can a permanent resident buy a house in canada

Can a Permanent Resident Buy a House in Canada? Your Comprehensive Guide to Canadian Homeownership

Can a permanent resident buy a house in Canada? This is a crucial question for many newcomers to Canada, and the definitive answer is yes. As a permanent resident, you possess the legal right and significant opportunities to purchase residential property anywhere across this vast and welcoming nation. At Legit Vendor US, we specialize in empowering permanent residents like you to navigate the Canadian real estate market with confidence, transforming your dream of homeownership into a tangible reality. We understand the unique journey of new Canadians and are dedicated to providing the expert guidance and tailored solutions required to secure your place in the Canadian housing landscape.

Canada’s robust and stable real estate market offers a pathway to establishing deep roots, building equity, and securing a future for your family. Acquiring a home is not merely a transaction; it’s a significant milestone that signifies stability, provides a sense of belonging, and often represents a sound long-term investment. This comprehensive guide will walk you through everything you need to know about buying a house as a permanent resident in Canada, explaining the process, requirements, and how Legit Vendor US stands as your indispensable partner in this exciting venture.

The Pathway to Homeownership for Permanent Residents

Permanent residents in Canada generally enjoy the same rights as Canadian citizens when it comes to property ownership. This means you are not subjected to the same restrictions or foreign buyer taxes that non-residents might face. However, while the right is clear, the path requires understanding specific Canadian financial and legal frameworks.

Benefits of Buying a Home as a Permanent Resident

- Building Equity & Investment: Real estate in Canada has historically proven to be a resilient and appreciating asset. Owning a home allows you to build equity over time, contributing significantly to your financial future and wealth creation.

- Stability & Community Integration: Homeownership provides a profound sense of stability and belonging. It actively integrates you into your chosen community, fostering connections and allowing you to personalize your living space without the constraints of renting.

- Tax Advantages & Programs: While not as extensive as in some other countries, Canada offers some programs and tax credits for first-time home buyers, which permanent residents may be eligible for, depending on individual circumstances.

- Freedom to Customize: Owning your home means you have the freedom to renovate, decorate, and adapt your living space to entirely suit your preferences and needs, something often restricted in rental properties.

Key Requirements and Considerations for Permanent Resident Home Buyers

While the fundamental right is established, certain criteria must be met to successfully secure a mortgage and purchase a property.

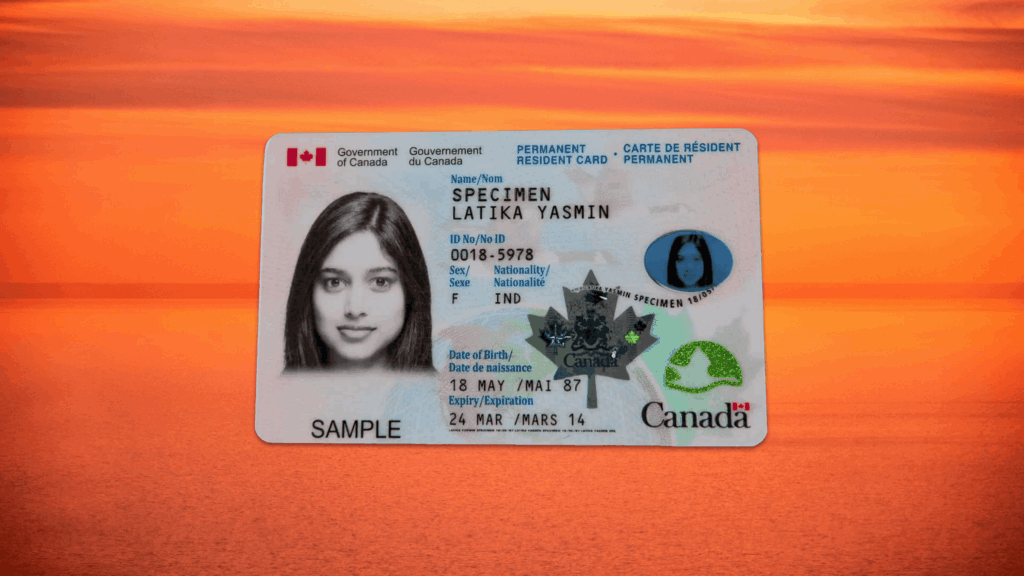

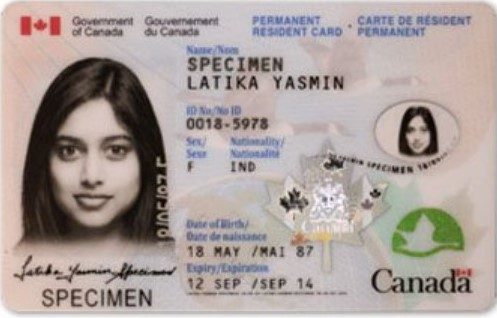

1. Proof of Permanent Resident Status

Your Permanent Resident Card is essential documentation. Lenders and legal professionals will require proof of your status to confirm your eligibility for Canadian mortgages and to exempt you from specific foreign ownership regulations.

