can a permanent resident in canada buy a house

Can a Permanent Resident in Canada Buy a House? Your Comprehensive Guide to Homeownership

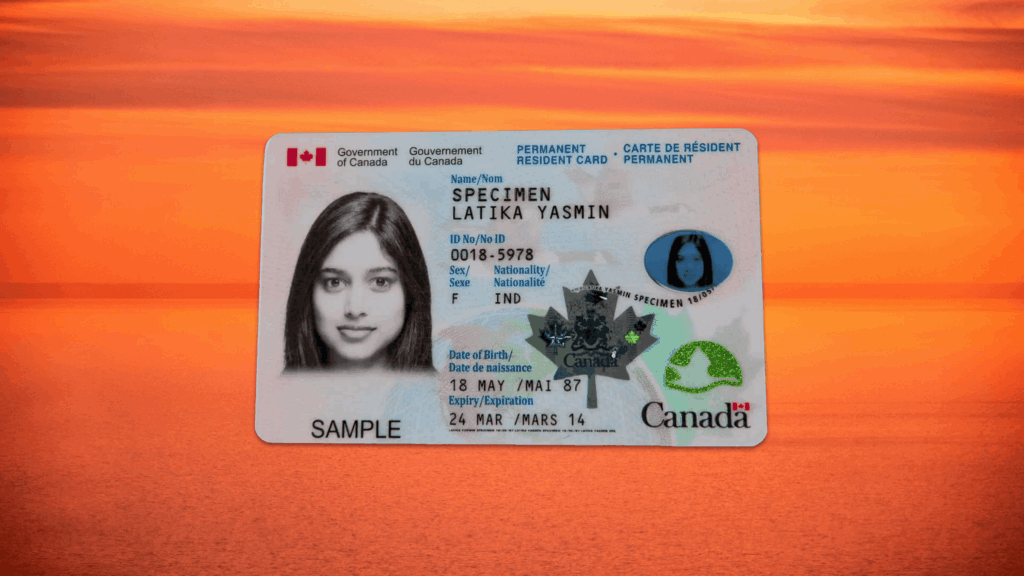

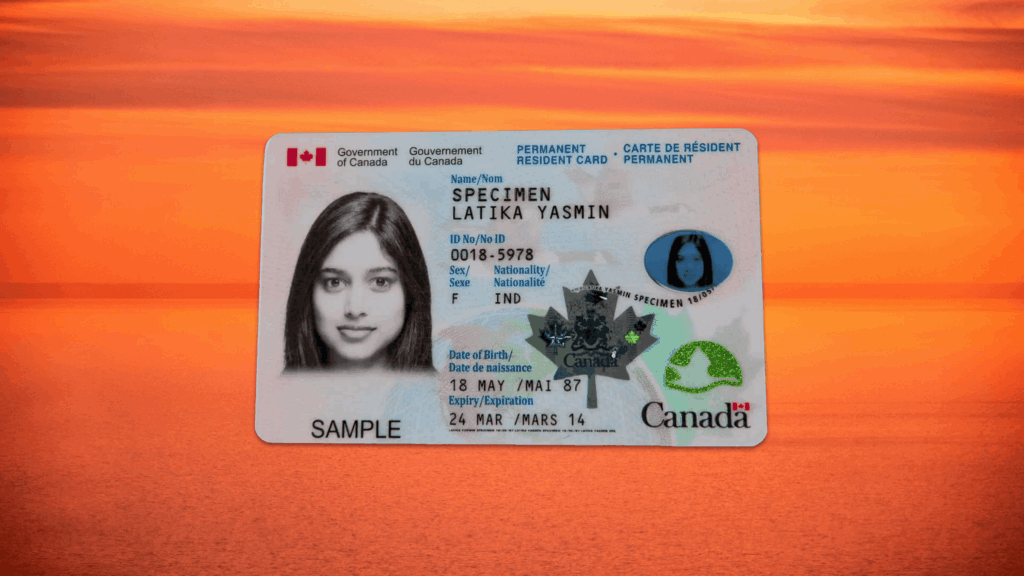

Can a permanent resident in Canada buy a house? The unequivocal answer is yes, permanent residents in Canada possess the same fundamental rights as Canadian citizens when it comes to purchasing real estate. This crucial understanding forms the bedrock of realizing your homeownership aspirations in one of the world’s most welcoming nations. For many new permanent residents, securing a home is a significant milestone, symbolizing stability, community integration, and a long-term investment in their Canadian future. At Legit Vendor US, we understand the unique journey of permanent residents and are dedicated to simplifying the complexities of the Canadian real estate market, ensuring a smooth and successful transition from renter to homeowner.

The Rights and Realities of Permanent Resident Homeownership in Canada

One of the most appealing aspects of permanent residency in Canada is the robust set of rights and privileges it confers, particularly in the realm of property ownership. Unlike some nations that impose restrictions or require special permits for non-citizens to acquire property, Canada’s legal framework treats permanent residents virtually identically to citizens when it comes to real estate transactions. This means that if you hold permanent resident status, you are fully entitled to purchase any type of residential or commercial property across all provinces and territories, without facing additional federal taxes or specific ownership limitations purely based on your immigration status.

This parity extends to various aspects of the home buying process, including:

- Property Title: Permanent residents can hold full legal title to a property, either individually or jointly with a spouse or partner, regardless of their citizenship status.

- Access to Mortgages: Canadian financial institutions generally assess permanent residents for mortgage eligibility using the same criteria as citizens, focusing on financial stability, credit history (even if new to Canada), and income.

- First-Time Home Buyer Programs: Many government-backed incentives, such as the First-Time Home Buyer Incentive, the Home Buyer Plan (HBP), and various provincial rebates, are accessible to permanent residents who meet the standard eligibility requirements.

