Best online car title loans

Discover the Best Online Car Title Loans for Your Financial Needs

Are you facing an unexpected expense, a medical emergency, or simply need quick access to funds without the complexities of traditional bank loans? Exploring the best online car title loans could be your ideal solution. At Legit Vendor USA, we understand that life throws curveballs, and sometimes you need a reliable, fast, and friendly way to get the cash you need, using the equity in your car. We’re dedicated to providing a transparent, efficient, and supportive experience from start to finish.

What Are Online Car Title Loans and How Do They Work?

Online car title loans are a specific type of secured loan where you use your vehicle’s clear title as collateral. This means that instead of relying primarily on your credit score, lenders assess the value of your car to determine how much you can borrow. The “online” aspect signifies that the entire process – from application to approval and even funding – can often be completed digitally, offering unparalleled convenience and speed.

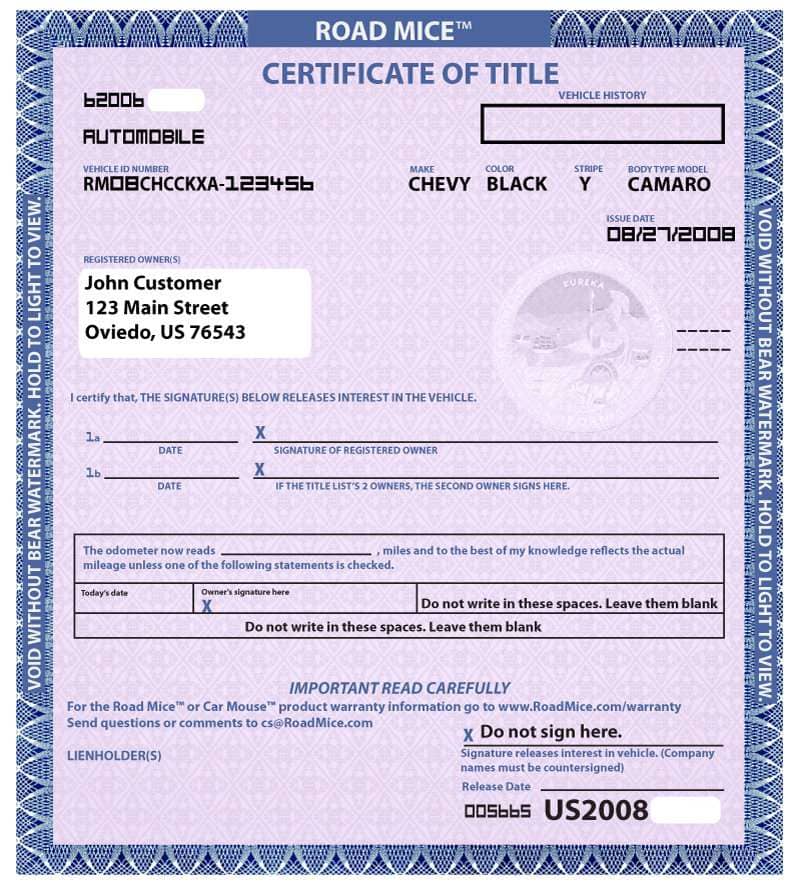

You maintain possession of and continue to drive your car throughout the loan period. The lender temporarily holds your car’s title as security. Once you’ve repaid the loan in full, including interest and fees, your title is returned to you. It’s a straightforward process designed to help you leverage your vehicle’s value without giving up your transportation.

The Core Mechanics: Collateral and Equity

The fundamental principle behind a car title loan is leveraging the equity you have in your vehicle. If you own your car outright or have paid a significant portion of your car loan, you likely have equity. The more equity, the more you may be able to borrow. The car title serves as collateral, providing the lender with security for the loan. This reduces the risk for the lender, which in turn often makes these loans more accessible than unsecured loans, especially for individuals with less-than-perfect credit.

Why Choose Online Car Title Loans?