2. Income and Employment History

Canadian lenders primarily assess your ability to repay a mortgage based on your income and employment stability.

- Stable Income: You will need to demonstrate consistent income from Canadian employment. If you are newly employed, some lenders might require a probationary period to pass.

- Employment History: Lenders typically look for a minimum of 2-3 years of consistent employment history in Canada. If your Canadian employment history is shorter, robust previous international experience in the same field, combined with a strong current Canadian job, can sometimes be considered.

- Co-applicants: If your income alone isn’t sufficient, applying with a spouse or partner who also has stable income can strengthen your application.

3. Credit History

A strong credit history is paramount for securing a mortgage in Canada.

- Canadian Credit Score: Lenders will pull your Canadian credit report to assess your financial responsibility. It takes time to build a robust credit history in Canada.

- Establishing Credit: If you are new to Canada, focus on building your credit early. This includes getting a Canadian credit card, paying bills on time, and avoiding excessive debt.

- Alternative Credit: For permanent residents with limited Canadian credit history, some lenders may consider alternative forms of credit, such as rental payment history, utility bill payments, or international credit reports (though this is less common and often requires a larger down payment or a co-signer). Legit Vendor US can guide you through lenders who are more flexible in this regard.

4. Down Payment

This is typically the largest upfront cost when buying a home.

- Minimum Down Payment: In Canada, the minimum down payment for a home valued under $500,000 is 5%. For homes between $500,000 and $999,999, 5% is required on the first $500,000, and 10% on the portion above $500,000. For homes $1,000,000 and above, a minimum of 20% down payment is required.

- Sources of Funds: Your down payment funds must be verifiable and sourced legitimately. This can include savings, gifts from immediate family members, or funds accumulated from the sale of a previous property. Lenders will require documentation proving the source of your down payment.

- Mortgage Loan Insurance: If your down payment is less than 20% (for properties under $1,000,000), you will be required to obtain mortgage loan insurance (e.g., from CMHC, Sagen, or Canada Guaranty). This insurance protects the lender in case you default on your mortgage and is added to your mortgage principal.

5. Mortgage Pre-Approval

Obtaining a mortgage pre-approval is a critical first step. It provides:

- Clarified Budget: A pre-approval tells you how much a lender is willing to lend you, setting a realistic budget for your home search.

- Rate Hold: Often, a pre-approval comes with a rate hold, protecting you from interest rate increases for a specific period (usually 90-120 days) while you search for a home.

- Credibility: It demonstrates to real estate agents and sellers that you are a serious and qualified buyer.

6. Understanding the Canadian Mortgage Market

The Canadian mortgage market offers various products.

- Fixed vs. Variable Rates: Understand the difference between fixed-rate mortgages (where your interest rate remains constant for the term) and variable-rate mortgages (where the rate fluctuates with market conditions).

- Amortization Period: This is the total length of time it will take to pay off your mortgage, typically 25 or 30 years (if your down payment is 20% or more, you can choose a longer amortization).

- Term: This is the length of your current mortgage contract (e.g., 1, 3, 5, or 10 years).

7. Other Costs Associated with Buying a Home

Beyond the down payment, be prepared for closing costs. These can typically range from 1.5% to 4% of the purchase price and include:

- Legal Fees: For a real estate lawyer to handle the transaction.

- Land Transfer Tax: A provincial and sometimes municipal tax on property purchases.

- Appraisal Fees: To determine the property’s market value.

- Home Inspection: Highly recommended to uncover potential issues with the property.

- Property Tax Adjustments: To cover property taxes from the date of possession.

- GST/HST: Applicable to new construction homes.

The Home Buying Process for Permanent Residents: A Step-by-Step Guide

Step 1: Financial Assessment and Goal Setting

Before anything else, assess your current financial situation. What are your savings? What is your monthly income and expenses? Determine what you can realistically afford for a down payment and monthly mortgage payments, including property taxes and utilities.

Step 2: Get Pre-Approved for a Mortgage

This is where Legit Vendor US shines. We connect you with lenders who understand the nuances of lending to permanent residents. Our experts will help you gather the necessary documentation and secure a pre-approval, giving you a clear budget and negotiating power.

Step 3: Find a Real Estate Agent

A good real estate agent, especially one experienced with new Canadians, can be invaluable. They will help you understand local markets, identify suitable properties, and guide you through the negotiation process.

Step 4: House Hunting

With your pre-approval in hand, you can confidently begin searching for your dream home. Consider location, property type, amenities, and future resale value.

Step 5: Make an Offer and Negotiate

Once you find a property you love, your agent will help you draft an offer. This will include the purchase price, conditions (e.g., home inspection, financing), and closing date. Negotiations may ensue until a mutually agreeable price and terms are reached.