- Investment Opportunities: Permanent residents can invest in real estate, whether for personal occupancy, rental income, or future capital appreciation, just like any Canadian citizen.

Understanding these foundational rights is the first step towards confidently pursuing homeownership. It eliminates a common misconception that often deters new permanent residents from exploring the market.

Navigating Mortgage Financing as a Permanent Resident

While permanent residents enjoy equal rights, securing a mortgage requires demonstrating financial readiness to Canadian lenders. This often presents a unique set of considerations for those new to the country’s financial system.

Key Factors Lenders Consider:

- Credit History: Lenders will assess your Canadian credit score. If you’ve recently arrived, building a credit history can often be a focus. Strategies to establish credit include:

- Secured credit cards.

- Reporting rent payments (through services like FrontLend or RentTrack).

- Obtaining a small loan or line of credit and repaying it diligently.

- Many lenders offer “newcomer” programs that may consider international credit reports or alternative forms of credit validation for a permanent resident buying a home in Canada.

- Income and Employment Stability: You’ll need to demonstrate a stable source of income, typically through employment letters, recent pay stubs, and tax assessments (once filed). Lenders generally prefer full-time, permanent employment, but contract or self-employment income can be considered with sufficient history and proof of regularity.

- Down Payment: While the minimum down payment for a conventional mortgage in Canada is 5% for homes under $500,000, a larger down payment (e.g., 20% or more) can help reduce or eliminate the need for mortgage insurance, potentially securing better interest rates. Funds for a down payment must be verifiable and sourced legitimately (e.g., from savings, a gift from a family member, or RRSP withdrawals via the Home Buyer Plan).

- Debt Service Ratios: Lenders calculate your Gross Debt Service (GDS) and Total Debt Service (TDS) ratios to ensure you can comfortably manage your mortgage payments, property taxes, heating costs, and other debts, demonstrating your capacity for permanent resident home ownership.

Mortgage Options for Permanent Residents:

- Conventional Mortgages: Available with a down payment of 20% or more, these avoid the need for mortgage default insurance.

