Best car title loans online

Discover the Best Car Title Loans Online: Your Fast Cash Solution

Life has a way of throwing unexpected curveballs when you least expect them. A sudden medical bill, an urgent home repair, or an unforeseen car breakdown can leave you scrambling for cash. In these moments, finding a quick, reliable, and accessible financial solution is paramount. This is where best car title loans online come into play, offering a lifeline for those needing immediate funds without the lengthy approval processes of traditional banks.

At Legit Vendor USA, we understand the pressure of financial emergencies. We’re dedicated to connecting you with the most reputable and efficient online lenders, ensuring you find the best car title loans online that fit your unique needs. Our platform is designed to make the process as smooth and stress-free as possible, allowing you to leverage the equity in your vehicle to get the cash you need, fast.

What Exactly Are Car Title Loans, and How Do Online Options Work?

A car title loan, also known as an auto title loan or pink slip loan, is a type of secured loan where you use your vehicle’s clear title as collateral. The key benefit? You get to keep driving your car while you repay the loan. This means your daily routine remains uninterrupted, even when you’re facing financial challenges.

Traditionally, title loans involved visiting a physical store, filling out paperwork, and waiting for an in-person appraisal. However, the digital age has revolutionized this process, bringing the convenience and speed of online car title loans directly to your fingertips.

When you opt for an online car title loan, the entire process—from application to approval and funding—can be completed remotely. You no longer need to spend time traveling to a lender’s office. Instead, you can apply from the comfort of your home, submit documents digitally, and even receive funds via direct deposit, often within the same business day. This shift to online platforms has made obtaining emergency cash more accessible, efficient, and discreet than ever before.

Why Choose the Best Car Title Loans Online? Unbeatable Benefits When You Need Cash Fast

Opting for the best car title loans online offers a multitude of advantages, particularly when you’re in a pinch and need a swift financial injection. These benefits are tailored to meet the demands of modern life, offering flexibility and speed that traditional lending simply can’t match.

1. Speed and Unmatched Convenience: Your Time is Valuable

One of the most compelling reasons to choose online title loans is the extraordinary speed and convenience they offer.

- 24/7 Application Access: Our online portal is always open. You can apply anytime, day or night, from anywhere with an internet connection – whether it’s your home, office, or even on the go via your smartphone. This eliminates the need to adhere to strict business hours or travel across town.

- Rapid Application Process: Filling out the online application typically takes just a few minutes. We’ve streamlined the form to ask for only the essential information, ensuring a quick start to your loan journey.

- Quick Approval Times: While traditional loans can take days or even weeks for approval, many online title loan applications are approved within hours, sometimes even minutes, after submitting all necessary documentation. This swift turnaround is crucial for urgent financial needs.

- Fast Funding: Once approved, funds can often be deposited directly into your bank account the same business day, or by the next business day. This near-instant access to cash makes online title loans an ideal solution for immediate emergencies.

- No Physical Visits Required: Say goodbye to queues, appointments, and piles of paper. The entire process, from document submission (uploading photos of your car and title) to e-signing your loan agreement, is handled digitally.

2. Keep Driving Your Car: Essential for Daily Life

This is a fundamental and often overlooked benefit. With an online car title loan, you retain possession and full use of your vehicle throughout the loan term. Your car is merely the collateral; you hand over the title to the lender, who places a lien on it, and once the loan is repaid, the lien is removed, and the title is returned to you. This means your commute to work, taking your kids to school, running errands, or simply maintaining your independence remains undisturbed. It’s a critical distinction from other types of secured loans where you might lose access to the asset.

3. Bad Credit? No Problem: Financial Inclusion for Everyone

Many individuals shy away from applying for loans due to a less-than-perfect credit history. This is where online car title loans shine. Because the loan is secured by the value of your vehicle, lenders place less emphasis on your credit score. Instead, they primarily assess:

- The Equity in Your Car: How much your vehicle is worth.

- Your Ability to Repay: Your stable income sources.

This makes car title loans an accessible option for people with bad credit, no credit, or limited credit history, who might otherwise be denied by conventional lenders. It opens up opportunities for emergency funding that would typically be out of reach.

4. Flexible Loan Amounts Tailored to Your Needs

The amount you can borrow with an online car title loan is primarily determined by two factors:

- The Wholesale Value of Your Vehicle: Lenders assess your car’s make, model, year, mileage, and condition.

- Your Ability to Repay the Loan: Your stable income ensures you can comfortably manage the repayments.

