car title loan online texas

Car Title Loan Online Texas: Fast, Flexible, and Hassle-Free Financial Solutions

If you’re searching for a car title loan online Texas, you’re not alone. Thousands of Texans turn to car title loans every year as a fast and reliable way to access emergency funds. With your vehicle’s title as collateral, you can secure same-day financing without the lengthy approval processes of traditional banks. Whether you’re facing an unexpected expense or need help bridging the gap between paychecks, an online car title loan in Texas offers a transparent, efficient, and accessible solution tailored to your financial needs.

Texas residents benefit from a lenient lending environment, where state regulations allow for fast approvals and borrower-friendly terms. Unlike conventional loans, car title loans online Texas require minimal credit checks and are designed to accommodate people from all financial backgrounds. This convenience, combined with the ability to maintain use of your vehicle during repayment, makes car title loans one of the most practical short-term financing options available today.

How Car Title Loan Online Texas Works: A Step-by-Step Guide

A car title loan online Texas is a secured loan where borrowers use their vehicle’s title as collateral to obtain immediate cash. The process is designed for speed, simplicity, and transparency. When you apply online, a licensed lender evaluates your vehicle’s market value — based on make, model, year, mileage, and condition — to determine how much you can borrow. Typically, borrowers receive between 25% and 50% of their car’s appraised value, with loan amounts ranging from $500 to $50,000 depending on eligibility.

The entire process is fully digital — from funding application. After submitting basic personal and vehicle information, verified documentation (like a government-issued ID, proof of income, and vehicle registration), and photos of your car, a certified underwriter reviews your case. Many borrowers receive an offer within minutes. Once you accept the loan agreement, funds are typically deposited into your bank account within 24 hours. Since the loan is secured by your vehicle title, your credit score plays a minimal role in approval, making it an ideal option for those with poor or no credit history.

The Online Application Process

Applying for a car title loan online Texas is incredibly user-friendly and can be completed from the comfort of your home or on the go. Most reputable lenders offer mobile-responsive websites, ensuring seamless access whether you’re using a smartphone, tablet, or desktop. The application form is short and secure, protecting your data with SSL encryption. You won’t need to visit a physical location unless required for vehicle inspection (though many lenders now offer virtual inspections via video call).

Within minutes of submitting your application, a loan specialist will contact you to verify details, answer questions, and guide you through the next steps. This personalized support ensures you fully understand the terms, interest rates, repayment schedule, and responsibilities before signing any agreement. Transparency is key — responsible lenders always disclose all fees upfront, so there are no hidden surprises down the line.

Why Choose an Online Title Loan Over In-Person?

Opting for a car title loan online Texas rather than visiting a brick-and-mortar store offers numerous advantages. First and foremost is convenience — no more waiting in long lines or taking time off work. Online lending eliminates geographical barriers, allowing rural and urban Texans alike to access equal financial opportunities. Additionally, digital lenders often have lower overhead costs, which can translate into better rates, faster processing times, and more flexible repayment terms.

Another major benefit is the enhanced privacy and control that comes with managing your loan online. You can review documents at your own pace, compare offers from multiple lenders, and make decisions based on thorough research. Many platforms also provide real-time account dashboards, where you can track your balance, view payment history, and even prepay your loan without penalties — features rarely available at traditional storefronts.

Benefits of Getting a Car Title Loan Online in Texas

One of the standout advantages of a car title loan online Texas is its accessibility. Unlike traditional bank loans that require excellent credit, lengthy applications, and extensive documentation, online title loans are designed for real people dealing with real financial emergencies. Whether you’re rebuilding credit, self-employed, or have gaps in your employment history, you can still qualify as long as you own a vehicle outright or have sufficient equity in it.

Speed is another critical factor. In situations where time matters — such as unexpected medical bills, urgent home repairs, or sudden travel expenses — waiting days or weeks for approval simply isn’t viable. With a car title loan online Texas, you can apply today and have money in your account tomorrow. Many lenders offer same-day funding, especially if your application is submitted early in the business day.

Keep Driving Your Vehicle During Repayment

A common misconception about title loans is that you must surrender your car to the lender. In reality, with a car title loan online Texas, you retain full use of your vehicle throughout the repayment period. This is a crucial benefit for working professionals, caregivers, delivery drivers, or anyone who relies on their car for daily life. As long as you make timely payments, there’s no disruption to your routine — you keep driving, while the lender holds a lien on the title until the loan is repaid in full.

This flexibility empowers borrowers to meet their financial obligations without sacrificing mobility. Whether you’re commuting to work, running errands, or transporting children to school, your transportation remains unaffected. Only in cases of prolonged default would repossession become a possibility — and even then, reputable lenders work proactively with borrowers to avoid this outcome.

No Credit Check Doesn’t Mean No Responsibility

While a car title loan online Texas typically doesn’t require a hard credit check, responsible borrowing is still essential. These loans are not meant to replace long-term financial planning but rather serve as a short-term bridge during emergencies. Because they are secured by your vehicle, failure to repay could result in repossession. However, most lenders offer flexible repayment plans, extended terms, and even refinancing options to help borrowers stay on track.

