car sale title transfer texas

Car Sale Title Transfer Texas: The Complete Guide to Fast, Legal, and Hassle‑Free Ownership Changes

Car sale title transfer Texas is the essential step that turns a signed bill of sale into a legally recognized vehicle ownership record. Whether you’re a first‑time seller, a seasoned dealer, or a buyer looking for peace of mind, mastering the Texas title transfer process saves time, avoids costly mistakes, and protects both parties from future disputes. This comprehensive guide walks you through every requirement, fee, and best practice so you can complete your transaction confidently and efficiently.

In Texas, the Department of Motor Vehicles (TxDMV) and county tax assessor‑collector offices handle title transfers, and the rules are designed to be straightforward—but only when you know where to look. From gathering the right paperwork to understanding electronic title options, each step has its own nuance. By following the roadmap below, you’ll eliminate confusion, stay compliant with state law, and move your new car off the lot (or out of your garage) without delay.

Understanding Texas Car Title Transfer Requirements (Car Sale Title Transfer Texas)

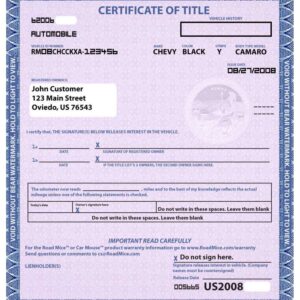

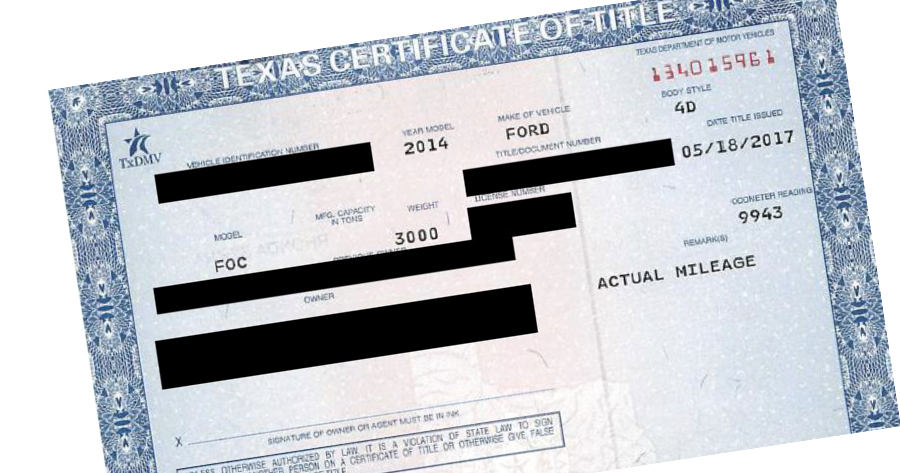

The first pillar of a successful title transfer is knowing exactly what documents the Texas DMV demands. At a minimum, you’ll need the original vehicle title, a properly completed Application for Texas Title and Registration (Form 130‑U), and a notarized Bill of Sale if the title is missing or if the seller is not listed on the title. Both buyer and seller must sign the title in the presence of a notary public, unless the transaction occurs at a county tax office that provides notarization services on site.

In addition to the core paperwork, Texas law requires proof of a current vehicle inspection (if the car is less than two years old) and proof of insurance before registration can be finalized. The buyer must also present a valid Texas driver’s license or ID, and the seller must ensure any liens on the vehicle are released. Failure to provide any of these items can result in delays, additional fees, or even a denied transfer, so double‑checking your checklist is essential.

Step‑by‑Step Process for a Car Sale Title Transfer in Texas (Car Sale Title Transfer Texas)

Step 1: Prepare the Title and Bill of Sale.

Begin by locating the original title. If there’s a lienholder listed, obtain a lien release letter. Complete the back of the title with the buyer’s name, sale price, odometer reading, and the date of sale, then have both parties sign in the presence of a notary. If the title is lost, apply for a duplicate using Form 130‑U and a $2.00 fee.

Step 2: Complete the Application for Texas Title and Registration (Form 130‑U).

This form captures buyer information, vehicle details, and any special plates or exemptions. The buyer fills out the majority of the form, while the seller provides their signature. Remember to include the “Seller’s Disclosure of Odometer Reading” if the vehicle is under ten years old.

Step 3: Gather Supporting Documents.

Collect proof of insurance, a valid driver’s license, and the most recent vehicle inspection report. If you’re transferring a vehicle with a personalized or specialty plate, bring the plate and any related paperwork. For out‑of‑state vehicles, you’ll also need a Vehicle Identification Number (VIN) verification completed by a Texas law enforcement officer or a certified inspection station.

Step 4: Pay Fees and Submit the Package.

Texas title transfer fees are modest: $33 for the title, $28.50 for registration (varies by county), plus any local county fees. Payment can be made by cash, check, or credit/debit card at the county tax office. Many counties now allow electronic submission through the TxDMV’s online portal, which can reduce processing time to as little as 24‑48 hours.

Step 5: Receive the New Title and Registration. Once processed, the buyer receives a new Texas title in the mail (usually within 5‑7 business days). The registration sticker is issued on the spot, allowing the vehicle to be legally driven immediately. Sellers should retain a copy of the Bill of Sale and the notarized title page for their records.

Common Mistakes and How to Avoid Them During Texas Title Transfers (Car Sale Title Transfer Texas)

One of the most frequent errors is neglecting to remove an existing lien before attempting a transfer. If the title still shows a lienholder, the buyer cannot obtain a clean title, and the DMV will reject the application. To avoid this, request a lien release letter from the creditor and verify that the lien is marked as “released” on the title before signing.

