car title loan online california

Fast & Easy Online Car Title Loan California – Get Cash Today!

If you need quick cash and own a vehicle, online car title loans in California offer a convenient solution. A car title loan allows you to borrow money using your car’s title as collateral—without giving up your vehicle. Whether you’re facing an emergency expense, unexpected bills, or simply need extra funds, California car title loans provide fast approval, competitive rates, and flexible repayment options. Read on to discover how you can secure the money you need while keeping your car on the road!

How Do California Online Car Title Loans Work?

Online car title loans in California provide a simple way to access emergency funds using your vehicle’s title as security. Unlike traditional bank loans, title loans don’t require a perfect credit score—approval is based on your car’s value and your ability to repay the loan. Here’s how it works:

- Apply Online – Fill out a quick application with basic details about your car and financial situation.

- Get Approved Fast – A lender reviews your application and determines your loan amount based on your car’s equity.

- Sign Documents & Get Cash – Once approved, sign the loan agreement and receive funds via direct deposit (often the same day).

- Keep Driving Your Car – You retain full use of your vehicle while repaying the loan.

These loans are ideal for California residents who need fast cash with no credit check, making them a lifeline in financial emergencies.

Why Choose an Online Car Title Loan in California?

If you’re considering a California car title loan, you may wonder why this option stands out over other borrowing methods. Here are the key benefits:

1. Quick & Easy Approval Process

Title loan lenders prioritize speed, meaning you could receive funds in as little as 24 hours. Many lenders do not require a credit check, making approval easier than traditional loans.

2. Keep Driving Your Car

Unlike a pawn shop loan, you keep your car while repaying the loan. The lender only holds the title, not your vehicle.

3. Flexible Repayment Terms

You can choose from various repayment plans, including short-term or installment options, ensuring the loan fits your budget.

4. No Restrictions on Use

Whether you need to cover medical bills, home repairs, or debt consolidation, California title loans let you use the funds however you need.

Eligibility Requirements for CA Title Loans

Before applying for online car title loans in California, you must meet certain criteria:

