canada permanent resident disability

Canada Permanent Resident Disability: Accessing Essential Benefits and Understanding Eligibility

Canada permanent resident disability benefits and support systems are a critical aspect of life for many newcomers establishing roots in the country. Becoming a permanent resident of Canada grants individuals the right to live, work, and study anywhere in the nation, along with access to most social benefits available to citizens. However, navigating the specific requirements for federal and provincial disability programs while maintaining permanent resident conditions Canada can be complex. This comprehensive guide, brought to you by the insights team at Legit Vendor Us, is designed to clarify the eligibility criteria, outline the available supports, and address common questions concerning the intersection of Canadian residency status and disability benefits.

Understanding Permanent Residency Status in Canada

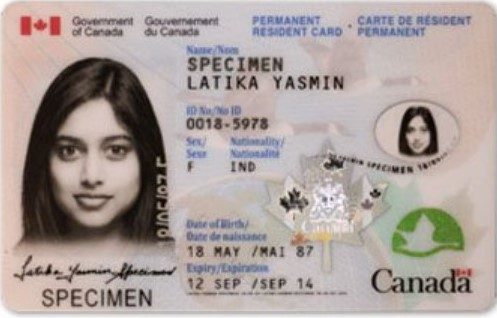

Before delving into disability benefits, it is essential to define what is a Canadian permanent resident. A permanent resident (PR) is an individual who has been granted the right to live in Canada indefinitely but is not a Canadian citizen. PRs enjoy most of the same rights and responsibilities as citizens, including Charter rights and freedoms, the ability to work, and access to social services.

The primary difference between a PR and a citizen lies in a few key areas: PRs cannot vote in federal elections, hold certain high-security jobs, or possess a Canadian passport. Crucially, PRs must meet certain permanent resident conditions Canada, such as the residency obligation (being physically present in Canada for at least 730 days within a five-year period) to maintain their status. Understanding permanent residence eligibility Canada is the first step toward accessing full benefits.

Can You Get Disability If You Are a Permanent Resident?

One of the most frequent questions posed by newcomers is: can you get disability if you are a permanent resident? The answer is unequivocally yes.

Permanent residents are generally entitled to all federal and provincial social benefits, provided they meet the specific eligibility requirements for each program. These requirements typically focus on factors such as age, contribution history (for employment-related benefits), income level, and medical criteria, rather than immigration status itself (beyond the requirement of legal status in Canada).

For a permanent resident to successfully apply, they must confirm they have met the residency period required by the specific program they are applying for.

What Qualifies as a Disability in Canada?

Eligibility for permanent disability benefits Canada hinges upon a clear definition of disability. Generally, the definition used across federal programs is that the individual must have a severe and prolonged mental or physical impairment that prevents them from earning a living or undertaking daily functions.

What is considered a disability in Canada can vary slightly between programs:

- For Tax Credits (DTC): The impairment must be severe enough to markedly restrict one or more basic functions of daily living (e.g., walking, feeding, dressing, mental functions necessary for everyday life). It must also be continuous or expected to last for at least 12 months.

- For CPPD (Contribution-Based): The disability must be severe (you are regularly unable to work at any substantially gainful occupation) and prolonged (it is likely to be long-term or permanent).

It is important to note that specific conditions like is ADHD a permanent disability Canada depend heavily on the severity and functional limitation the condition imposes on the individual, requiring detailed medical evidence.

Key Federal Disability Benefit Programs for Permanent Residents

Permanent residents can access several crucial federal programs administered by the Government of Canada disability benefits portal or through Service Canada.

1. Canada Pension Plan Disability (CPPD)

The CPPD benefit provides income replacement for individuals who have contributed to the Canada Pension Plan (CPP) during their working years and are unable to work due to a severe and prolonged disability.

Do permanent residents get CPP? Yes. Eligibility is based on the worker’s contribution history, regardless of citizenship or permanent residency status. If a permanent resident has worked in Canada and made sufficient contributions to the CPP for the minimum required duration (usually four out of the last six years, or three out of the last six years for those with many contributions), they are eligible to apply.

Can a permanent resident apply for disability through CPPD? Absolutely, provided the contribution requirements are met. This is often one of the most substantial federal disability benefits Canada available.

2. The Canada Disability Benefit (CDB)

The Canada Disability Benefit (CDB) is a new, proposed federal benefit designed to reduce poverty among working-age persons with disabilities. While the final status of Canada Disability Benefit is still pending legislation (as of late 2023/early 2024), it is anticipated that eligibility will be tied to income level and possession of the Disability Tax Credit (DTC).

As this benefit aims to support low-income Canada persons with disabilities, permanent residents who meet the income and medical criteria are expected to be fully eligible, further solidifying the access PRs have to essential social safety nets. Understanding Canada disability benefit requirements will be crucial once the program is fully rolled out.