This flexibility means you can often secure a loan amount that genuinely addresses your specific financial need, whether it’s a few hundred dollars or several thousand. Lenders typically offer a percentage of your car’s wholesale value, ensuring a fair and manageable loan.

5. Transparency and Security: Building Trust in the Digital Age

Reputable providers of the best car title loans online prioritize transparency and the security of your information.

- Clear Terms and Conditions: Before you sign anything, all loan terms, including interest rates (APR), repayment schedule, and any associated fees, are clearly outlined. There are no hidden charges or surprises.

- Secure Online Platforms: We utilize advanced encryption and security protocols to protect your personal and financial data during the application process. Your privacy and security are paramount.

- Dedicated Customer Support: Even though the process is online, you’ll have access to customer service representatives who can answer your questions and guide you through each step, ensuring a smooth experience.

By combining speed, convenience, accessibility for various credit scores, and robust security, online car title loans stand out as a highly effective solution for urgent financial needs.

Who Qualifies for the Best Online Car Title Loans? Understanding the Requirements

While online car title loans are known for being more accessible than traditional loans, there are still a few key requirements you’ll need to meet. These criteria are in place to ensure responsible lending and borrowing.

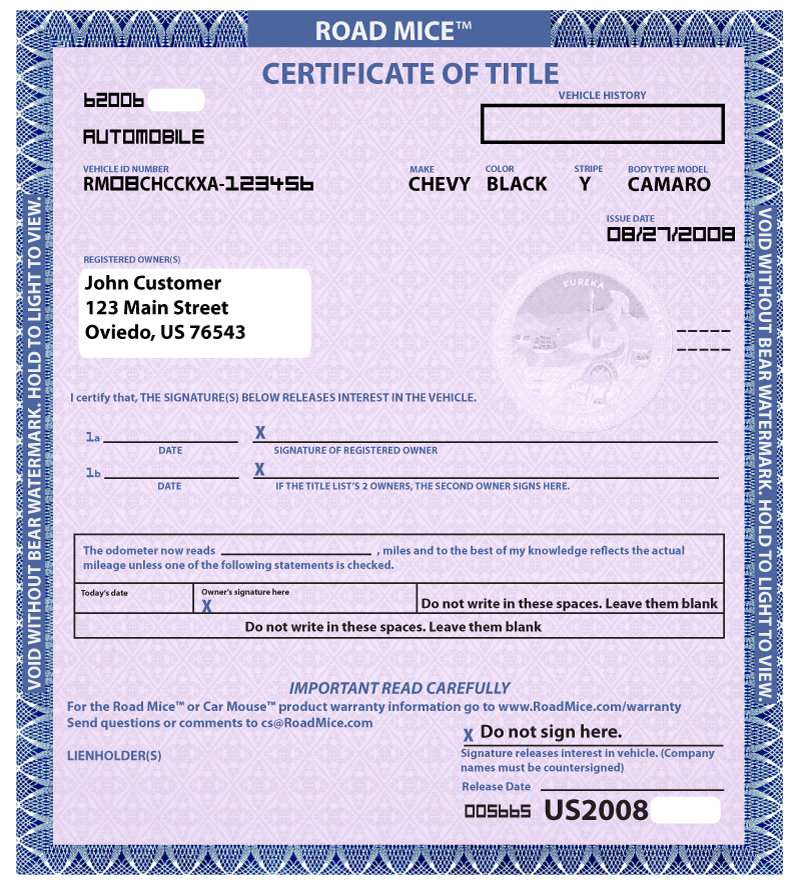

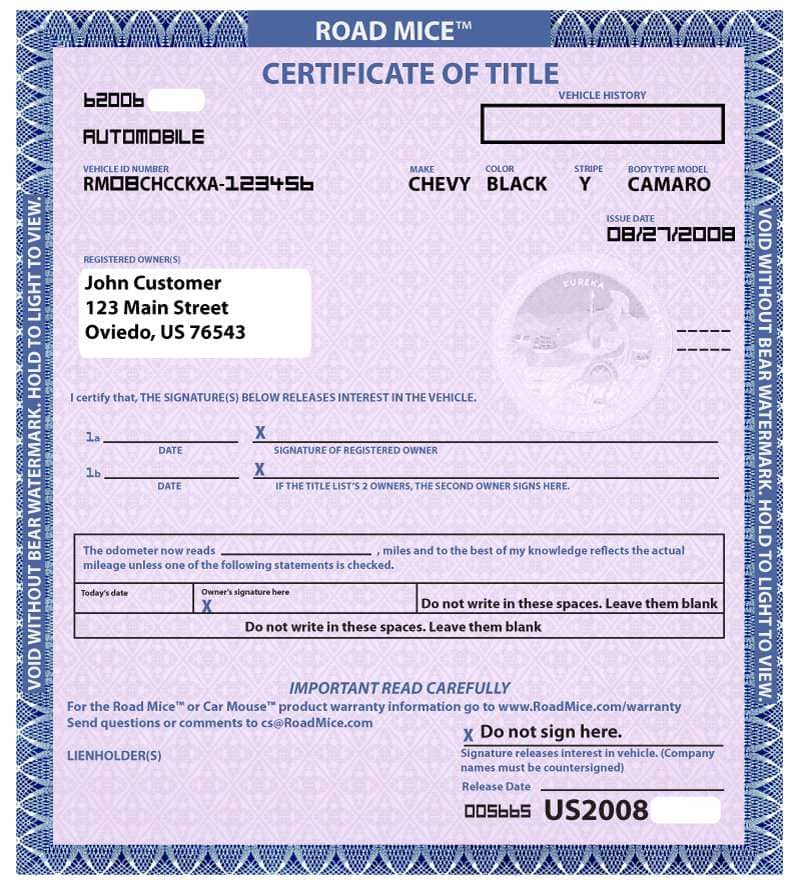

1. Clear Vehicle Title in Your Name

This is the most fundamental requirement. You must own your vehicle outright, and the title must be free of any existing liens or co-owners. If you are still making payments on your vehicle, or if there’s another name on the title, you may not qualify, or you’ll need to work through specific steps (like getting the other party’s consent or paying off the remaining balance) before applying. The title should be issued by your state’s DMV.

2. Sufficient Vehicle Value

Lenders will assess the make, model, year, mileage, and overall condition of your car to determine its wholesale market value. This valuation dictates the maximum loan amount you can qualify for. Generally, newer, lower-mileage vehicles in good condition will qualify for higher loan amounts, but older vehicles with consistent value can still be accepted. Most lenders require a minimum vehicle value to process a loan.

3. Proof of Income

Even though your car secures the loan, lenders need to be confident that you have the ability to make regular payments without undue hardship. Proof of income can come from various sources:

- Employment income: Pay stubs, employment verification letters.

- Self-employment income: Bank statements, tax returns.