When you’re in a financial bind, speed and accessibility are paramount. Online car title loans offer several compelling advantages that make them a popular choice for many:

1. Speed and Efficiency

One of the most significant benefits of applying for car title loans online is the lightning-fast process. Unlike traditional bank loans that can take days or even weeks for approval, many online title loan providers can process your application and approve your loan in as little as 30 minutes. Funds can often be disbursed to your bank account on the same day or within one business day, making them ideal for urgent financial needs.

2. Convenience from Anywhere

The online aspect means you can apply from the comfort of your home, office, or anywhere with an internet connection. There’s no need to visit a physical branch, stand in lines, or deal with piles of paperwork. The entire process, from submitting documents to signing agreements, can be done digitally, saving you time and hassle.

3. Credit Score Is Less of a Factor

Traditional lenders heavily rely on your credit score to assess risk. For individuals with bad credit or no credit history, obtaining a loan can be a significant challenge. Car title loans, because they are secured by your vehicle’s title, focus more on the value of your car and your ability to repay the loan than on your credit score. This opens up financial access for a broader range of borrowers.

4. Keep Driving Your Car

This is a crucial advantage. Many people mistakenly believe they have to surrender their car to get a title loan. This is simply not true. You keep your vehicle, continue driving it for work, errands, and personal use, as long as you make your scheduled payments. The lender only holds the title, not the car itself.

5. Flexible Loan Amounts

The amount you can borrow typically depends on the fair market value of your vehicle and your ability to repay. This allows for a certain degree of flexibility in loan amounts, often ranging from a few hundred dollars to several thousand, catering to various financial needs.

6. Transparent Process

Reputable online lenders prioritize transparency. They will clearly outline the loan terms, interest rates, fees, and repayment schedules upfront, ensuring you understand exactly what you’re agreeing to before you sign anything.

Who Can Benefit from Online Car Title Loans?

Online car title loans are designed for a wide array of individuals facing diverse financial situations. They are particularly beneficial for:

- Emergency Situations: Unexpected medical bills, urgent home repairs, sudden travel needs, or unforeseen car trouble often require immediate funds.

- Bridging Gaps: When you’re waiting for your next paycheck but need cash now to cover essential expenses.

- Individuals with Poor or No Credit: If your credit score prevents you from getting approved for traditional loans, a title loan can offer a viable alternative.

- Small Business Owners: Sometimes, a quick influx of cash can help cover unexpected operational costs or take advantage of a timely opportunity.

- Anyone Needing Quick Cash: The streamlined online process is perfect for anyone who values speed and convenience in accessing funds.

It’s important to remember that while accessible, title loans are short-term financial solutions and should be used responsibly for urgent needs rather than recurring expenses.

How to Get the Best Online Car Title Loans: A Step-by-Step Guide

Securing a car title loan online is designed to be straightforward. Here’s a breakdown of the typical process:

Step 1: Online Application

The journey to getting the best online car title loans begins with a simple online application form. You’ll typically be asked for basic personal information (name, address, contact), details about your vehicle (make, model, year, mileage, VIN), and your employment/income information. This initial step helps the lender understand your eligibility and the potential value of your vehicle.

Step 2: Vehicle Valuation

Once your application is submitted, the lender will perform a quick assessment of your vehicle’s value. This is often done using industry-standard tools and your provided details. Some lenders might ask for a few photos of your car. The valuation helps determine how much you qualify to borrow.