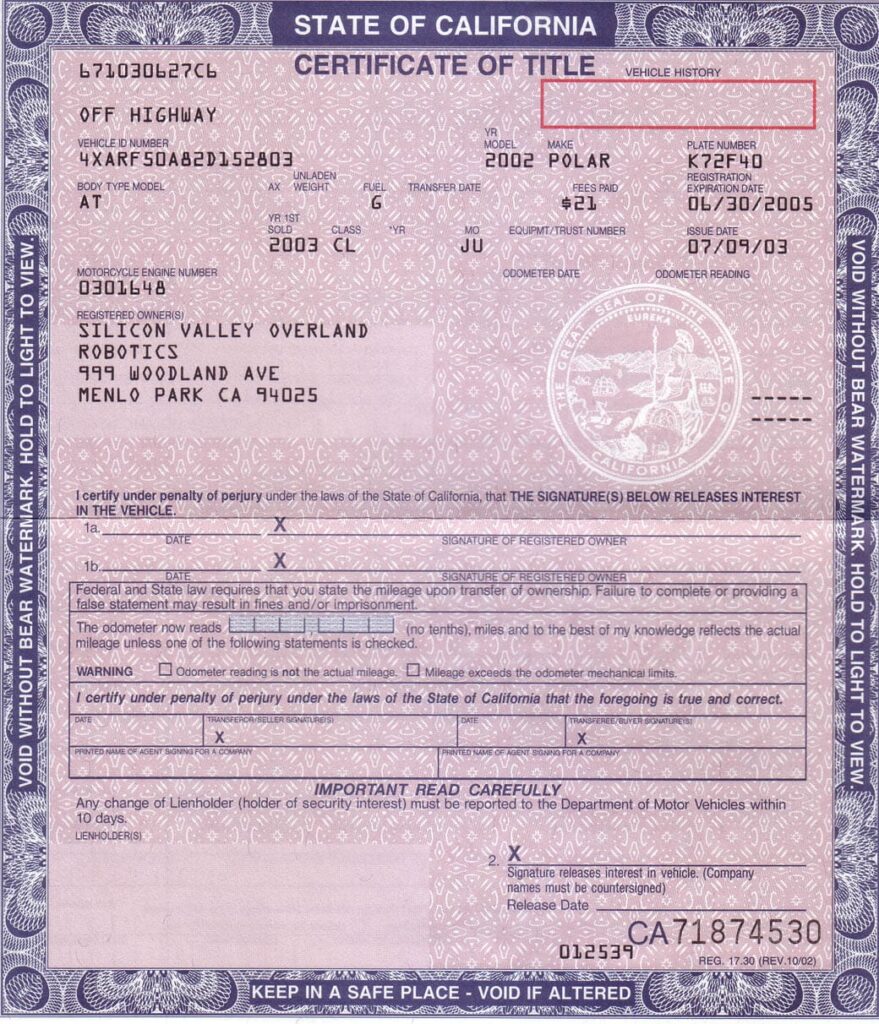

✔ Own a Vehicle with Equity – Your car must be fully or mostly paid off (minimum equity varies by lender).

✔ Valid Government ID – Proof that you’re at least 18 years old.

✔ Proof of Income – While some lenders accept alternative income sources, steady income improves approval odds.

✔ Vehicle Title in Your Name – The car must be registered under your name with no liens (unless refinancing).

✔ Proof of Residency – California residency is required for in-state title loans.

If you meet these requirements, you can typically get same-day funding without lengthy paperwork.

How Much Can You Borrow with a Car Title Loan in California?

The loan amount for California online title loans depends on your vehicle’s market value. Lenders typically offer 25% to 50% of the car’s worth, with loan amounts ranging from $2,500 to $50,000 (varies by lender).

Factors That Determine Your Loan Amount:

- Car’s Make, Model & Year – Newer, high-value vehicles qualify for larger loans.

- Mileage & Condition – Lower mileage and well-maintained cars get higher offers.

- Lender’s Policies – Each lender has different loan-to-value (LTV) ratios.

To get the most cash for your title loan, ensure your car is in good working condition and has minimal damage.

California Title Loan Laws & Regulations

Before applying for online car title loans in California, it’s crucial to understand state laws protecting borrowers:

✔ Interest Rate Caps – California caps title loan APRs to prevent predatory lending.

✔ Loan Terms & Renewals – Lenders must provide clear terms, including repayment schedules and rollover policies.

✔ Right to Rescind – Borrowers may have a brief window to cancel the loan without penalty.

✔ Lender Licensing – Title loan companies must be licensed under the California Department of Financial Protection and Innovation (DFPI).

Always read the loan agreement carefully and ensure your lender follows state compliance guidelines.

How to Get the Best California Online Title Loan Rates

While car title loans in California are convenient, securing the best rates is key to minimizing costs. Follow these steps for a favorable deal:

1. Compare Multiple Lenders

Different lenders offer varying interest rates and terms. Comparing quotes helps you find the most affordable option.

2. Check for Hidden Fees

Some lenders charge origination fees, late penalties, or prepayment penalties. Ensure transparency before signing.

3. Negotiate Loan Terms

If you have a strong repayment ability, you may negotiate lower rates or extended repayment periods.

4. Improve Your Car’s Value

A well-maintained, newer vehicle with low mileage may qualify for a higher loan amount with better rates.

By following these tips, you can secure a low-cost CA title loan that fits your financial needs.

FAQs About California Online Car Title Loans

1. Can I Get a Title Loan with Bad Credit?

Yes! Most car title loan lenders in California don’t require a high credit score since the loan is secured by your car.

2. How Fast Can I Get Money with a Title Loan?

With online lenders, you can receive funds in as little as one business day, sometimes even the same day.

3. What Happens If I Can’t Repay My Title Loan?

If you default, the lender may repossess your car. However, reputable lenders work with borrowers on payment extensions or refinancing.

4. Do I Need a Job to Qualify for a Title Loan?

While traditional income (employment) helps, some lenders accept alternative income sources like disability, social security, or self-employment.

5. Can I Apply for a Title Loan Online in California?

Yes! Many lenders offer 100% online title loans, eliminating the need for in-person visits.

Apply for a Car Title Loan in California Today!

If you’re ready to unlock quick cash with California online car title loans, the process is simple. Compare lenders, choose the best offer, and get approved in minutes. Keep your car, fix your finances, and regain control—apply now!

Need immediate assistance? Contact our team for expert guidance on the best title loan solutions in California.

Showing the single result