car title houston texas

Car Title Loans Houston Texas: Your Ultimate Guide to Financial Freedom

In Houston, Texas, car title loans have become a popular option for individuals seeking quick and easy access to cash. With a car title loan, you can use your vehicle’s title as collateral to secure a loan, providing you with the financial freedom to tackle any unexpected expenses or financial emergencies. At Legit Vendor US, we specialize in providing car title loans in Houston Texas, offering a hassle-free and efficient process to get you the cash you need.

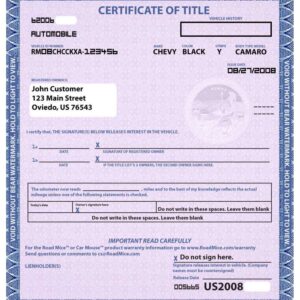

Car title loans are a type of secured loan, which means that you pledge your vehicle’s title as collateral in exchange for the loan amount. This type of loan is ideal for individuals with poor credit or those who have been rejected by traditional lenders. With a car title loan, you can borrow a significant amount of money, often up to 50% of your vehicle’s value, and repay it over a flexible period. Our car title loans Houston Texas are designed to be easy to understand, with no hidden fees or charges.

The process of obtaining a car title loan in Houston, Texas, is relatively simple. You start by filling out an online application or visiting one of our physical locations. Our team will then assess the value of your vehicle and determine the loan amount you are eligible for. Once you agree to the terms, you will hand over your vehicle’s title, and we will provide you with the cash. You can then use the loan amount to cover any expenses or financial emergencies, and repay the loan over the agreed period.

How Car Title Loans Work in Houston Texas

Car title loans in Houston, Texas, work by allowing you to use your vehicle’s title as collateral to secure a loan. The loan amount is determined by the value of your vehicle, and you can borrow up to 50% of its value. The lender will then hold onto your vehicle’s title until the loan is repaid in full. Our car title loans Houston Texas are designed to be flexible, with repayment terms ranging from a few months to a few years. We also offer competitive interest rates, ensuring that you can afford to repay the loan without breaking the bank.

One of the main benefits of car title loans in Houston, Texas, is the speed and efficiency of the process. Unlike traditional loans, which can take weeks or even months to be approved, car title loans can be approved in as little as 30 minutes. This makes them ideal for individuals who need cash quickly, such as in the event of a financial emergency. Our team is dedicated to providing a hassle-free experience, with a simple and straightforward application process that can be completed online or in-person.

Benefits of Car Title Loans in Houston Texas

There are several benefits to using car title loans in Houston, Texas. For one, they provide a quick and easy way to access cash, making them ideal for individuals who need to cover unexpected expenses or financial emergencies. Car title loans also offer flexible repayment terms, allowing you to repay the loan over a period that suits your budget. Additionally, car title loans do not require a credit check, making them accessible to individuals with poor credit or those who have been rejected by traditional lenders.

Another benefit of car title loans in Houston, Texas, is that they allow you to continue driving your vehicle while you repay the loan. This means that you can still use your vehicle for daily activities, such as commuting to work or running errands, while also having access to the cash you need. Our car title loans Houston Texas are designed to be flexible and accommodating, with repayment terms that can be tailored to your individual needs.

Car title loans in Houston, Texas, are also a great option for individuals who need to rebuild their credit. By repaying the loan on time, you can improve your credit score and demonstrate to lenders that you are a responsible borrower. This can make it easier to obtain credit in the future, and can even help you to qualify for better interest rates and terms.