Another common pitfall is failing to properly notarize the signatures. Texas law is explicit: the title and any associated documents must be notarized unless the transaction occurs at a county tax office that provides notarization services. Using an uncertified signature can lead to a transfer denial and force both parties back to the drawing board, costing time and money.

Lastly, many buyers overlook the importance of the odometer disclosure. For vehicles less than ten years old, federal law requires an accurate odometer reading. Inaccurate or omitted readings can trigger penalties and potentially expose the seller to legal claims of fraud. Always double‑check the odometer reading, write it legibly on the title and Bill of Sale, and have both parties initial the entry.

Online Options, Fees, and Timeframes for Texas Title Transfers (Car Sale Title Transfer Texas)

Texas has embraced digital solutions to streamline title transfers. Through the TxDMV’s Online Services portal, sellers can submit a “Title Transfer – Private Party” request, upload scanned copies of the notarized title, Bill of Sale, and supporting documents, and pay fees securely. The online system typically processes the transfer within 1‑2 business days, after which the new title is mailed directly to the buyer’s address on file.

While online submissions are convenient, they are not universally accepted for all scenarios. For instance, transfers involving specialty plates, out‑of‑state vehicles, or unresolved liens still require in‑person verification at a county tax office. In such cases, the buyer should schedule an appointment to avoid long wait times; many counties now offer “express lanes” for title transfers that can cut processing times to under an hour.

Fee structures vary slightly by county, but the core statewide fees include a $33 title fee, a $28.50 registration fee (subject to local rates), and a $6.00 inspection fee if a new inspection is required. Optional services—such as expedited processing ($25) or duplicate title requests ($2)—add to the total cost. By budgeting for these fees up front, both parties can ensure a smooth financial transaction without surprise charges.

Legal Implications and Protecting Yourself in a Texas Car Sale (Car Sale Title Transfer Texas)

Beyond paperwork, a car sale in Texas carries legal responsibilities that protect both buyer and seller. The seller must provide a clear title, free of liens, and disclose any known defects or salvage history. Failure to disclose material facts can result in civil liability and potential rescission of the sale. Conversely, the buyer must verify that the Vehicle Identification Number (VIN) on the title matches the physical VIN on the vehicle, ensuring they are not inadvertently purchasing a stolen or cloned car.

To safeguard against fraud, both parties should conduct a VIN check through the National Motor Vehicle Title Information System (NMVTIS) or a reputable service like Carfax. This report reveals any prior accidents, flood damage, or title brands that could affect the vehicle’s value. Additionally, consider obtaining a written “as‑is” clause on the Bill of Sale, which clarifies that the buyer accepts the vehicle in its current condition and releases the seller from future claims.

Finally, retain all transaction records—including the notarized title, Bill of Sale, lien release letters, and inspection reports—for at least three years. These documents serve as proof of ownership and can be critical if you need to dispute a claim, file an insurance claim, or prove compliance with Texas state regulations.

Frequently Asked Questions About Car Sale Title Transfer Texas

Do I need a notary for a private party title transfer in Texas?

Yes. Texas law requires that both the buyer and seller sign the title and any related documents in the presence of a certified notary public, unless the transfer is completed at a county tax office that provides notarization services on site.

Can I transfer a title online?

Yes, the TxDMV offers an online portal for private party title transfers. You can upload scanned copies of the notarized title, Bill of Sale, and supporting documents, and pay the required fees electronically. However, certain situations—such as specialty plates or unresolved liens—still require an in‑person visit.

What happens if the title has a lien?

The lien must be released before the title can be transferred. Obtain a lien release letter from the creditor and ensure the release is indicated on the title. Without a clear title, the DMV will reject the transfer application.

How much does a title transfer cost in Texas?

The core fees are $33 for the title, $28.50 for registration (varies by county), and a $6.00 inspection fee if required. Optional services such as expedited processing or duplicate title requests add additional costs.

How long does it take to receive the new title?

When processed in person, the new title is typically mailed within 5‑7 business days. Online submissions are often processed within 1‑2 business days, after which the title is mailed to the buyer’s address.

Do I need a vehicle inspection before transferring the title?

If the vehicle is less than two years old, a current Texas inspection report is required. For older vehicles, an inspection is only necessary if the car is being registered in Texas for the first time or if the county tax office mandates it.

Can I transfer a title if the seller’s name is misspelled on the title?

Yes, but you’ll need to submit a corrected title application (Form 130‑U) with supporting documentation that proves the correct name, such as a marriage certificate or court order. The correction must be notarized.

Is there a deadline for completing the title transfer after a sale?

Texas law requires the buyer to apply for a new title within 30 days of the purchase. Failing to do so can result in penalties and may affect your ability to register the vehicle.

What is the “as‑is” clause and should I include it?

An “as‑is” clause in the Bill of Sale states that the buyer accepts the vehicle in its current condition, protecting the seller from future liability for defects. It’s recommended for private party sales.

Do I need to inform my insurance company about the title transfer?

Yes. Once the title is transferred, update your insurance policy to reflect the new ownership. Failure to do so may result in coverage gaps or claim denials.

By following this detailed guide, you’ll navigate every nuance of a car sale title transfer in Texas with confidence, ensuring a legal, swift, and stress‑free change of ownership. Ready to close your deal? Gather your documents, schedule a notarization, and start the transfer today—your new ride awaits!

Showing the single result