- Government benefits: Social Security, disability payments.

- Retirement income: Pension statements.

- Other verifiable income: Annuities, settlements. The goal is to demonstrate a stable and consistent income stream that can comfortably cover your loan repayments.

4. Valid Government-Issued Identification

You will need to provide a current, valid photo ID, such as:

- A driver’s license.

- A state-issued ID card.

- A passport. This is to verify your identity and ensure you are of legal age (typically 18 or 21, depending on state law) to enter into a loan agreement.

5. Proof of Residency

Lenders will need to verify your current address. Acceptable documents include:

- Utility bills (electricity, water, gas).

- Rental agreement or mortgage statement.

- Bank statements with your address.

- Mail from a government agency.

6. Vehicle Registration and Insurance (State Dependent)

Some states and lenders may require proof of current vehicle registration and/or active insurance coverage (liability or full coverage) for the duration of the loan. This protects both you and the lender in case of an accident or damage to the vehicle.

7. Verifiable References (Occasionally)

While less common for online applications, some lenders might ask for personal or professional references, especially for higher loan amounts or unique circumstances.

By ensuring you meet these straightforward requirements, you significantly increase your chances of securing the best car title loans online and getting the fast cash you need.

The Simple Process: Getting the Best Car Title Loan Online in 5 Easy Steps

One of the greatest advantages of online car title loans is their streamlined, user-friendly process. We’ve simplified it into five clear steps, designed to get you from application to cash as quickly as possible.

Step 1: Complete Our Secure Online Application

This is where your journey begins. Visit our website and locate the online application form. You’ll be asked for basic information about yourself and your vehicle, including:

- Personal Details: Name, contact information, address, date of birth.

- Vehicle Information: Make, model, year, mileage, VIN (Vehicle Identification Number).

- Employment/Income Details: Source and amount of income.

The form is intuitive and designed for quick completion. Remember, accuracy is key to speeding up the approval process. All information submitted is protected by advanced encryption.

Step 2: Submit Required Documentation for Vehicle Evaluation

Once your application is submitted, you’ll be prompted to provide the necessary documents digitally. This usually involves:

- Photos of your car: Exterior (front, back, sides), interior, odometer reading, and VIN. These photos help us and the lender assess your vehicle’s condition and value remotely.

- Clear Vehicle Title: Photos of your actual vehicle title (front and back).