Requirements for Car Title Loans in Houston Texas

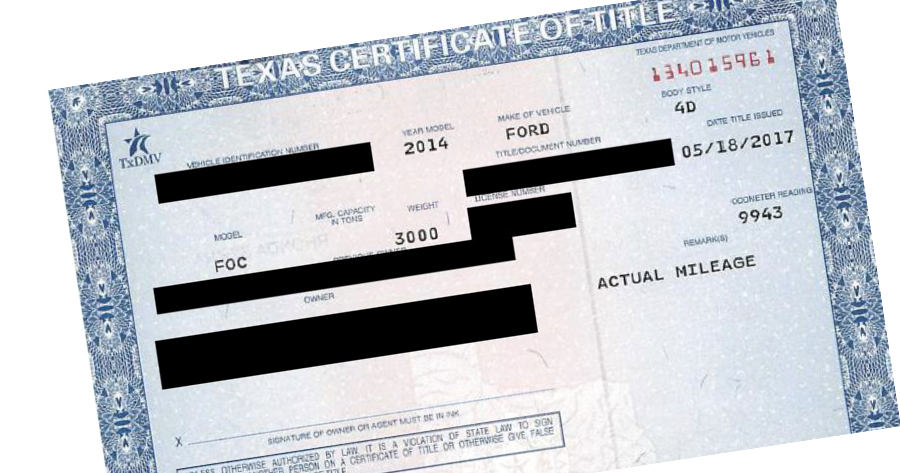

To qualify for a car title loan in Houston, Texas, you will need to meet certain requirements. First and foremost, you must own a vehicle that is free of any liens or outstanding loans. You will also need to provide proof of income, such as a pay stub or bank statement, to demonstrate that you can repay the loan. Additionally, you will need to provide a valid government-issued ID, such as a driver’s license or passport.

Our car title loans in Houston, Texas, also require that you have a clear title to your vehicle. This means that you must be the sole owner of the vehicle, and that there are no other individuals or entities with a claim to the title. You will also need to provide proof of insurance to ensure that the vehicle is protected in the event of an accident or other damage.

In terms of the vehicle itself, we accept a wide range of makes and models, including cars, trucks, and SUVs. The vehicle must be in good condition, with a minimum value of $2,500. We also require that the vehicle be registered in your name and that you have a valid registration sticker.

How to Apply for Car Title Loans in Houston Texas

Applying for a car title loan in Houston, Texas, is a straightforward and efficient process. You can start by filling out our online application, which can be found on our website. The application will ask for some basic information, such as your name, address, and contact details, as well as information about your vehicle, such as its make, model, and year.

Once you have submitted the application, one of our team members will contact you to discuss the next steps. We will need to verify the information you provided and assess the value of your vehicle. This may involve inspecting the vehicle, as well as reviewing your proof of income and ID.

If you are approved for the loan, we will provide you with a loan agreement that outlines the terms and conditions of the loan. This includes the loan amount, interest rate, and repayment terms. You will need to sign the agreement and hand over your vehicle’s title before we provide you with the cash.

Car Title Loans Houston Texas: Frequently Asked Questions

Here are some frequently asked questions about car title loans in Houston, Texas:

Q: How much can I borrow with a car title loan?

A: The amount you can borrow with a car title loan depends on the value of your vehicle. We offer loans of up to 50% of your vehicle’s value.

Q: What are the interest rates for car title loans?

A: Our interest rates are competitive and vary depending on the loan amount and repayment terms.

Q: Can I still drive my vehicle while I repay the loan?

A: Yes, you can continue to drive your vehicle while you repay the loan.

Q: How long does it take to get approved for a car title loan?

A: The approval process for a car title loan is typically quick and can take as little as 30 minutes.

Q: What if I have poor credit?

A: We do not require a credit check for car title loans, making them accessible to individuals with poor credit.

Q: Can I repay the loan early?

A: Yes, you can repay the loan early, and you may be eligible for a reduced interest rate.

Additional Tips and Considerations

Before applying for a car title loan in Houston, Texas, it’s essential to consider the pros and cons. While car title loans can provide quick and easy access to cash, they can also come with high interest rates and fees. It’s crucial to carefully review the loan agreement and understand the terms and conditions before signing.

Additionally, it’s essential to ensure that you can afford to repay the loan. Defaulting on a car title loan can result in the lender repossessing your vehicle, which can have serious consequences. Make sure to create a budget and plan for repayment to avoid any issues.

In conclusion, car title loans in Houston, Texas, can provide a convenient and efficient way to access cash when you need it most. By understanding the requirements, benefits, and process, you can make an informed decision and take control of your financial situation. At Legit vendor us, we are committed to providing a hassle-free and supportive experience, with a team of experts dedicated to helping you every step of the way.

Showing the single result