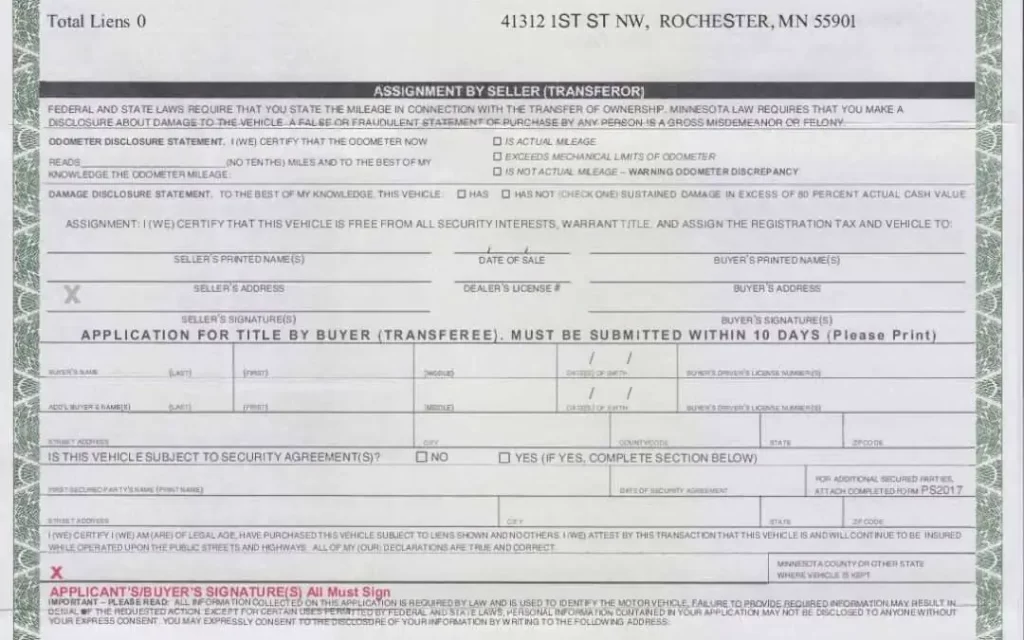

Step 3: Document Submission

To verify your information and finalize the loan, you’ll need to submit a few key documents. This can usually be done by uploading scans or clear photos directly through the online portal, or via email. We’ll detail the required documents shortly.

Step 4: Loan Offer and Review

Upon reviewing your application and documents, a representative will typically contact you with a loan offer. This offer will include the principal loan amount, interest rate (APR), total repayment amount, and the repayment schedule. This is your opportunity to carefully review all terms and ask any questions you may have. A reputable lender will ensure you understand every aspect of the agreement.

Step 5: E-Signature and Funding

If you’re satisfied with the loan terms, you’ll sign the loan agreement electronically. Once signed, the funds are quickly disbursed. Depending on your bank and the lender’s processes, the money can be deposited directly into your bank account via ACH transfer within hours, or at most, by the next business day.

Step 6: Repayment

You’ll make regular payments according to the agreed-upon schedule. Options often include online payments, automatic deductions, or phone payments. Once the loan is fully repaid, the lien on your title is released, and your clear title is returned to you.

Key Features to Look for in the Best Online Car Title Loans Provider

Not all online car title loan providers are created equal. To ensure you’re getting the best online car title loans, consider these critical features:

1. Transparent Terms and Conditions

A top-tier lender will always be upfront about all costs involved. Look for clear explanations of interest rates, APR (Annual Percentage Rate), origination fees, late payment fees, and any other potential charges. Avoid lenders who seem vague or unwilling to provide a detailed breakdown of costs.

2. Competitive Interest Rates

While title loan interest rates are generally higher than traditional bank loans due to the associated risk, the “best” providers strive to offer competitive rates within the industry. Compare offers from different lenders to ensure you’re getting a fair deal.

3. Flexible Repayment Plans

Life is unpredictable. The best lenders understand this and may offer flexible repayment schedules or options for extending your loan (rollovers) if you encounter temporary difficulties. However, always exercise caution with rollovers as they can increase the total cost of your loan.

4. Fast Approval and Funding Times

The primary reason many choose online title loans is speed. The best providers boast rapid application processing, quick approvals, and same-day or next-day funding to get you the cash when you need it most.

5. Excellent Customer Service

A friendly, knowledgeable, and responsive customer service team is invaluable. They should be available to answer your questions, guide you through the process, and assist with any issues that arise. Look for providers with multiple contact options (phone, email, chat).

6. Strong Online Security

Since you’ll be sharing sensitive personal and financial information, robust online security is non-negotiable. Ensure the website uses encryption (look for “https://” in the URL and a padlock symbol) and has a clear privacy policy outlining how your data is protected.

