c and c title company

C and C Title Company: Your Trusted Partner for Secure and Seamless Real Estate Transactions

C and C Title Company stands as a beacon of reliability and expertise in the complex world of real estate transactions. When you are buying, selling, or refinancing property, the clarity and security of your title are paramount. At C and C Title Company, we understand the significant investment and emotional commitment involved in real estate. Our dedicated team of seasoned professionals is committed to providing comprehensive title and escrow services that safeguard your interests, ensuring every transaction proceeds with unparalleled precision, efficiency, and peace of mind.

Navigating property ownership can be intricate, fraught with potential pitfalls from hidden liens and encumbrances to past boundary disputes. Without a thorough title examination and robust title insurance, your property rights could be vulnerable. This is precisely where C and C Title Company excels. We meticulously examine property histories, identify and resolve potential issues proactively, and provide the essential protection offered by title insurance. Our goal is to eliminate surprises, secure your investment, and facilitate a smooth, stress-free closing experience.

Why Choose C and C Title Company?

Selecting the right title company is a critical decision that impacts the security and efficiency of your real estate transaction. C and C Title Company distinguishes itself through a steadfast commitment to excellence, integrity, and client satisfaction.

- Unrivaled Expertise: Our team comprises highly experienced title examiners, escrow officers, and closing agents who possess an in-depth understanding of state and local real estate laws and regulations. This expertise allows us to anticipate challenges and implement effective solutions, ensuring compliance and protection for all parties involved.

- Commitment to Integrity: Transparency and honesty are the cornerstones of our operations. We conduct all business with the highest ethical standards, providing clear communication and unbiased service to every client. Your trust is our most valued asset.

- Efficiency and Timeliness: We recognize that time is of the essence in real estate. Our streamlined processes, advanced technology, and proactive approach ensure that title searches, examinations, and closings are conducted promptly and efficiently, without compromising accuracy.

- Client-Centric Approach: At C and C Title Company, every client is a priority. We offer personalized service, taking the time to understand your specific needs and concerns. Our team is readily available to answer questions, provide guidance, and keep you informed every step of the way, transforming complex legal processes into understandable steps.

- Robust Security Measures: Protecting your sensitive information and funds is paramount. C and C Title Company employs state-of-the-art security protocols and adheres to the most stringent industry standards for data protection and financial security, safeguarding against fraud and unauthorized access. We are proud to uphold standards consistent with reputable industry partners, ensuring your transaction is as secure as possible.

Our Comprehensive Title & Escrow Services

C and C Title Company offers a full spectrum of title and escrow services designed to meet the diverse needs of homebuyers, sellers, real estate agents, lenders, and commercial investors.

Title Searches & Examinations

The foundation of a secure real estate transaction begins with a comprehensive title search. Our meticulous title examiners delve into public records to uncover any potential clouds on the property’s title. This involves reviewing deeds, mortgages, liens, judgments, easements, property taxes, and other documents that may affect ownership. We meticulously analyze these records to identify any existing encumbrances or defects that could challenge your ownership rights. Our thorough examination process is crucial for preventing future legal complications and ensuring a clear chain of title.

Title Insurance

Title insurance is a critical but often misunderstood component of real estate transactions. Unlike other forms of insurance that protect against future events, title insurance protects against past events that could affect your property title. C and C Title Company provides both Owner’s Title Insurance and Lender’s Title Insurance.

- Owner’s Title Insurance: This policy protects the property owner against financial loss from defects in title that were unknown at the time of purchase. Should a claim arise concerning past ownership issues, such as undisclosed heirs, forged documents, unreleased liens, or errors in public records, your owner’s policy will cover legal defense costs and compensate for covered losses, up to the policy amount. It’s a one-time premium for lifelong protection of your most significant investment.

- Lender’s Title Insurance: Required by most lenders, this policy protects the lender’s investment in the property against title defects. While it safeguards the lender’s interest, it does not protect the homeowner. Both policies are essential for a complete and secure transaction.