- High-Ratio Mortgages: For down payments less than 20%, these are mandatory insured by organizations like CMHC, Sagen (formerly Genworth Canada), or Canada Guaranty. This insurance protects the lender in case of default, but the cost (premium) is passed on to the borrower and can be added to the mortgage principal.

- Newcomer Mortgage Programs: Several major Canadian banks and credit unions offer specialized mortgage programs specifically designed for permanent residents and new immigrants. These programs often feature more flexible criteria regarding credit history requirements and sometimes allow for a smaller down payment with suitable co-signers or alternative financial proofs.

At Legit Vendor US, we specialize in connecting permanent residents with lenders who understand their unique profiles. Our experts help you prepare the necessary documentation and guide you through the various mortgage products available, ensuring you secure the best possible terms for buying a home in Canada as a PR.

The Canadian Home Buying Process for Permanent Residents

The process of buying a home in Canada follows a well-established framework, and permanent residents navigate these steps just like any other buyer. Understanding each stage is crucial for a smooth and stress-free experience.

1. Financial Preparation & Pre-Approval:

- Assess Your Finances: Determine your realistic budget, potential down payment amount, and estimate additional closing costs (legal fees, land transfer tax, appraisal fees, etc.).

- Build Credit (if New): Focus on establishing a strong Canadian credit history as early as possible.

- Get Pre-Approved for a Mortgage: This vital step involves a lender assessing your financial situation and providing a conditional commitment for a mortgage amount. A pre-approval clarifies your budget, can lock in an interest rate for a period (usually 90-120 days), and makes your offers more attractive to sellers.

2. Finding Your Home:

- Define Your Needs and Wants: Consider important factors like location (proximity to work, schools, amenities, public transit), property type (condo, townhouse, detached house), size, and specific features.

- Work with a Real Estate Agent: A skilled and experienced real estate agent is an invaluable asset. They understand the local market, can identify suitable properties that match your criteria, negotiate effectively on your behalf, and guide you through viewings and the offer process. At Legit Vendor US, we partner with experienced agents who are sensitive to the needs of permanent residents buying a home in Canada.

3. Making an Offer & Negotiation:

- Once you find a suitable property, your agent will help you prepare a written Offer to Purchase. This legally binding document includes the proposed price, deposit amount, desired closing date, and any conditions (e.g., subject to financing, subject to a satisfactory home inspection).

- Negotiations may ensue between you and the seller until an agreement is reached on all terms.

4. Fulfilling Conditions & Due Diligence:

- If your offer is conditional, you’ll work diligently to satisfy these conditions within the specified timeframe. This typically involves:

- Finalizing Mortgage Financing: Your lender will review the specific property you’ve chosen and your updated financial information to issue a firm mortgage commitment.

- Home Inspection: A professional home inspector will thoroughly assess the property’s condition, identifying any potential structural, mechanical, or safety issues.

- Reviewing Legal Documents: Your real estate lawyer will review all legal documents, including the property title, sales agreement, and any relevant zoning or condominium documents.

5. Waiving Conditions & Closing the Deal:

- Once all conditions are met, and you are fully satisfied with the results of your due diligence, your lawyer will advise you to formally “waive” the conditions, making the offer firm and binding.

- Closing Day: On the agreed-upon closing date, your lawyer handles the transfer of funds (your down payment, mortgage funds from your lender) and the registration of the property title in your name. You receive the keys and officially become a Canadian homeowner!

Key Considerations & Challenges for Permanent Resident Home Buyers

While the path to homeownership for permanent residents is largely similar to citizens, some specific areas warrant careful attention.

- Understanding Canadian Real Estate Terminology: The Canadian real estate market has its own jargon (e.g., “closing costs,” “condo fees,” “land transfer tax,” “appraisal”). Familiarizing yourself with these terms or relying on knowledgeable professionals is key.

- Adapting to Local Market Dynamics: Real estate markets vary significantly across Canada. What’s common in Toronto might be rare or priced differently in Calgary or Halifax. Researching local trends, average prices, and inventory levels for homes that a permanent resident can buy in Canada is crucial.