3. Registered Disability Savings Plan (RDSP)

The RDSP is a registered savings plan designed to help Canadians with disabilities save for the long term. Eligibility requires the individual to be a resident of Canada, have a Social Insurance Number (SIN), and be eligible for the Disability Tax Credit (DTC). Since permanent residents meet the residency and SIN requirements, they can establish an Registered Disability Plan Canada and access associated grants and bonds from the government.

Provincial Disability Benefits Eligibility

While federal programs like CPPD cover income replacement based on contributions, provincial governments provide direct financial assistance and supplementary benefits for basic living needs, often referred to as social assistance. These benefits are critical for newcomers and PRs who may not have a long CPPD contribution history.

Canada permanent resident disability supports are generally administered provincially once a resident meets the local residency requirements (which often mandate a short waiting period).

Examples of Provincial Programs:

- Ontario Disability Support Program (ODSP): Provides income and employment support. Permanent disability benefits Ontario are available to PRs who live in the province and meet stringent medical and financial needs tests.

- British Columbia (BC) Persons with Disabilities (PWD): In BC, the Ministry of Social Development and Poverty Reduction offers benefits to eligible persons with disability benefits BC. PRs residing in the province can apply for disability benefits BC Canada and the associated medical and support services.

The eligibility rules for how to qualify for disability benefits Canada often involve meeting the provincial income and asset limits, alongside providing doctor-certified proof of disability.

Immigration and Disability: The Initial Hurdle

A separate, though related, concern for immigrants is: can you immigrate to Canada if you are disabled?

Historically, medical inadmissibility was a significant barrier. Medical inadmissibility could occur if an applicant’s health condition was deemed likely to cause “excessive demand” on Canada’s health or social services.

However, recognizing the importance of human rights and disability Canada, the federal government significantly reformed these rules in 2018. While medical examinations are still required for Canada immigration permanent resident applications, the threshold for what constitutes “excessive demand” has been raised substantially.

Today, most individuals seeking permanent resident eligibility Canada will not be refused solely on the basis of a disability unless their care costs significantly exceed the average per capita health and social services spending, making it highly unlikely for most people. This ensures that skilled workers, family members, and refugees with disabilities can pursue Canadian permanent residency eligibility without undue discrimination.

Conclusion

The Canadian system is designed to provide comprehensive support for all its long-term residents. As a permanent resident of Canada, you possess substantial rights, including access to essential disability and social support programs. Whether you are exploring how to get disability in Canada through federal contribution plans like CPPD or through provincial support systems in high-population areas like Ontario or BC, a PR status ensures you are treated equivalently to a citizen in benefit entitlement.

For guidance on navigating the complex application forms or understanding your specific provincial requirements, utilize resources provided by Service Canada permanent resident services, or consult with immigration and benefits experts like those at Legit Vendor Us to ensure a smooth application process.

Frequently Asked Questions (FAQs)

Q1: Do permanent residents get CPP (Canada Pension Plan)?

Yes, do permanent residents get CPP? They are eligible if they have made sufficient contributions to the CPP during their employment in Canada. CPPD is a contributory benefit, meaning eligibility is based on work history and contributions, not citizenship status.

Q2: Can a permanent resident apply for disability benefits immediately upon arrival?

Generally, no. While PR status grants the right to apply, various programs have residency requirements. Provincial social assistance programs often require you to be a resident of that province for a short period. CPPD requires a history of contributions, which takes time to establish through employment. You must meet the specific Canada disability benefits eligibility criteria for each program.

Q3: What is the difference between a Canadian Citizen and a Permanent Resident regarding disability benefits?

In almost all respects concerning access to social security and disability benefits in Canada, there is no functional difference. A PR has full access to provincial healthcare (Canada permanent resident health care), CPPD, provincial disability supports, and the future Canada Disability Benefit, provided they meet the non-status-related criteria (e.g., income, contribution history, medical criteria).

Q4: Does the disability I had before immigrating affect my Permanent Resident Status?

If you successfully obtained permanent resident status Canada, your prior medical history has already been assessed by Immigration, Refugees and Citizenship Canada (IRCC). Once PR status is granted, that disability will not jeopardize your status, provided you continue to meet the permanent resident conditions Canada (i.e., the residency obligation).

Q5: How do I apply for federal disability benefits as a Permanent Resident?

You first need to determine which programs you qualify for. For CPPD, apply through Service Canada permanent resident services, providing the required medical documentation. For the Disability Tax Credit (DTC), you and your practitioner must fill out Form T2201 and submit it to the Canada Revenue Agency (CRA). This often serves as the foundational requirement for many other disability programs.

Showing the single result