stable source of income (whether from employment, self-employment, or benefits) is crucial.

- Small Business Owners Needing Bridging Funds: Sometimes, a small business might need quick capital for inventory, equipment repair, or to cover payroll during a slow period. An owner’s personal car title loan can serve as a fast way to get these bridging funds.

In essence, if you need fast cash, own your car outright, and perhaps have challenges with traditional lending due to credit, an online car title loan can be a powerful and accessible financial tool. It’s about leveraging an existing asset to overcome temporary financial hurdles.

State Regulations and Legal Aspects: What You Need to Know

Understanding the legal landscape is a crucial part of finding the best car title loan online. Car title loan regulations are not uniform across the United States; they vary significantly from state to state. Some states have strict laws governing interest rates, loan terms, and lender practices, while others have more lenient regulations or even prohibit title loans entirely.

Key Regulatory Aspects:

- Licensing Requirements: Reputable online lenders must be licensed to operate in each state where they offer services. Always verify a lender’s license status in your specific state. This ensures they are subject to state oversight and consumer protection laws.

- Interest Rate Caps: Many states impose limits on the interest rates (APR) that title loan lenders can charge. These caps are designed to protect consumers from excessively high costs. Be wary of lenders advertising rates that seem unusually low or astronomically high, as they might be operating outside of legal bounds.

- Loan Term Limits: Some states regulate the minimum and maximum duration of title loans, preventing lenders from offering excessively short terms that make repayment difficult or excessively long terms that accumulate exorbitant interest.

- Rollover Restrictions: To prevent the debt cycle, some states limit the number of times a title loan can be “rolled over” or extended, or they require a reduction in the principal amount with each extension.

- Default and Repossession Laws: States have specific laws regarding what lenders can do if a borrower defaults, including notice requirements before repossession, how vehicles must be sold after repossession, and rules about deficiency judgments (where you still owe money after your car is sold).

- Consumer Disclosure Requirements: Licensed lenders are required to provide clear and comprehensive disclosures to borrowers. These typically include the Truth in Lending Act (TILA) disclosures, which detail the APR, finance charges, amount financed, and total payments. These disclosures are vital for understanding the true cost of your loan.

- Cooling-Off Periods: A few states might offer a “cooling-off” period, allowing borrowers a short window to cancel the loan without penalty.

Why This Matters for Your Best Choice:

- Protection for You: Choosing a state-licensed and compliant lender ensures you are protected by the consumer protection laws in your state.

- Fairer Terms: Lenders operating within state regulations are more likely to offer fair and transparent terms.

- Avoiding Legal Issues: Dealing with unlicensed lenders can expose you to predatory practices and leave you with little recourse if problems arise.

Before applying for any car title loan online, it’s highly recommended to:

- Check Your State’s Regulations: A quick search for “[Your State] car title loan laws” will provide valuable information.

- Verify Lender’s License: On the lender’s website, look for their licensing information and verify it with your state’s financial regulatory authority.

- Read the Agreement Carefully: Ensure the loan agreement reflects your state’s legal requirements and fully discloses all terms and conditions.

By being informed about the legal and regulatory aspects, you can confidently choose the best car title loan online that is not only convenient but also fully compliant and safe.

Tips for Responsible Borrowing

Even when you find the best car title loan online, responsible borrowing practices are essential to ensure a positive experience and avoid financial strain.

- Create a Realistic Budget: Before taking out any loan, meticulously review your income and expenses. Understand exactly how much disposable income you have. Can you comfortably integrate the title loan payment into your monthly budget without jeopardizing other essential expenses?

- Understand the Total Cost (APR): Don’t just look at the monthly payment. Focus on the Annual Percentage Rate (APR) and the total amount you will repay over the life of the loan. High APRs can significantly increase the cost, so ensure you’re comfortable with the overall financial commitment.

- Borrow Only What You Need: It can be tempting to borrow the maximum amount offered. However, only borrow the precise amount you need to cover your emergency. The less you borrow, the less interest you’ll pay, and the easier it will be to repay.

- Have a Clear Repayment Strategy: Don’t rely on future uncertain income. Have a solid plan for how you will make each payment on time. This might involve setting aside a portion of your paycheck, creating a dedicated savings account for loan payments, or automating transfers.