- The Emotional Aspect of a Major Purchase: Moving to a new country and making a significant financial commitment like buying a home can be an emotional journey. Having a supportive team that understands cultural nuances and can provide reassurance can make a significant difference.

- Forecasting Future Needs: Consider your long-term plans in Canada. Will your family grow? Do you anticipate moving provinces for career opportunities? These factors can influence your choice of property type and location.

- Foreign Buyer Bans (Provincial and Federal): While the federal government has implemented a temporary ban on foreign buyers of residential property, permanent residents are explicitly exempt from this ban. Similarly, some provinces like British Columbia and Ontario have specific provincial foreign buyer taxes or bans; crucially, permanent residents are generally exempt from these as well, but it’s vital to confirm your status and eligibility with a legal professional.

Legit Vendor US provides comprehensive support to permanent residents, ensuring you are well-informed and confident at every stage, mitigating potential challenges and ensuring a positive outcome for your permanent resident home ownership.

The Enduring Benefits of Homeownership for Permanent Residents

Beyond the immediate satisfaction of owning your own space, homeownership in Canada offers significant long-term advantages for permanent residents.

- Building Equity and Wealth: Your home is often your largest asset. As you diligently pay down your mortgage and property values appreciate (historically, Canadian real estate has shown long-term growth), you build substantial home equity, a powerful tool for future financial goals.

- Stability and Security: Owning a home provides a stable living environment, free from unpredictable rent increases and landlord decisions. It fosters a strong sense of belonging and permanence within your new country.

- Community Integration: Homeownership often leads to deeper engagement with local communities, schools, and services, accelerating your integration into Canadian society and fostering local connections.

- Tax Advantages: Canada offers certain tax benefits related to homeownership, such as the Principal Residence Exemption, which exempts capital gains from the sale of your primary residence from taxation.

- Customization and Personalization: Enjoy the freedom to transform your living space to truly reflect your tastes and needs, something often restricted in rental properties.

- Leverage for Future Investments: The equity built in your home can be leveraged through a Home Equity Line of Credit (HELOC) or a refinance for other investments, education, or emergencies.

Homeownership is not just about a house; it’s about building a robust foundation for your future in Canada.

Why Choose Legit Vendor US for Your Homeownership Journey

At Legit Vendor US, we understand that for permanent residents, buying a home is more than just a transaction – it’s a pivotal moment in establishing your life in Canada. Our mission is to transform this significant step into a seamless, transparent, and ultimately rewarding experience.

Our Commitment to Permanent Residents:

- Specialized Expertise: We possess in-depth knowledge of the nuances that permanent residents face, from establishing Canadian credit to navigating specific mortgage programs. Our team is trained to address your unique needs.

- Tailored Solutions: We don’t believe in one-size-fits-all. We take the time to deeply understand your individual financial situation, homeownership goals, and timeline to craft a personalized strategy for your home purchase.

- Comprehensive Network: Legit Vendor US has cultivated strong relationships with a diverse network of trusted mortgage brokers, real estate agents, real estate lawyers, and financial advisors who are extensively experienced in assisting permanent residents. This means you gain access to the best professionals in the field, all working collaboratively for your success.

- Clarity and Guidance: The Canadian real estate landscape can be complex. We break down the process into understandable steps, providing clear explanations and proactive guidance at every turn. You’ll never feel alone or confused.

- Advocacy and Support: From your initial inquiry to receiving the keys to your new home, we act as your dedicated advocates, ensuring your interests are protected and your questions are answered promptly and thoroughly.

- Sales Conversion Focus: Our ultimate goal is your success in securing the home of your dreams. We streamline the process, highlight opportunities (like first-time home buyer incentives), and proactively resolve potential roadblocks to ensure a positive outcome and a high conversion rate for our services.

Let Legit Vendor US be your trusted partner in realizing your Canadian homeownership dream. We eliminate the guesswork and provide the expert support you need to make one of the most important investments of your life with confidence.

Ready to take the first step towards owning your piece of Canada?