- Proof of Income: Recent pay stubs, bank statements, or other income verification.

- Valid ID: A photo of your government-issued identification.

- Proof of Residency: A recent utility bill or rental agreement.

Our system allows for easy uploading of these documents, or you can send them via email or even text message in some cases. This digital submission eliminates the need for physical paperwork.

Step 3: Receive Your Loan Offer and Review Terms

Once your application and documents are reviewed, a lender will assess your vehicle’s value and your ability to repay. They will then present you with a loan offer, which includes:

- The Loan Amount: How much cash you qualify for.

- Interest Rate (APR): The annual percentage rate of the loan.

- Repayment Schedule: The number and frequency of payments (e.g., monthly).

- Total Cost of the Loan: All fees and interest summed up.

It is crucial to read and understand all the terms and conditions outlined in the offer. Don’t hesitate to ask questions if anything is unclear. Reputable lenders are committed to transparency.

Step 4: Electronically Sign Your Loan Agreement

If you’re satisfied with the loan offer, the next step is to sign the loan agreement. With online title loans, this is typically done electronically via e-signature. This digital signature holds the same legal weight as a handwritten one. Before signing, ensure you fully comprehend:

- All loan terms: Especially the APR, total repayment amount, and any potential penalties for late payments.

- Your rights and responsibilities: As the borrower.

- The lender’s responsibilities: Regarding loan servicing and title handling.

Step 5: Get Your Cash Instantly!

Congratulations! Once the loan agreement is signed, the funds are disbursed quickly. Most often, the money is directly deposited into your checking account. Depending on the lender and your bank, you could see the funds arrive:

- Within hours on the same business day.

- By the next business day.

Some lenders may also offer alternative funding methods like wire transfers or picking up cash at a designated location, but direct deposit is the most common and efficient for online title loans.

And that’s it! Five simple steps to get the emergency cash you need, all from the convenience of your home, and with you still driving your car.

What Makes Us (or a Lender) Offer the Best Car Title Loans Online? Our Commitment to You

When searching for the best car title loans online, it’s essential to partner with a service that prioritizes your needs, offers competitive terms, and operates with integrity. Here’s what sets us apart and defines a truly “best-in-class” online title loan experience:

1. Competitive Rates and Flexible Terms

We collaborate with a network of lenders who strive to offer competitive interest rates (APR) and flexible repayment terms. While title loans generally have higher APRs than traditional bank loans due to the risk and speed involved, we aim to connect you with options that are fair and manageable. Our lenders understand that one size doesn’t fit all, offering various loan durations to better suit your budget and ability to repay.

2. Exceptional Customer Service and Support

Even with an online process, personal support is crucial. Our team and our lending partners are committed to providing outstanding customer service. From guiding you through the application to answering your questions about repayment, we’re here to help every step of the way. We believe in clear, friendly communication that builds trust and confidence.

3. Unwavering Transparency: No Hidden Fees, No Surprises

Transparency is a cornerstone of our service. We only partner with lenders who clearly disclose all terms, conditions, interest rates, and any associated fees upfront. You will never encounter hidden charges or unexpected clauses in the fine print. Our goal is to ensure you fully understand your loan agreement before you commit, empowering you to make informed decisions.

4. Reputation and Trust: Licensed and Compliant Lending

The best online title loan providers operate with the highest standards of integrity and adhere strictly to state and federal lending regulations. We vet our network of lenders to ensure they are properly licensed and have a strong, positive reputation within the industry. We encourage you to read reviews and testimonials to see what other satisfied customers have to say.

5. Streamlined and Secure Online Platform

Our platform is meticulously designed for ease of use, efficiency, and robust security. We invest in the latest encryption technology to protect your personal and financial data. The application process is intuitive, and document submission is straightforward, ensuring a hassle-free and safe user experience from start to finish.

6. Fast Funding Commitment

We understand that when you need cash, you need it now. Our processes and partnerships are optimized for speed, aiming for quick approvals and same-day or next-business-day funding. Our goal is to minimize your waiting time so you can address your financial emergency without delay.

By choosing our platform, you’re not just applying for a loan; you’re accessing a service that stands for fairness, efficiency, and customer empowerment, truly delivering on the promise of the best car title loans online.

Understanding the Costs: APR, Fees, and How to Manage Repayment Responsibly

While online car title loans offer a vital solution for urgent financial needs, it’s crucial to understand their associated costs and how to manage repayment responsibly. Transparency is key to making an informed decision.