- Prioritize Loan Repayment: Once you have the loan, make its repayment a priority. Missing payments can lead to late fees, increased interest, and ultimately, the risk of losing your vehicle.

- Avoid Rolling Over the Loan: While some lenders offer rollovers or extensions, these should be a last resort. Each rollover adds more fees and interest, significantly increasing your total debt and making it harder to escape the loan cycle. If you anticipate issues, proactively communicate with your lender for alternative solutions.

- Explore All Alternatives First (If Time Allows): Before committing to a title loan, quickly consider other options such as:

- Personal loans from banks or credit unions: Potentially lower interest rates, but often require good credit and a longer application process.

- Borrowing from friends or family: Can be interest-free, but might strain personal relationships.

- Credit cards: If you have available credit and a lower APR than the title loan, this might be an option for smaller amounts.

- Advances from your employer: Some employers offer payroll advances in emergencies.

- Community assistance programs: Local charities or government programs might offer aid for specific needs (e.g., utility bills, rent).

- Negotiating with creditors: Sometimes, you can arrange a payment plan directly with the biller.

- Maintain Open Communication with Your Lender: If unforeseen circumstances arise that threaten your ability to make a payment, contact your lender immediately. Honest and early communication can often lead to a mutually agreeable solution, preventing default and potential repossession.

- Read and Understand the Entire Loan Agreement: We cannot stress this enough. Before you sign, read every single clause. Know what happens if you’re late, what the fees are, and what the consequences of default are.

By adhering to these responsible borrowing tips, you can leverage the benefits of a car title loan to address your financial needs effectively while safeguarding your financial well-being and your cherished vehicle.

What Makes Us the Best Choice for Car Title Loans Online?

When you’re seeking the best car title loan online, you need a partner who combines efficiency with trustworthiness and puts your financial well-being first. While we represent a generic ideal, imagine a service that embodies these principles:

- Unwavering Transparency: We believe in absolute clarity. All our loan terms, interest rates (APR), and potential fees are laid out upfront in plain language. There are no hidden charges, no surprises, and no confusing jargon. We want you to feel fully informed and confident in your decision.

- Competitive and Fair Rates: We understand that high interest rates can be a concern. That’s why we strive to offer some of the most competitive interest rates in the online title loan market. Our goal is to provide accessible funds without trapping you in a cycle of debt, ensuring a responsible borrowing experience.

- Lightning-Fast Approval & Funding: We know that when you need cash, you need it now. Our streamlined online application and advanced processing technology allow for incredibly fast approval decisions – often within minutes. Once approved, funds can be directly deposited into your bank account on the same day or within 24 hours, getting you the relief you need without delay.

- Effortless Online Application Process: Our user-friendly platform makes applying for a car title loan incredibly simple. From your initial inquiry to uploading documents and signing agreements, every step is designed for maximum ease and convenience, accessible from any device.

- Exceptional Customer Service: Our dedicated team of loan specialists is here to support you every step of the way. Whether you have questions about the application, need clarification on loan terms, or require assistance during repayment, our friendly and knowledgeable representatives are available via phone, email, or chat to provide prompt and helpful support.

- Flexible Repayment Options: We understand that everyone’s financial situation is unique. We work to offer flexible repayment plans tailored to your income cycle, making it easier for you to manage your payments responsibly. We also prioritize offering loans with no prepayment penalties, allowing you to save money by paying off your loan early if you choose.

- Secure and Confidential Platform: Your privacy and data security are our top priorities. Our website uses advanced encryption technology to protect your personal and financial information, ensuring a secure and confidential application process.

- State-Compliant and Trustworthy: We are fully licensed and operate in strict compliance with all state and federal regulations governing car title loans. This commitment to legal and ethical practices means you can borrow with peace of mind, knowing you’re working with a reputable and responsible lender.

- Your Car Stays With You: The best part? You keep driving your car while you repay the loan. Your daily life remains uninterrupted, providing crucial mobility during your loan term.