Escrow Services

Our professional escrow services provide a neutral third-party holding place for funds and documents related to your real estate transaction until all conditions of the sale are met. C and C Title Company acts as a trusted intermediary, ensuring that all contractual obligations are fulfilled before the property changes hands and funds are disbursed. Our escrow officers manage the collection and disbursement of funds, handle necessary documentation, and ensure all parties adhere to the terms of the purchase agreement, bringing impartiality and security to the closing process.

Closing & Settlement Services

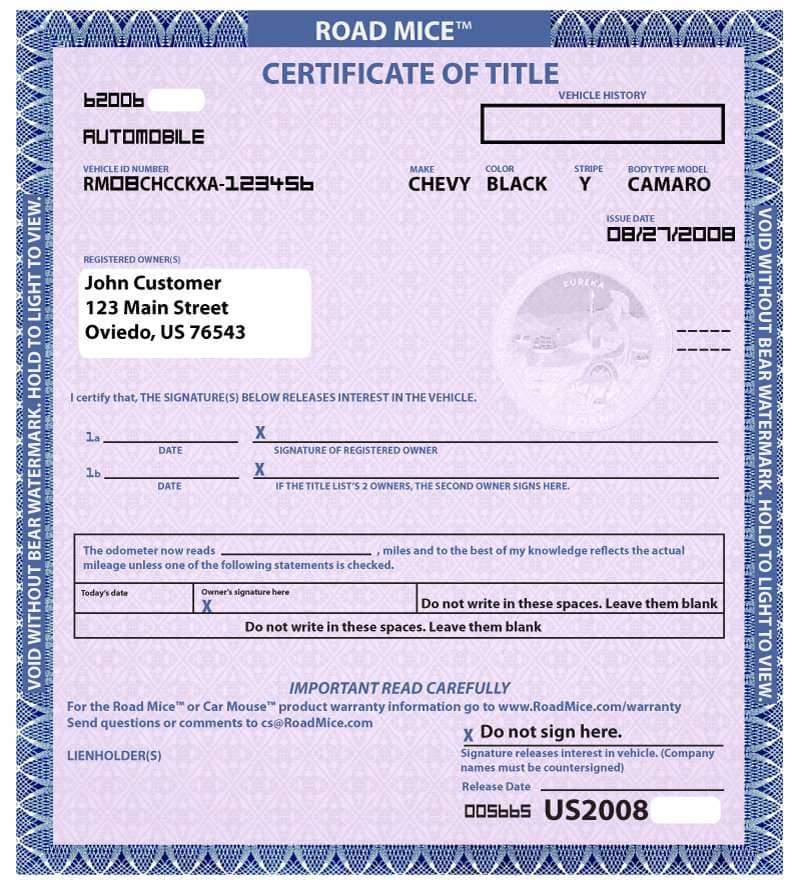

The closing is the culmination of your real estate journey. C and C Title Company facilitates a smooth and efficient closing experience, guiding all parties through the final steps. Our closing agents prepare all necessary documents, including deeds, affidavits, and settlement statements; ensure all conditions are fulfilled; and coordinate the signing process. We explain each document clearly and answer any questions, ensuring you understand every aspect of your transaction before finalization. Our meticulous attention to detail at this critical stage guarantees a legally sound transfer of ownership and funds.

Commercial Title Services

Commercial real estate transactions often involve greater complexity and higher stakes than residential ones. C and C Title Company offers specialized commercial title services tailored to the unique demands of investors, developers, and businesses. From multi-parcel developments to complex financing structures, our commercial title experts possess the knowledge and resources to handle large-scale transactions with precision and thoroughness, mitigating risks and protecting significant investments.

