Bill of sale for car vs title

Bill of Sale for Car vs. Title: Your Guide to a Smooth and Legal Vehicle Transfer

Bill of sale for car vs. title – it’s the classic pair of documents that every car buyer and seller encounters, yet their distinct roles often cause confusion. If you’ve ever found yourself wondering, “Which one is more important?” or “Do I need both?”, you’re not alone. Understanding the critical difference between a car bill of sale and a vehicle title is the cornerstone of a secure, legal, and hassle-free transaction. This comprehensive guide will demystify these two essential documents, explaining what they are, why you need them, and how they work together to protect both parties in a vehicle sale.

Think of it this way: the title is the car’s birth certificate and passport, proving who legally owns it. The bill of sale is the detailed receipt and contract for its most recent journey from one owner to the next. One proves long-term ownership; the other documents the specific terms of a single transaction. Skipping either one can lead to significant headaches, from legal and financial liability to outright fraud. Whether you’re a first-time seller or a seasoned buyer, getting this right is non-negotiable. Let’s dive into the details of each document and then explore how they function as a powerful team in your transaction.

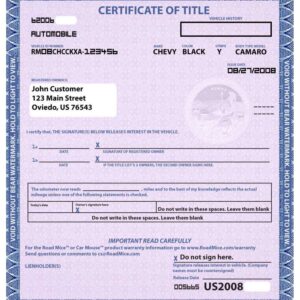

What is a Car Title? The Proof of Ownership

A car title, officially known as a “Certificate of Title,” is a legal document issued by a state’s Department of Motor Vehicles (DMV) or similar agency. It is the definitive proof of ownership for a vehicle. You cannot legally sell a car without the title, and you cannot legally register a car you’ve purchased without transferring the title into your name.

Key Elements of a Car Title:

- Vehicle Identification Number (VIN): The unique 17-digit fingerprint of the car.

- Owner’s Name and Address: The legal owner(s) of the vehicle.

- Lienholder Information: If there is an outstanding loan on the car, the bank or lender will be listed as a lienholder. The title cannot be transferred without the lienholder’s release.

- Vehicle Details: Make, model, year, and sometimes odometer reading at the time of the last title issuance.

- Title Number: A unique number assigned by the state.

- Signatures: Space for the seller(s) to sign over the title to the new owner.

The Different Types of Titles:

It’s crucial to check the title’s “brand” before buying, as it indicates the vehicle’s history:

- Clean Title: The vehicle has never been seriously damaged or declared a total loss by an insurance company.

- Salvage Title: The car has been damaged to the point where the cost of repairs exceeded a certain percentage of its value (e.g., 75%). It was declared a total loss.

- Rebuilt/Reconstructed Title: A salvaged vehicle that has been repaired and passed state inspections to be deemed roadworthy again.

- Lemon Law Title: The vehicle was repurchased by the manufacturer due to persistent, unfixable defects.

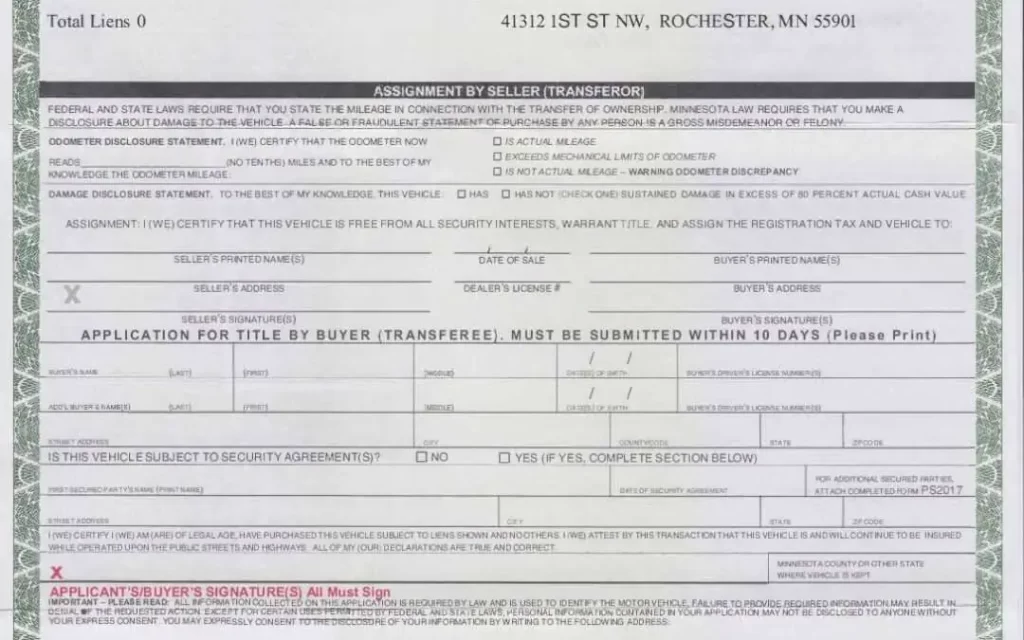

What is a Bill of Sale? The Record of the Transaction

A bill of sale for a car is a legal document that serves as a receipt and a contract for the transaction between a buyer and a seller. While not all states legally require it for a vehicle transfer, it is an incredibly wise and highly recommended document to create and keep for your records. It details the who, what, when, and how much of the sale.

Why a Bill of Sale is So Important (Even if Your State Doesn’t Mandate It):

- Proof for the Buyer: It proves you paid for the vehicle and outlines the agreed-upon “as-is” condition, protecting you if the seller later tries to make a false claim.