Step 6: Fulfill Conditions and Secure Final Mortgage Approval

After an offer is accepted, you’ll work to satisfy any conditions. This typically involves a home inspection and securing final mortgage approval. Legit Vendor US will assist you in providing all necessary documentation to your lender for the final approval.

Step 7: Legal Review and Closing

Your real estate lawyer will conduct a title search, prepare all legal documents, and ensure a smooth transfer of ownership. On the closing day, funds are transferred, and you receive the keys to your new home!

How Legit Vendor US Empowers Permanent Residents to Buy a Home

At Legit Vendor US, we understand that navigating the Canadian real estate market as a permanent resident can be daunting. We are committed to simplifying this journey, providing specialized expertise and unwavering support every step of the way.

- Tailored Mortgage Solutions: We connect permanent residents with lenders who offer flexible programs specifically designed for newcomers, including those with limited Canadian credit history or unique employment situations. Our extensive network ensures you get access to the best rates and terms available.

- Expert Guidance: Our team of experienced mortgage professionals and real estate advisors deeply understands the specific requirements and challenges permanent residents face. We provide clear, concise, and personalized advice to make informed decisions.

- Streamlined Application Process: We help you compile all necessary documentation, ensuring your mortgage application is complete, accurate, and presented in the best possible light to lenders. We proactively address potential hurdles, saving you time and stress.

- Financial Planning & Education: Beyond securing a mortgage, we offer insights into managing your homeownership finances, understanding property taxes, and leveraging government programs that may be available to you.

- Dedicated Support: From your initial inquiry to the day you receive your keys, Legit Vendor US is your dedicated partner. We are here to answer your questions, provide updates, and advocate on your behalf, ensuring a smooth and successful home-buying experience.

- Comprehensive Resources: We pride ourselves on providing extensive resources, educational materials, and personalized consultations to ensure you feel confident and informed throughout your homeownership journey.

Your status as a permanent resident is a gateway to a secure future in Canada, and homeownership is a cornerstone of that security. Don’t let uncertainty delay your dreams. With Legit Vendor US, you have a knowledgeable, compassionate, and effective ally committed to helping you achieve your homeownership goals.

Ready to take the first step towards owning your piece of Canada? Contact Legit Vendor US today for a personalized consultation. Let us help you unlock the doors to your new home.

Frequently Asked Questions (FAQs)

Q1: Can a permanent resident buy a house in Canada without a down payment?

A1: No, a down payment is always required in Canada. The minimum down payment is 5% for homes under $500,000. If your down payment is less than 20%, you will need mortgage loan insurance. Some lenders might require a larger down payment for permanent residents with limited Canadian credit history.

Q2: Do permanent residents pay foreign buyer tax in Canada?

A2: No, in most provinces that have implemented a foreign buyer tax (like Ontario and British Columbia), permanent residents are explicitly exempt from this tax. Your PR status grants you the same treatment as a Canadian citizen in this regard.

Q3: How long after becoming a permanent resident can I buy a house?

A3: There is no minimum waiting period after obtaining permanent residency. As soon as you have your PR status and can meet the financial requirements (stable income, down payment, and some level of credit history), you are eligible to apply for a mortgage and purchase a home.

Q4: What if I don’t have enough Canadian credit history?

A4: Building Canadian credit takes time. While a solid credit score is ideal, some lenders are more flexible with permanent residents. They might consider alternative data like consistent rent payments, utility bill payments, or require a larger down payment. Legit Vendor US can connect you with such lenders.

Q5: Can I use funds from outside Canada for my down payment?

A5: Yes, you can. However, lenders will require documentation to verify the source of these funds to ensure they are legitimate and not obtained through illicit means. This often involves showing bank statements over a period to demonstrate the accumulation of savings.

Q6: Do I need to be employed for a certain period in Canada before buying a home?

A6: Lenders generally look for stable employment. While some may prefer to see 2-3 years of Canadian employment history, if you have a strong, new job offer or have passed your probationary period, and have a good down payment, it’s often possible to secure a mortgage. Legit Vendor US helps streamline this assessment for you.

Q7: What is mortgage pre-approval and why is it important for permanent residents?

A7: A mortgage pre-approval is a conditional commitment from a lender to provide you with a mortgage up to a certain amount. It’s crucial because it clarifies your budget, locks in an interest rate for a period, and demonstrates to sellers that you are a serious and qualified buyer. For permanent residents, it also helps confirm that your specific financial situation meets lender criteria.

Q8: What role does Legit Vendor US play in the home-buying process for permanent residents?

A8: Legit Vendor US acts as your expert guide and advocate. We assess your unique financial situation, connect you with lenders offering suitable mortgage products for permanent residents, help you navigate requirements like credit history and down payment sources, and support you through the entire application and closing process to ensure a smooth and successful home purchase.

Showing the single result