Refinance Title Services

When refinancing your property, specific title services are required to ensure the lien for the new loan is properly recorded and prior liens are discharged. C and C Title Company provides efficient refinance title services, including updated title searches, title insurance endorsements, and streamlined closing processes to help you secure better loan terms or access your home equity without unnecessary delays.

Document Preparation & Recording

Accurate documentation and timely recording are vital for establishing legal ownership and protecting your property rights. Our team meticulously prepares all required legal documents, such as deeds, mortgages, and affidavits, ensuring they comply with all local, state, and federal regulations. We then handle the prompt and correct recording of these documents with the appropriate government authorities, officially updating public records and securing your interest in the property.

The Importance of Title Insurance: Your Shield Against Hidden Risks

While a title search reveals issues of public record, it cannot protect against hidden defects that may emerge after closing. These “hidden risks” can include:

- Forged documents: A deed or mortgage may appear legitimate but be based on a forgery.

- Undisclosed heirs: A previous owner may have passed away, and an unknown heir could claim ownership.

- Errors in public records: Mistakes in recording or indexing can lead to title issues.

- Mental incompetence: A previous owner may have lacked the legal capacity to sell the property.

- Fraud: Deliberate misrepresentation by a party involved in a prior transaction.

Without title insurance, you would bear the financial burden and legal costs of resolving such issues. Owner’s Title Insurance from C and C Title Company provides vital protection, covering legal expenses to defend your title and compensating you for any covered losses, ensuring your property ownership remains secure and unchallenged.

Our Streamlined Process: What to Expect

At C and C Title Company, we strive to make your experience as smooth and transparent as possible. Our typical process involves:

- Order Placement: Your real estate agent, lender, or attorney places a title order with us.

- Title Search & Examination: Our expert team conducts a thorough search of public records pertaining to the property.

- Title Commitment Issuance: We issue a Title Commitment, outlining the conditions that must be met before title insurance can be issued, and detailing any existing liens or encumbrances.

- Escrow Setup: An escrow account is established to hold funds and documents.

- Closing Coordination: We work with all parties to schedule and prepare for the closing, ensuring all documents are ready.

- Closing & Funding: We facilitate the signing of all final documents, disburse funds, and ensure legal transfer of ownership.

- Document Recording & Policy Issuance: We record the new deed and mortgage with the relevant government office and issue your final title insurance policies.

Who We Serve

C and C Title Company is proud to serve a diverse clientele across the real estate spectrum:

- Homebuyers & Sellers: Providing clarity, security, and peace of mind for your most significant personal investment.

- Real Estate Agents: Offering reliable, efficient title and escrow services that support your clients and enhance your reputation.

- Lenders: Ensuring the collateral for your loans is secure with accurate title examinations and comprehensive lender’s title insurance.

- Attorneys: Partnering to provide the detailed title research and closing expertise your clients require.

- Developers & Investors: Facilitating complex commercial transactions with specialized knowledge and resources.

Leveraging Technology for Enhanced Security and Efficiency

In an increasingly digital world, C and C Title Company embraces cutting-edge technology to enhance the security and efficiency of our services. From secure online portals for document exchange to advanced title search software, we leverage innovation to expedite processes, reduce errors, and protect client data. Our commitment to cybersecurity, alongside adherence to national data privacy standards by trusted organizations, ensures that your sensitive information and funds are handled with the utmost care and protection against evolving cyber threats. We continuously invest in robust systems and employee training to maintain a secure environment for all transactions.

Our Commitment to You

At C and C Title Company, our mission is to deliver exceptional title and escrow services that instill confidence and ensure the legality and security of every real estate transaction. We are not just a service provider; we are your dedicated partners, committed to guiding you through every step with professionalism, precision, and unwavering support. Trust us to protect your investment and facilitate a seamless pathway to property ownership.

Contact C and C Title Company today to discuss your title and escrow needs or to request a quote. Let us provide you with the peace of mind you deserve for your next real estate endeavor.