Understanding the Annual Percentage Rate (APR)

The APR (Annual Percentage Rate) is the total cost of borrowing money for one year, expressed as a percentage. It includes not only the interest rate but also any additional fees charged by the lender.

- Why APRs can be higher: Car title loans are short-term, high-risk loans (from the lender’s perspective, due to the speed and often less stringent credit checks). Therefore, their APRs are typically higher than traditional bank loans or credit cards.

- Comparing APRs: Always compare the APRs offered by different lenders. A lower APR means a lower overall cost of the loan. Don’t just look at the monthly payment; focus on the total cost over the life of the loan.

- Short-term solution: These loans are best used for short-term financial gaps, not as a long-term financial solution, precisely because of the higher APRs.

Common Fees Associated with Car Title Loans

Beyond the interest, some lenders may charge additional fees. Reputable providers of the best car title loans online will disclose all fees upfront. Common fees might include:

- Origination Fee: A one-time fee charged for processing the loan.

- Processing Fee: Similar to an origination fee, covering administrative costs.

- Late Payment Fee: A charge incurred if you miss a payment deadline.

- Lien Fee/DMV Fee: Some states may have a small fee for placing a lien on your title.

- Prepayment Penalty: Rare for title loans, but always check if there’s a penalty for paying off your loan early. (Ideally, choose a lender without this.)

How to Minimize Fees:

- Shop Around: Different lenders have different fee structures.

- Read the Loan Agreement: Scrutinize the agreement for all listed fees.

- Ask Questions: If a fee isn’t clear, ask for an explanation.

- Pay On Time: Avoid late payment fees by adhering to your repayment schedule.

Strategies for Responsible Repayment

Managing your loan effectively is crucial to a positive experience and avoiding financial strain.

- Budgeting is Key: Before taking out the loan, create a realistic budget that includes the loan payments. Ensure you have enough disposable income to comfortably make payments without sacrificing other essential expenses.

- Make Payments On Time: This is paramount. On-time payments prevent late fees, maintain a good borrowing relationship, and prevent the risk of default (and potential repossession of your car).

- Pay More Than the Minimum (If Possible): If your financial situation improves, paying more than the minimum required payment can significantly reduce the total interest paid and help you become debt-free faster. Many lenders allow early payoff without penalty.

- Communicate with Your Lender: If you foresee difficulty making a payment, contact your lender immediately. Many reputable lenders are willing to work with you to find a solution, such as a payment extension or a modified plan, rather than resorting to default.

- Refinancing/Extensions: In some cases, if your financial situation is difficult, some lenders might offer options to refinance your loan or extend the term. However, these options often come with additional fees or interest, so they should be carefully considered.

By understanding the costs, comparing offers, and committing to responsible repayment, you can effectively utilize online car title loans to navigate your financial emergencies.

Common Myths vs. Realities of Online Car Title Loans

Misinformation can often surround financial products. Let’s debunk some common myths about online car title loans and reveal the realities, helping you approach this option with clarity and confidence.

Myth 1: You’ll Lose Your Car Immediately if You Take Out a Title Loan.

Reality: This is the most pervasive and misleading myth. With reputable online car title loan providers, you absolutely keep driving your car throughout the entire loan term, as long as you make your agreed-upon payments. The lender places a lien on your car’s title, not on the car itself. Your daily life remains unaffected, and you only hand over the physical title (or a digital equivalent) as collateral, not the vehicle. Repossession is a last resort for lenders and only occurs in cases of sustained non-payment and after every other option has been exhausted.

Myth 2: Car Title Loans Are Only for Desperate People with No Other Options.

Reality: While title loans are an excellent option for those facing urgent financial needs when traditional banks are out of reach, they are also a smart financial tool for responsible individuals facing temporary cash flow gaps. Unexpected expenses can hit anyone, regardless of their financial background. Many choose online car title loans because of their speed, convenience, and accessibility, making them a practical and strategic choice for short-term financial solutions.

Myth 3: All Car Title Loans Are Predatory and Designed to Trap Borrowers.

Reality: This is a dangerous generalization. While, like any financial industry, there can be less scrupulous actors, many providers of online car title loans are reputable, licensed, and operate with transparency and a commitment to customer service. The key is to choose wisely. Look for lenders who clearly disclose all terms, have positive customer reviews, are licensed in your state, and are willing to answer all your questions. Our platform is dedicated to connecting you with such trusted partners.

Myth 4: Your Credit Score Is Everything, and You Won’t Qualify with Bad Credit.

Reality: This is largely untrue for car title loans. Unlike traditional personal loans or credit cards, online car title loans put less emphasis on your credit score. Because the loan is secured by the equity in your vehicle, lenders primarily focus on two factors:

- The market value of your car.