Contact Legit Vendor US today for a personalized consultation. Our expert team is ready to answer your questions, assess your eligibility, and outline a clear path to homeownership.

Frequently Asked Questions (FAQs)

Q1: Can a permanent resident in Canada buy a house without a Canadian credit history?

A1: While a Canadian credit history is generally preferred, some lenders and special “newcomer” mortgage programs are designed to accommodate permanent residents with limited or no Canadian credit history. They may consider international credit reports, proof of consistent rent payments, or require a larger down payment. Legit Vendor US can help you identify these lenders and programs and guide you on building your Canadian credit.

Q2: Are there any specific taxes or fees that permanent residents pay when buying a house in Canada that citizens don’t?

A2: Generally, no. Permanent residents are treated the same as Canadian citizens regarding federal property taxes and fees. However, some provinces (like British Columbia and Ontario) have provincial foreign buyer taxes, but permanent residents are typically exempt from these as they are not considered “foreign” buyers. It’s crucial to confirm your specific situation with a legal professional to ensure full compliance.

Q3: Is it harder for a permanent resident to get a mortgage than a Canadian citizen?

A3: Not necessarily harder, but the process may have different considerations. Lenders apply similar criteria (income, down payment, debt). The main difference can be establishing a Canadian credit history or proving stable income if you’ve recently arrived. Legit Vendor US can guide you through these specific requirements and connect you with suitable lenders who understand the nuances of permanent resident financing.

Q4: Can I use my foreign income to qualify for a mortgage in Canada as a permanent resident?

A4: Most Canadian lenders prefer to see Canadian-sourced income to qualify for a mortgage. However, some specialized programs or lenders may consider foreign income under specific circumstances, often requiring additional documentation or a larger down payment. It’s best to discuss your individual income situation and its verifiability with a mortgage expert.

Q5: What is the minimum down payment required for a permanent resident to buy a house in Canada?

A5: The minimum down payment for a permanent resident is the same as for a Canadian citizen: 5% for homes priced up to \$500,000. For homes between $500,000 and $999,999, it’s 5% on the first $500,000 and 10% on the portion above $500,000. Homes priced at $1,000,000 or more require a minimum 20% down payment.

Q6: Can a permanent resident access first-time home buyer programs in Canada?

A6: Yes, permanent residents are generally eligible for federal and provincial first-time home buyer programs, provided they meet all other program-specific criteria. These criteria typically include residency requirements, income limits, and not having owned a home in Canada in the past four years.

Q7: How long does the home buying process typically take for a permanent resident?

A7: The timeline can vary widely based on market conditions, how quickly you find a suitable property, and how prepared you are financially. From starting your search to closing, it can take anywhere from 2-3 months to much longer. Getting pre-approved for a mortgage early can significantly expedite the process.

Q8: Do I need a lawyer when buying a house in Canada as a permanent resident?

A8: Yes, it is legally required and highly advisable to engage a real estate lawyer for any property purchase in Canada. Your lawyer will handle the legal transfer of title, review all documents, ensure all financial obligations are met, and protect your legal interests throughout the transaction. Legit Vendor US can recommend trusted real estate lawyers specializing in assisting new Canadians.

Q9: What are common closing costs that a permanent resident should budget for?

A9: Beyond the down payment, closing costs typically range from 1.5% to 4% of the purchase price, though this percentage can vary by province. Common costs include land transfer taxes (provincial and sometimes municipal), legal fees, property appraisal fees, property insurance, and potentially mortgage default insurance premiums (if your down payment is less than 20%).

Q10: What role does Legit Vendor US play in my home buying journey?

A10: Legit Vendor US acts as your comprehensive guide and partner for buying a home in Canada as a PR. We provide expert advice, connect you with a network of trusted professionals (mortgage brokers, real estate agents, lawyers), help you navigate financial requirements, understand market dynamics, and ensure a seamless path to homeownership. Our goal is to make your dream of owning a home in Canada a reality with confidence and ease.

Showing the single result