Frequently Asked Questions (FAQs)

Q1: What is a title company, and what does C and C Title Company do?

A1: A title company, such as C and C Title Company, specializes in ensuring that the title to a piece of real estate is legitimate and free of encumbrances. We conduct thorough title searches to examine the property’s history, identify potential issues (like liens, judgments, or errors in previous deeds), provide title insurance to protect buyers and lenders against future claims, and act as a neutral third party (escrow agent) to facilitate the closing of real estate transactions, managing funds and documents until all conditions are met.

Q2: Why do I need title insurance? Isn’t a title search enough?

A2: While a title search is crucial for revealing publicly recorded defects, it cannot protect against “hidden risks” that may not appear in public records. These can include forged documents, undisclosed heirs, errors in previous surveys, or mistakes in recording documents. Title insurance, specifically an Owner’s Policy, protects you, the homeowner, against financial loss and legal expenses arising from such past, unknown defects that could challenge your ownership, even years after closing. It’s a one-time premium for lifelong protection of your investment.

Q3: What is the difference between Owner’s Title Insurance and Lender’s Title Insurance?

A3: Owner’s Title Insurance protects the property owner (you) from financial losses due to covered title defects. Lender’s Title Insurance, which is typically required by your mortgage lender, protects the lender’s financial interest in the property. It ensures that the lender has a valid and enforceable lien on the property. While both are critical for a transaction, they protect different parties. As a homebuyer, securing an Owner’s Policy from C and C Title Company is highly recommended to protect your equity.

Q4: How long does the title and escrow process take with C and C Title Company?

A4: The duration of the title and escrow process can vary depending on the complexity of the transaction, the property’s history, and the responsiveness of all parties involved. Generally, for a standard residential transaction, it can take anywhere from 30 to 45 days, aligning with typical mortgage processing times. Complex commercial transactions may take longer. C and C Title Company prides itself on efficiency and will work diligently to expedite the process while maintaining accuracy and thoroughness.

Q5: What is escrow, and why is it necessary?

A5: Escrow is a legal arrangement where a neutral third party (an escrow agent from C and C Title Company) holds assets or money temporarily until a particular condition has been met. In real estate, the escrow officer holds funds (like the buyer’s down payment and lender’s loan) and documents until all conditions of the purchase agreement are satisfied. This ensures that no money or property changes hands until all terms are met, providing security and fairness for both the buyer and the seller.

Q6: What documents will I need to bring to closing?

A6: The specific documents you’ll need may vary, but generally, buyers should bring a valid government-issued photo ID, the remaining funds for the down payment and closing costs (often via a wire transfer or cashier’s check), and any other documents requested by your lender. Sellers typically need to bring a valid ID, keys to the property, and potentially other documents related to the property (e.g., HOA documents, survey). C and C Title Company’s closing agents will provide a detailed list beforehand to ensure you are fully prepared.

Q7: Can C and C Title Company handle out-of-state transactions?

A7: C and C Title Company primarily focuses on transactions within our specific service areas. Please contact us directly to confirm whether we can assist with your specific out-of-state requirements or to recommend trusted partners in other jurisdictions. Our network allows us to provide guidance even if we cannot directly handle the transaction.

Q8: How much do title and escrow services cost?

A8: The cost of title and escrow services includes fees for the title search, title examination, title insurance premiums, and escrow closing fees. These costs can vary based on the property’s value, location, and the specifics of the transaction. A portion of these costs is typically paid by the buyer and a portion by the seller, as negotiated in the purchase agreement. C and C Title Company provides transparent fee schedules and detailed quotes upfront, so you know exactly what to expect.

Q9: What should I do if I have more questions or want to start a transaction?

A9: If you have more questions or are ready to initiate a title or escrow service, please do not hesitate to contact C and C Title Company directly. Our experienced team is available by phone, email, or through our website’s contact form. We are here to provide clear answers and professional guidance for all your real estate title needs.

Showing the single result