- Your verifiable ability to repay the loan (stable income). This makes them an excellent option for individuals with imperfect credit histories or those without a credit history who need immediate funds.

Myth 5: The Application Process for Title Loans is Long and Complicated.

Reality: With online car title loans, the opposite is true. The process has been specifically designed for speed and simplicity. From filling out a short online application to digitally submitting documents and e-signing agreements, the entire journey can often be completed within hours. This efficiency is a core benefit, especially when time is of the essence.

By understanding these realities, you can approach online car title loans with a clear perspective, making an informed decision that best suits your financial situation.

Tips for Choosing the Best Online Car Title Loan Provider

Finding the best car title loans online isn’t just about speed; it’s about finding a reputable lender who offers fair terms and excellent service. Here are essential tips to guide your choice:

1. Compare Multiple Offers

Never settle for the first offer you receive. Use platforms like ours to compare rates, terms, and fees from several different lenders. This is the single most effective way to ensure you’re getting the most competitive deal available. Look beyond just the loan amount; consider the APR, total repayment cost, and length of the loan term.

2. Read Reviews and Testimonials

Customer experiences can tell you a lot about a lender’s reliability and service quality. Look for reviews on independent platforms, social media, and the Better Business Bureau (BBB). Pay attention to comments regarding transparency, customer support, and the ease of the application and repayment process. A pattern of positive feedback is a strong indicator of a trustworthy provider.

3. Verify Licensing and Accreditation

Ensure that any lender you consider is properly licensed to operate in your state. Licensing ensures they adhere to state-specific regulations designed to protect consumers. You can often check this information on the lender’s website or through your state’s financial regulatory body. Accreditation with industry organizations can also be a sign of commitment to best practices.

4. Understand All Terms and Conditions Before Signing

This cannot be stressed enough. Thoroughly read the entire loan agreement. Pay close attention to:

- Annual Percentage Rate (APR): This is the true cost of the loan over a year.

- All Fees: Ensure every fee (origination, processing, late payment, etc.) is clearly itemized and understood.

- Repayment Schedule: Know exactly when and how much your payments will be.

- Default Consequences: Understand the implications if you cannot make payments (though no reputable lender wants to repossess your car, it’s a possibility in extreme cases of non-payment). If anything is unclear, ask for clarification. A reputable lender will be happy to answer your questions.

5. Prioritize Transparency: Beware of Hidden Fees

A trustworthy lender will be completely transparent about all costs associated with the loan. Avoid any lender that seems evasive, pushes you to sign quickly without reading, or uses overly complex language to obscure fees. The best car title loans online are offered by providers who believe in clear, straightforward communication.

6. Assess Customer Support Quality

Test their customer service before committing. Send an email or make a phone call with a question. How quickly and helpfully do they respond? Good customer support indicates a lender who values their clients and will be there for you if issues arise during your loan term.

7. Beware of “Guaranteed Approval” Claims Without Proper Vetting

While title loans are more accessible, legitimate lenders still conduct some checks (like verifying income and vehicle value). Be wary of any offer that guarantees approval without any questions asked, as this could be a sign of a predatory lender.

By following these tips, you empower yourself to choose the best car title loans online provider, ensuring a safe, fair, and efficient financial solution for your needs.

When Is an Online Car Title Loan the Right Choice for You?

Understanding when online car title loans are a suitable financial tool is just as important as knowing how they work. These loans are designed for specific situations and should be considered strategically.

1. Emergency Expenses That Can’t Wait

This is the most common and appropriate use for car title loans. If you’re facing an urgent expense that requires immediate cash, and you don’t have an emergency fund or other available credit, a title loan can be a lifesaver. Examples include:

- Medical Emergencies: Unexpected hospital visits, prescription costs, or essential treatments.

- Urgent Home Repairs: A burst pipe, a broken furnace in winter, or a damaged roof.

- Unexpected Vehicle Repairs: If your car is your livelihood, getting it fixed quickly is critical.

- Preventing Utility Shut-off: Avoiding the loss of essential services like electricity or heating.

- Other Time-Sensitive Bills: Situations where delaying payment would incur significant penalties or lead to severe consequences.

In these scenarios, the speed and accessibility of online car title loans can provide much-needed relief.

2. Short-Term Cash Flow Gaps

Sometimes, you know you have funds coming (e.g., your next paycheck, a tax refund, or an insurance payout), but you need cash now to bridge a temporary gap. A title loan can provide the immediate liquidity you need to cover expenses until your expected funds arrive. It’s crucial, however, to have a clear plan for repayment once those funds are received.