7. Positive Customer Reviews and Reputation

Before committing, research the lender’s reputation. Look for positive reviews, testimonials, and high ratings on independent review platforms. This provides insight into other customers’ experiences.

8. No Hidden Fees

Reputable lenders pride themselves on having no surprises. All fees should be disclosed upfront. Be wary of any lender that introduces unexpected charges later in the process.

Essential Eligibility Requirements

To qualify for most online car title loans, you’ll generally need to meet specific criteria. While requirements can vary slightly by lender and state, the core ones include:

- Be at least 18 years old: This is a universal legal requirement for entering into a loan agreement.

- Own your vehicle outright: You must have a clear, lien-free title in your name. If you’re still making payments, you typically won’t qualify, although some lenders might work with you if you only have a small balance remaining.

- Proof of income: Lenders need to ensure you have a stable source of income to repay the loan. This can come from employment, self-employment, disability benefits, social security, or other verifiable sources.

- Valid government-issued ID: A driver’s license, passport, or state ID is required for identity verification.

- Proof of residency: A utility bill or lease agreement can serve as proof that you live at your stated address.

- Active bank account: Necessary for receiving funds and often for setting up repayments.

- Working vehicle: Your car needs to be in good running condition and have sufficient value to secure the loan. Some lenders may inspect the vehicle, either physically or through photos.

Required Documents for Application

Having your documents ready can significantly speed up the application and approval process for the best online car title loans. You’ll typically need:

- Original Vehicle Title: This is the most crucial document. It must be clear (no liens) and in your name.

- Valid Government-Issued ID: Such as a driver’s license, state ID, or passport.

- Proof of Income: Recent pay stubs, bank statements showing direct deposits, tax returns, or benefit statements.

- Proof of Residency: A utility bill (electric, gas, water), mortgage statement, or rental agreement with your current address.

- Vehicle Registration and Insurance: Current registration and proof of active auto insurance.

- Photos of Your Vehicle: Some online lenders require a few recent photos of your car (front, back, sides, odometer) to assist with valuation.

- References (Optional): Some lenders might ask for personal or professional references, though this is less common with online applications.

Understanding Interest Rates and Fees in Online Car Title Loans

When seeking the best online car title loans, it’s crucial to understand the costs involved beyond just the principal amount.

Annual Percentage Rate (APR)

The APR is the total cost of the loan, expressed as a yearly rate. It includes the interest rate plus any additional fees. Title loan APRs can be higher than those for unsecured personal loans due to the short-term nature and the risk profile. Always compare APRs from different lenders.

Interest Rates

This is the percentage charged on the principal amount borrowed. It’s the core cost of borrowing money.

Other Potential Fees:

- Origination Fees: A one-time fee charged by the lender for processing the loan.

- Processing Fees: Similar to origination fees, covering administrative costs.

- Late Payment Fees: Charged if you miss a scheduled payment.

- Lien Fees: Some states allow lenders to charge a fee for placing and removing a lien on your title.

- Prepayment Penalties: Less common with title loans, but always check if there’s a penalty for paying off your loan early. The best online car title loan providers will not have these.

Always ask for a complete breakdown of all fees and charges before signing any agreement. A transparent lender will happily provide this.

Repayment Options and Flexibility

The best online car title loans providers offer convenient and flexible repayment options to make the process as easy as possible:

- Online Payments: The most common and convenient method, allowing you to pay directly from your bank account through the lender’s secure portal.

- Automatic Payments (ACH): Set up recurring deductions from your bank account, ensuring you never miss a payment.

- Phone Payments: Make payments over the phone with a customer service representative.

- Money Order/Cashier’s Check: Some lenders allow payments via mail.

- Early Repayment: Most reputable lenders allow you to pay off your loan early without penalty, which can save you money on interest. Always confirm this policy.

- Rollovers/Extensions: If you face difficulty making a payment, some lenders may offer a loan rollover or extension. While this can provide temporary relief, it often comes with additional fees and interest, extending the loan term and increasing the overall cost. Use these options with caution and only as a last resort.

Pros and Cons of Online Car Title Loans

Like any financial product, online car title loans have their advantages and disadvantages. Understanding both sides helps you make an informed decision.