Moreover, some lenders report your on-time payments to credit bureaus, meaning consistent repayment can actually help improve your credit score over time. This dual benefit — immediate cash plus potential credit improvement — makes car title loans a strategic tool when used wisely.

Transparent Terms and Competitive Rates

Texas law allows for relatively favorable conditions when it comes to title lending. While interest rates may appear higher than traditional loans (due to the short-term, high-risk nature of the product), they are regulated under the Texas Finance Code, ensuring fair practices. Reputable online lenders comply strictly with these regulations and provide clear, itemized breakdowns of all costs.

Borrowers should always compare Annual Percentage Rates (APRs), loan durations, and prepayment policies across different providers. Many online lenders offer 30-day, 90-day, or installment-based repayment schedules, giving you the power to choose a plan that aligns with your budget. Look for lenders who offer rate discounts for autopay enrollment or early repayment incentives.

Who Qualifies for a Car Title Loan Online in Texas?

Eligibility for a car title loan in Texas is straightforward and inclusive. To qualify, you must be at least 18 years old, a legal resident of Texas, and own a vehicle free of major liens. The car should be in operable condition and registered in your name. Most lenders accept cars, trucks, SUVs, motorcycles, and even recreational vehicles — as long as they have clear title and sufficient resale value.

Proof of income is also required, though it doesn’t need to come from traditional employment. Self-employment income, disability benefits, Social Security, pension, or even unemployment can suffice, depending on the lender. This inclusivity makes car title loans online Texas one of the most accessible forms of emergency financing available.

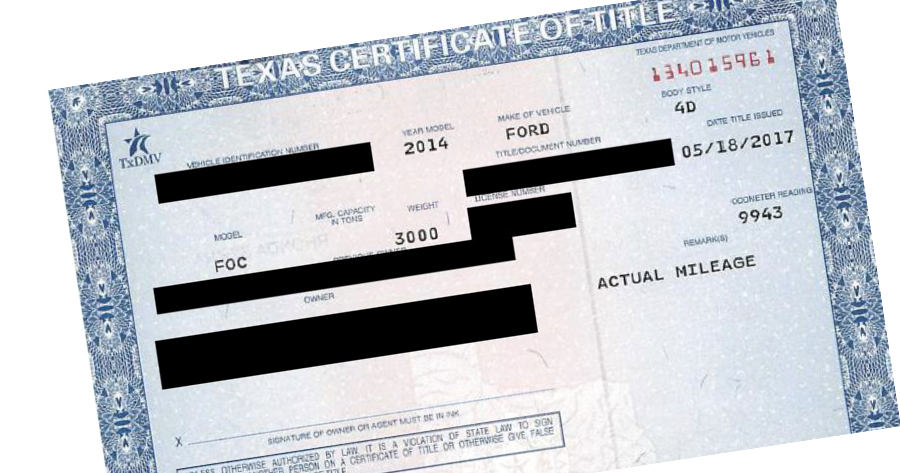

Vehicle Requirements and Appraisal Process

Your vehicle plays a central role in securing a car title loan in Texas. Lenders assess its value using industry-standard tools like Kelley Blue Book (KBB) or National Auto Dealers Association (NADA) guidelines. Factors such as year, make, model, mileage, overall condition, and maintenance history influence the final appraisal. Even older vehicles with high mileage can qualify, provided they run reliably and have a clear title.

During the online evaluation process, you’ll upload photos of the exterior, interior, dashboard, and VIN. Some lenders may request a brief video walkaround to verify the condition. If approved, the lender places a lien on your title, which is released upon full repayment. You maintain ownership and can transfer the title once the loan is settled.

Documents You’ll Need to Apply

To complete your application for a car title loan in Texas, you’ll typically need the following documents:

- A government-issued photo ID (driver’s license or state ID)

- Vehicle title showing clear ownership

- Proof of residency (utility bill, lease agreement)

- Proof of income (pay stubs, bank statements, benefit letters)

- Current vehicle registration

- Insurance information (optional in some cases)

Having these documents ready streamlines the process and increases your chances of fast approval. Most lenders accept digital copies, reducing the need for printing or scanning.

Understanding Loan Amounts and Repayment Terms

Loan amounts for a car title loan online in Texas depend heavily on your vehicle’s value and your ability to repay. On average, borrowers receive between $1,000 and $5,000, though high-value vehicles may qualify for up to $50,000. Repayment terms vary — some lenders offer 30-day balloon payments, while others provide installment plans spanning 3 to 24 months.

It’s important to choose a repayment plan that fits your cash flow. While shorter terms mean higher monthly payments, they also reduce total interest paid. Longer terms lower monthly obligations but increase the overall cost. Always review the amortization schedule and ask your lender to explain any terms you don’t understand.