3. When Traditional Loans Aren’t an Option

If you’ve been turned down by banks or credit unions due to a low credit score, a lack of collateral for a traditional loan, or insufficient credit history, an online car title loan provides an alternative. Because they are secured by your vehicle’s equity and prioritize your ability to repay over your credit score, they open doors for many who would otherwise be unable to access emergency funds.

4. You Have a Clear Title and a Valued Vehicle

If you own your car outright and it has sufficient market value, you possess untapped equity that can be quickly converted into cash. This makes you an ideal candidate for a title loan, as your primary collateral is readily available.

5. You Have a Clear Repayment Strategy

Before applying, honestly assess your ability to repay the loan within the agreed-upon terms. If you have a stable income and a realistic plan to make consistent payments, then an online car title loan can be a responsible choice. However, if you’re unsure about your ability to repay or if the loan payments would severely strain your budget, it’s wise to explore other options or reconsider the amount you borrow.

When it might not be the right choice:

- Long-term financial problems: Title loans are not a solution for ongoing debt or chronic financial instability.

- Non-essential purchases: Using a high-interest loan for discretionary spending is generally not recommended.

- If you might struggle with repayment: The risk of spiraling debt or eventual car repossession is real if you default.

By carefully evaluating your situation against these points, you can determine if the best car title loans online truly align with your needs and provide a viable, responsible path forward.

What to Have Ready for Your Online Application: A Checklist

To ensure the fastest and smoothest application process for the best car title loans online, having all your necessary information and documents prepared beforehand is key. Here’s a practical checklist:

1. Personal Identification Information

- Valid Government-Issued ID: Your driver’s license, state ID, or passport number. Make sure it’s current and not expired.

- Social Security Number (SSN): Or other taxpayer identification number, if required for verification.

- Date of Birth.

2. Contact and Residency Information

- Current Address: Proof of residency, such as a utility bill (electricity, water, gas) or a rental agreement/mortgage statement from the last 30-60 days.

- Phone Number: A reliable number where you can be reached.

- Email Address: For sending documents, updates, and the loan agreement.

3. Vehicle Information

- Clear Vehicle Title: The original title in your name, free of any liens. Have photos of both the front and back ready for digital submission.

- Vehicle Identification Number (VIN): This 17-digit code is usually found on your dashboard (driver’s side) and on your car’s registration and title.

- Make, Model, Year, and Mileage: Be accurate with these details as they are crucial for valuation.

- Photos of Your Car:

- Exterior (front, rear, sides).

- Interior.

- Odometer reading.

- Photo showing the VIN.

- Any significant damage or unique features.

- Vehicle Registration: Current registration documents.

- Proof of Insurance: (If required by the lender or your state) your current auto insurance policy details.

4. Income and Financial Information

- Proof of Income:

- For Employed Individuals: Recent pay stubs (last 1-2 months) or a letter from your employer.

- For Self-Employed Individuals: Recent bank statements showing consistent income deposits, or tax returns.

- For Benefit Recipients: Statements showing Social Security, disability, pension, or other regular benefit payments.

- Bank Account Information: Your bank name, account number, and routing number for direct deposit of funds. Most lenders require a checking account.

By gathering these items before you begin the online application, you can significantly reduce the time it takes to complete the process and accelerate your path to getting the cash you need from the best car title loans online.

Beyond the Loan: Building Financial Health

While online car title loans provide a critical solution for immediate financial needs, it’s equally important to view them as a stepping stone towards stronger long-term financial health. Responsible borrowing, combined with smart financial habits, can help prevent future emergencies or at least make them more manageable.

1. Responsible Borrowing Practices

- Borrow Only What You Need: While you might qualify for a higher amount, only take out a loan that truly meets your immediate need. Over-borrowing means higher repayments and more interest.

- Understand Your Capacity to Repay: Before committing, be absolutely certain that your current income can comfortably cover the loan payments without jeopardizing other essential expenses.

- Read the Fine Print: As mentioned, fully understand all terms, rates, and fees. This prevents surprises and empowers you to make informed decisions.

2. Develop a Solid Budget and Stick to It

Creating a personal budget is the foundation of financial stability.

- Track Your Income and Expenses: Know exactly where your money comes from and where it goes.

- Categorize Spending: Identify essential vs. non-essential spending.

- Find Areas to Cut Back: Even small reductions in discretionary spending can free up funds for saving or debt repayment.

- Automate Savings: Set up automatic transfers from your checking to a separate savings account each payday, even if it’s a small amount.