- Proof for the Seller: It proves you released the vehicle and received payment, protecting you from liability if the new owner gets into an accident before transferring the title. It also documents the sale price, which is important for tax purposes.

- For the DMV: Some states use the bill of sale to verify the sale price for tax calculations or to process a title transfer if there’s an issue with the title itself.

Key Elements of a Comprehensive Bill of Sale:

A simple receipt won’t cut it. A robust bill of sale should include:

- Date of Sale: The exact day the transaction occurred.

- Parties Involved: The full legal names, addresses, and driver’s license numbers of both the seller and the buyer.

- Vehicle Details: Year, make, model, body style, color, and most importantly, the VIN.

- Odometer Disclosure: The current mileage at the time of sale. Federal law requires this disclosure to prevent odometer fraud.

- Sale Price: The exact amount paid for the vehicle, written in both numbers and words.

- “As-Is” Clause: A statement confirming the vehicle is sold in its present condition, with no warranties or guarantees from the seller. This is critical for private party sales.

- Signatures: The handwritten signatures of both the buyer and the seller.

Bill of Sale vs. Title: The Critical Differences Side-by-Side

Now that we understand each document individually, let’s crystallize the differences.

| Aspect | Vehicle Title | Bill of Sale |

|---|---|---|

| Primary Purpose | Proof of Legal Ownership. It answers “Who owns this car?” | Proof of Transaction. It answers “What was the agreement for this sale?” |

| Issued By | State Government (DMV) | The Buyer and Seller (You create it) |

| Legality | Absolute Requirement. You cannot legally transfer ownership without it. | Highly Recommended. It is a protective contract, but not always a state-mandated document. |

| Duration | Permanent. It remains with the vehicle throughout its life, transferring from owner to owner. | Temporary/Transactional. It documents a single point-in-time event and is then filed away for records. |

| Function at DMV | Mandatory for Registration. The DMV uses it to transfer ownership and issue a new title. | Sometimes Requested. The DMV may ask for it to verify the sale price for tax purposes or to resolve discrepancies. |

| Content Focus | Identity of the vehicle (VIN) and the legal owner. | Details of the transaction: parties, date, price, condition, and odometer. |

The Dynamic Duo: How They Work Together in a Sale

The bill of sale and title are not competitors; they are partners. Here’s how they work in concert during a typical private party vehicle sale:

1. The Negotiation Phase: You agree on a price and terms. This is where the details that will go into the bill of sale are decided.

2. The Transaction Phase: This is where both documents come into play.

- The seller provides the title. They will sign it in the designated “seller” section, officially releasing their ownership interest. They must fill out the odometer disclosure on the title itself.

- Together, the buyer and seller fill out the bill of sale. This document captures all the specifics of the deal that aren’t on the title.

- The buyer gives the seller the payment (preferably a cashier’s check or another secure method).

- The seller gives the buyer the signed title, the signed bill of sale, and the keys.

3. The Aftermath Phase:

- The Seller’s Responsibility: The seller should keep a copy of the bill of sale for their records. In some states, they may need to submit a release of liability to the DMV, notifying them that they are no longer the owner. This protects them from tickets or fines incurred by the new owner.

- The Buyer’s Responsibility: The buyer must take the signed title and the bill of sale to their local DMV within the state-mandated time frame (often 30 days). They will pay the sales tax (based on the sale price documented on the bill of sale) and registration fees to get the title transferred into their name and receive new license plates.

Potential Pitfalls and How to Avoid Them

Failing to properly handle these documents can lead to serious consequences.

For the Buyer:

- Buying a Car with a Lien: If the title lists a lienholder, the loan must be paid off and the lien released before you can get a clear title. Never buy a car where the seller promises to “pay off the loan later.”

- Title Washing: A scam where a seller obtains a “clean” title in a state with lax laws for a car that was previously salvaged. Always get a vehicle history report (like Carfax or AutoCheck) using the VIN.

- No Title, No Sale: Never accept excuses like “I lost the title” or “I’ll mail it to you later.” The process for getting a duplicate title is straightforward, and the seller must do it before the sale.

For the Seller:

- Liability for Others’ Actions: If you don’t file a release of liability with the DMV and the new owner gets in an accident or accumulates parking tickets, you could be held responsible.

- Tax Implications: The bill of sale documents your income from the sale, which may be important for your taxes, especially if the car was used for business.

- Fraudulent Payment: Accepting a personal check can be risky, as it could bounce. A cashier’s check or cash is safer.

Creating a Rock-Solid Bill of Sale

You don’t need to be a lawyer to create an effective bill of sale. The key is to be thorough and clear. While you can write one from scratch, using a professionally drafted template ensures you don’t miss any critical legal clauses. A good template will include:

- All the key elements listed above.

- Clear “As-Is” language.

- Spaces for witness signatures (not required everywhere but adds an extra layer of protection).

- Compliance with specific state requirements regarding odometer disclosure and notarization.

Conclusion: Don’t Leave the Dealership Without Them

Navigating the transfer of a vehicle is a significant responsibility. By understanding the distinct yet complementary roles of the bill of sale for a car vs. the title, you empower yourself to conduct a transaction that is secure, legal, and free from future disputes. The title is your non-negotiable key to ownership, and the bill of sale is your invaluable shield against uncertainty.

Before you shake hands and exchange keys, make absolutely sure you have a properly signed title and a meticulously completed bill of sale. This one-two punch of documentation is the simplest and most effective way to protect your investment, your liability, and your peace of mind. Don’t just hope for the best—document it. Your future self will thank you for taking the extra time to do it right.

Showing the single result