Pros:

- Fast Access to Funds: Often same-day or next-day funding.

- Less Emphasis on Credit Score: Ideal for those with bad or no credit.

- Convenient Online Process: Apply from anywhere, anytime.

- Keep Your Car: You retain possession and use of your vehicle.

- Flexible Loan Amounts: Based on your car’s value and ability to repay.

- Reduced Paperwork: Compared to traditional loans.

Cons:

- Higher APRs: Generally more expensive than traditional bank loans due to the short-term, high-risk nature.

- Risk of Losing Your Car: If you default on the loan, the lender can repossess your vehicle.

- Debt Cycle Potential: Rollovers and extensions can increase the total cost and potentially lead to a cycle of debt if not managed carefully.

- Not Available in All States: State regulations vary, so title loans may not be legal or available in every location.

Debunking Common Myths About Car Title Loans

There are several misconceptions about car title loans that can deter people from considering them as a viable option. Let’s set the record straight:

- Myth 1: You Lose Your Car Immediately.

- Fact: You keep and continue driving your car throughout the loan term, as long as you make your scheduled payments. The lender only holds the physical title.

- Myth 2: Title Loans Are Only for People with Bad Credit.

- Fact: While they are accessible to individuals with poor credit, anyone needing quick cash can apply, regardless of their credit history. The focus is on your car’s value and your income.

- Myth 3: All Title Loans Are Predatory.

- Fact: While some unscrupulous lenders exist (which is why due diligence is crucial), many reputable online providers operate ethically, offering transparent terms and fair practices. Choosing the best online car title loans means finding one of these ethical lenders.

- Myth 4: The Application Process is Complicated and Time-Consuming.

- Fact: Especially with online platforms, the application is designed to be quick, simple, and takes only a few minutes to complete. Document submission is often digital.

- Myth 5: You Can Only Get a Small Amount.

- Fact: Loan amounts vary widely based on your vehicle’s value, from a few hundred dollars to several thousand, making them suitable for various financial needs.

Tips for Choosing the Best Online Car Title Loan Provider

To ensure you partner with a trustworthy and beneficial lender for your best online car title loans, follow these tips:

- Compare Multiple Offers: Don’t just take the first offer. Apply with a few different reputable online lenders to compare APRs, fees, and terms.

- Read the Fine Print Carefully: Before signing, thoroughly review the loan agreement. Understand every clause, especially regarding interest rates, fees, repayment schedule, and consequences of default.

- Check for Licensing and Regulation: Ensure the lender is licensed to operate in your state and adheres to local regulations. A legitimate lender will usually display their licensing information on their website.

- Prioritize Transparency: Choose lenders who are open about all costs and terms with no hidden surprises.

- Assess Customer Service: Test their customer service. Are they responsive, helpful, and clear in their communication?

- Look for Positive Reviews: Check independent review sites like Trustpilot, Google Reviews, or the Better Business Bureau for feedback from other customers.

- Ensure Secure Website: Verify the website uses HTTPS encryption to protect your personal information.

- Understand Repayment Options: Confirm the flexibility of repayment methods and if there are penalties for early repayment.

Safety and Security When Applying for Online Car Title Loans

Your financial security and privacy are paramount. When seeking the best online car title loans, always prioritize lenders who demonstrate a strong commitment to data protection:

- SSL Encryption: Look for “https://” in the website URL and a padlock symbol, indicating that your data is encrypted during transmission.

- Privacy Policy: A comprehensive privacy policy should outline how your personal and financial information is collected, used, and protected.

- Reputable Payment Processors: Lenders should use secure and recognized payment gateways for fund transfers and repayments.

- Phishing Awareness: Be vigilant against phishing scams. Reputable lenders will rarely ask for sensitive information like your full social security number or bank account password via unsolicited emails or texts.

- Physical Security: While online, the company behind the platform should have strong internal data security protocols to protect stored information.

Customer Support and Resources

A sign of the best online car title loans provider is their dedication to customer support and providing helpful resources. Look for:

- Multiple Contact Channels: Phone, email, live chat, and a robust FAQ section.