3. Build an Emergency Fund

One of the best ways to avoid needing emergency loans in the future is to have a robust emergency fund.

- Start Small: Begin by saving even $100-$500 for minor unexpected expenses.

- Grow Gradually: Aim for 3-6 months’ worth of living expenses in an easily accessible, separate savings account. This safety net can cover job loss, major medical bills, or significant repairs without resorting to high-interest loans.

4. Improve Your Credit Score (Long-Term Goal)

While title loans don’t heavily rely on credit, a good credit score opens doors to lower-interest traditional loans in the future.

- Pay All Bills On Time: This is the most significant factor in credit scoring.

- Keep Credit Utilization Low: If you have credit cards, try to use less than 30% of your available credit.

- Review Your Credit Report Regularly: Check for errors that could negatively impact your score.

5. Seek Financial Counseling if Needed

If you find yourself consistently struggling with debt or managing your finances, consider reaching out to a non-profit credit counseling service. They can offer personalized advice, help you create a debt management plan, and provide resources to improve your financial literacy.

By combining the immediate relief offered by the best car title loans online with these proactive financial management strategies, you can not only navigate current challenges but also build a more secure and stable financial future.

Frequently Asked Questions (FAQs) About Online Car Title Loans

Here are answers to some of the most common questions people have about the best car title loans online:

Q1: Can I get a car title loan with bad credit?

A1: Yes! One of the biggest advantages of online car title loans is that they are less reliant on your credit score. Lenders primarily focus on the value of your vehicle and your ability to repay the loan, making them an accessible option for people with bad credit or no credit history.

Q2: How fast can I get the money?

A2: Typically, very fast. Many reputable online lenders offer approval within hours and can deposit funds directly into your bank account on the same business day, or by the next business day, once your application is complete and approved.

Q3: Do I need a checking account for an online title loan?

A3: Most online lenders prefer or require a checking account for direct deposit of your loan funds and for setting up automatic repayments. This streamlines the process and ensures quick access to your cash.

Q4: Will I lose my car if I get an online title loan?

A4: No, you keep driving your car. You only provide your car’s clear title as collateral, and the lender places a lien on it. As long as you make your agreed-upon payments, you retain full use of your vehicle. Repossession is a last resort in cases of sustained non-payment.

Q5: How much can I borrow?

A5: The loan amount largely depends on the wholesale market value of your vehicle and your ability to repay the loan. Lenders typically offer a percentage of your car’s value, which can range from a few hundred to several thousand dollars.

Q6: What documents do I need to apply for the best car title loans online?

A6: You’ll typically need a clear vehicle title in your name, a valid government-issued ID, proof of income (pay stubs, bank statements), proof of residency (utility bill), and photos of your vehicle.

Q7: Are there any hidden fees with online title loans?

A7: Reputable providers of the best car title loans online are transparent about all fees. Before signing, ensure the loan agreement clearly outlines the APR, origination fees, late payment fees, and any other charges. Always read the terms thoroughly.

Q8: What if I can’t repay my loan on time?

A8: If you anticipate difficulty making a payment, it’s crucial to contact your lender immediately. Many reputable lenders are willing to work with you to discuss options like payment extensions or a modified repayment plan, which can help you avoid default and potential repossession.

Q9: Is my personal information safe when applying online?

A9: Yes, legitimate online lenders and platforms use advanced encryption and security protocols to protect your personal and financial data. Always ensure you are on a secure website (look for “https://” in the URL).

Q10: Can I pay off my online title loan early?

A10: Most reputable lenders allow you to pay off your loan early without penalty, which can save you money on interest. Always confirm this in your loan agreement.

Ready for Your Fast Cash Solution? Apply for the Best Car Title Loans Online Today!

When life demands immediate financial attention, don’t let traditional lending hurdles hold you back. The best car title loans online offer a fast, convenient, and accessible pathway to the funds you need, all while keeping you in the driver’s seat of your own vehicle.

We’ve designed our platform to connect you with a network of trusted and transparent lenders, ensuring you receive competitive offers and exceptional service throughout your borrowing journey. Experience the ease of a fully online application, swift approval decisions, and prompt direct deposits – because when you’re facing an emergency, every second counts.

Don’t wait for uncertainty to take over. Take control of your financial situation today.

APPLY NOW AND GET YOUR FREE QUOTE!

Or, if you prefer to speak with a friendly expert, call us at Whatsapp +1 707 409 7892 to discuss your options. We’re here to help you get the best car title loan online that fits your needs.

Showing the single result