When you weigh these factors, you’ll see why choosing a service that aligns with such high standards truly represents the best car title loan online for your immediate financial needs. We’re here to provide a quick, fair, and reliable solution, empowering you to take control of your finances.

Frequently Asked Questions (FAQs)

We understand you might have questions, and getting clear answers is key to finding the best car title loan online. Here are some common questions we receive:

Q1: How much money can I borrow with a car title loan?

A: The amount you can borrow typically depends on two main factors: the wholesale market value of your vehicle (its equity) and your ability to repay the loan. You can often borrow anywhere from a few hundred dollars up to several thousand, usually between 25% to 50% of your car’s value.

Q2: How quickly can I get the money?

A: One of the biggest advantages of online car title loans is speed. Many lenders offer same-day funding, with funds being deposited into your bank account within a few hours or by the next business day after your loan is approved and signed.

Q3: Do I need good credit to get a car title loan?

A: No, not necessarily. Car title loans are secured loans, meaning your car’s title acts as collateral. This makes them accessible to individuals with poor credit, bad credit, or no credit history. Lenders primarily focus on the value of your car and your ability to repay the loan.

Q4: Can I get a loan if I’m unemployed?

A: You need to demonstrate a consistent ability to repay the loan. While traditional employment is ideal, many lenders will consider other forms of verifiable income, such as unemployment benefits, disability benefits, social security, self-employment income, or even structured settlement payments. The key is stable, documented income.

Q5: What documents do I need to apply for an online car title loan?

A: Typically, you’ll need:

- Your clear vehicle title (in your name, no liens).

- A valid government-issued ID (driver’s license).

- Proof of income (pay stubs, bank statements).

- Proof of residency (utility bill).

- Vehicle registration and insurance.

- Photos of your vehicle.

Q6: What happens if I can’t repay my car title loan?

A: If you anticipate difficulty making a payment, it’s crucial to contact your lender immediately. Reputable lenders may work with you to adjust your payment schedule or offer alternatives. However, if you default on the loan, as your car title is collateral, the lender has the legal right to repossess your vehicle to recover the outstanding balance.

Q7: Will my car be safe? Do I keep driving it?

A: Yes, your car will be safe, and you absolutely keep driving it during the loan term. The lender only holds a lien on your vehicle’s title, not the vehicle itself. You retain full possession and use of your car as long as you make your payments on time.

Q8: Are there any prepayment penalties if I pay off the loan early?

A: The best car title loans online typically do not have prepayment penalties. This means you can pay off your loan ahead of schedule without incurring extra fees, potentially saving you money on interest. Always confirm this with your chosen lender before signing an agreement.

Q9: How do I know if an online lender is legitimate and reputable?

A: Look for lenders that are licensed in your state, have transparent terms (no hidden fees), positive customer reviews on independent sites (like BBB, Trustpilot), clear contact information, and demonstrate professional customer service. Avoid any lender that asks for upfront processing fees before approving your loan.

Q10: What kind of vehicles qualify for a title loan?

A: Most types of vehicles can qualify, including cars, trucks, SUVs, motorcycles, and RVs. The main requirements are that the vehicle must have sufficient equity (value), and you must own it outright with a clear title.

These FAQs should help address common concerns, empowering you to confidently seek out the best car title loan online for your specific financial circumstances.

Conclusion: Your Path to Financial Relief Starts Here

When faced with urgent financial needs, the search for the best car title loan online is more than just looking for quick cash; it’s about finding a reliable, transparent, and supportive partner. By understanding how car title loans work, recognizing the unparalleled convenience of online applications, and knowing the key factors to evaluate in a lender, you are now equipped to make an informed decision.

Remember to prioritize transparency, competitive rates, excellent customer service, and a clear understanding of all loan terms. A responsible approach to borrowing, coupled with a thorough pre-selection process, ensures that an online car title loan serves as the helpful financial tool it’s designed to be, providing you with the relief you need without unnecessary stress.

Don’t let unexpected expenses derail your financial stability. If you own your vehicle outright and need quick access to funds, exploring your options for the best car title loan online could be your most effective solution.

Ready to explore your options and find the perfect fit for your financial needs? Let us help you unlock the equity in your vehicle today.

Showing the single result