- Knowledgeable Representatives: Staff should be able to clearly answer all your questions about the loan process, terms, and repayment.

- Educational Content: The website should offer articles, guides, or blog posts that explain title loans, responsible borrowing, and financial literacy.

- Assistance with Difficulties: A good lender will work with you if you face temporary financial hardship during your repayment period, discussing options before repossession becomes a consideration.

Responsible Borrowing Practices

While online car title loans can be a lifesaver in urgent situations, responsible borrowing is key to a positive experience.

- Borrow Only What You Need: Don’t take out more than you absolutely require. Larger loans mean larger repayments and more interest.

- Understand Your Repayment Ability: Before you commit, be honest with yourself about your ability to comfortably make the scheduled payments. Create a budget to ensure you can afford the loan.

- Read and Understand the Agreement: Never sign anything you don’t fully comprehend. Ask questions until you are completely clear on all terms.

- Avoid Rollovers if Possible: While they offer a safety net, frequent rollovers can significantly increase the total cost of your loan.

- Have a Repayment Plan: Know exactly how and when you will make each payment.

- Consider Alternatives: Before applying for a title loan, briefly explore other options like personal loans from credit unions, borrowing from family/friends, or employer advances, especially if your credit is good. Title loans are best for those who need quick cash and have limited traditional options.

Comparison with Other Loan Types

To truly appreciate the utility of the best online car title loans, it helps to understand how they differ from other common loan options:

- Traditional Bank Loans: Typically offer lower interest rates but require excellent credit, extensive paperwork, and a lengthy approval process. Not suitable for fast cash needs or those with poor credit.

- Personal Loans: Can be secured or unsecured. Unsecured personal loans rely heavily on credit scores. Secured personal loans might use other assets as collateral, but vehicle equity is specific to title loans. Approval can still take time.

- Payday Loans: Very short-term, small-dollar loans, often due on your next payday. They typically have extremely high APRs and can lead to a debt cycle quickly. Title loans are often for larger amounts and can have longer repayment periods.

- Credit Card Cash Advances: Quick but come with very high interest rates and often immediate interest accrual. They also reduce your available credit limit.

Online car title loans carve out a niche for individuals who need quick access to a moderate amount of cash, own their car outright, and may not qualify for traditional loans due to credit history.

Glossary of Key Terms

Understanding the jargon can empower you to make more informed decisions when dealing with best online car title loans:

- APR (Annual Percentage Rate): The total cost of borrowing money for one year, expressed as a percentage, including interest and fees.

- Collateral: An asset (in this case, your car’s title) pledged by a borrower to a lender as security for a loan.

- Lien: A legal claim placed on your property (your car’s title) by a lender until a debt is paid.

- Lien-Free Title: A vehicle title that has no outstanding loans or claims against it.

- Principal: The original amount of money borrowed, excluding interest and fees.

- Equity: The difference between your car’s market value and the amount you still owe on it (if any). For title loans, you need significant or full equity.

- Default: Failure to fulfill the terms of a loan agreement, typically by not making payments.

- Repossession: The act of taking back collateral (your car) by a lender when a borrower defaults on a secured loan.

- Rollover (or Renewal): An option to extend the loan term, often incurring additional fees and interest, pushing the repayment date further out.

Final Thoughts: Your Path to Financial Flexibility

Securing the best online car title loans can be a straightforward and effective way to navigate unexpected financial challenges. By leveraging the equity in your vehicle, you gain access to funds quickly, conveniently, and often without the stringent credit requirements of traditional lenders.

At LegitVendorUS, we are committed to being a leader in providing transparent, efficient, and friendly online title loan services. We encourage you to educate yourself, compare your options, and borrow responsibly. Our goal is to empower you with the financial flexibility you need, ensuring you can confidently address your immediate cash needs while keeping your car on the road.

If you’re ready to explore your options or have any questions, our dedicated team is here to assist you every step of the way. Apply today and discover how easy it can be to get the financial relief you deserve!

Showing the single result