Legal Protections and Consumer Rights in Texas Title Lending

Texas law provides strong protections for consumers seeking a car title loan online Texas. Under the Texas Finance Code, title lenders must be licensed by the Office of the Consumer Credit Commissioner (OCCC). This ensures accountability, fair practices, and compliance with state regulations. Before signing any agreement, you have the right to receive a full copy of the loan contract, including APR, fees, repayment schedule, and default consequences.

Additionally, Texas law prohibits rollovers or “renewals” of title loans. This means lenders cannot extend your due date by charging additional fees — a practice that previously led to debt cycles. Instead, borrowers can refinance only after repaying at least 20% of the principal, promoting responsible lending and preventing predatory behavior.

Avoiding Predatory Lending Practices

While most online lenders operate ethically, borrowers must remain vigilant against predatory practices. Warning signs include pressure to sign quickly, refusal to provide written terms, excessive fees, or threats of immediate repossession. Always verify a lender’s license through the OCCC website and check customer reviews on trusted platforms like the BBB, Trustpilot, or Google.

Reputable car title loan online Texas providers prioritize education and empowerment. They offer transparent pricing, no-pressure consultations, and dedicated customer service teams to assist you throughout the loan lifecycle.

Right to Rescind and Repossession Rules

Texas law grants borrowers a three-day right to rescind (cancel) a title loan without penalty. This cooling-off period allows you to reconsider your decision and return the funds if necessary. Regarding repossession, lenders must follow strict procedures — including written notice and a 10-day grace period — before taking action. They cannot seize your vehicle without court authorization unless you voluntarily surrender it.

These safeguards ensure that even in difficult financial times, your rights as a consumer are protected.

Comparing Top Online Car Title Loan Lenders in Texas

With so many options available, selecting the best provider for your car title loan online Texas requires careful comparison. Look for lenders with strong reputations, fast funding, competitive rates, and excellent customer service. Some of the top-rated platforms include Max Cash Title Loans, Texas Title Loan Center, Speedy Title Loans, and Lone Star Title Loans — each offering unique benefits such as mobile apps, extended payment windows, or loyalty discounts.

When evaluating lenders, consider factors beyond interest rates — including customer support availability, ease of online management, and flexibility in repayment. Read real user reviews and examine response times to complaints. The best lenders don’t just give you money — they become partners in your financial resilience.

Customer Service and Support Accessibility

A standout feature of premium car title loan online Texas providers is their commitment to customer support. Top-tier lenders offer 24/7 phone assistance, live chat, email support, and comprehensive FAQ sections. This level of service is invaluable during emergencies when quick answers matter. Whether you need help uploading documents, adjusting your payment date, or understanding your balance, responsive support makes all the difference.

Additionally, many lenders assign personal loan representatives to guide you from application to repayment, ensuring a smooth, stress-free experience.

Technology and Security Features

In today’s digital age, security is paramount. Leading online lenders invest in robust cybersecurity measures, including two-factor authentication, encrypted data transmission, and biometric login options. These technologies protect your personal and financial information from fraud and unauthorized access.

User-friendly interfaces, mobile apps, and automated reminders enhance convenience and help prevent missed payments. The best platforms also integrate with budgeting tools and financial wellness resources, supporting long-term stability beyond the loan itself.

Frequently Asked Questions About Car Title Loan Online Texas

Can I get a car title loan online in Texas with bad credit?

Yes, absolutely. A car title loan online Texas does not depend on your credit score. Since the loan is secured by your vehicle, lenders focus more on the car’s value and your ability to repay. Even borrowers with poor or no credit can qualify, making it one of the most inclusive financial solutions available.

How fast can I receive funds from a Texas online title loan?

Most borrowers receive funds within 24 hours of approval, with some lenders offering same-day deposits. Processing speed depends on how quickly you submit required documents and complete verification steps.

Do I need to let the lender keep my car?

No. With a car title loan online Texas, you continue driving your vehicle as normal. The lender only holds the lien on the title until the loan is repaid.

What happens if I can’t repay my title loan on time?

If you’re unable to repay, contact your lender immediately. Many offer extensions, refinancing, or modified payment plans to help you avoid repossession. Texas law also limits late fees and requires formal notice before any action is taken.

Are online car title loans legal in Texas?

Yes, car title loans online Texas are fully legal and regulated under state law. Licensed lenders must adhere to strict guidelines set by the OCCC, ensuring fair treatment and consumer protection.

Can I pay off my loan early without penalties?

Most reputable lenders allow early repayment without fees. In fact, paying early reduces total interest and helps you regain full ownership of your title faster.

What types of vehicles qualify for a title loan?

Cars, trucks, SUVs, motorcycles, vans, and RVs can all qualify, provided they have a clear title, are in working condition, and hold sufficient market value.

With the right knowledge and a trustworthy lender, a car title loan online Texas can be a powerful tool for financial empowerment. It’s not just about getting cash — it’s about regaining control, overcoming obstacles, and moving forward with confidence. Apply today and discover how easy, fast, and secure emergency funding can be.

Showing the single result