online car title loans california

Online Car Title Loans California – Fast Cash When You Need It Most

Are you searching for online car title loans California to secure quick financial relief? At [Your Company Name], we provide fast, hassle-free auto title loans with competitive rates and flexible repayment options. Whether you need emergency funds for medical bills, home repairs, or unexpected expenses, our California car title loans offer a convenient solution. Keep driving your car while accessing the cash you need—no credit check required! Read on to explore how online title loans in California work, their benefits, and answers to common borrower questions.

What Are Online Car Title Loans California?

Online car title loans California allow you to borrow money by using your vehicle’s title as collateral. Unlike traditional bank loans, these loans don’t require extensive paperwork or a perfect credit score. Instead, lenders evaluate your car’s value and approve a loan amount based on that appraisal.

The application process for California car title loans is simple and fast. You submit basic information online, provide details about your vehicle, and receive an instant decision. Once approved, you get the funds deposited directly into your bank account, often on the same day. Best of all, you keep driving your car while repaying the loan.

How Do Online Title Loans in California Work?

Step 1: Apply Online

Applying for online car title loans California is straightforward. Fill out a secure application form with your personal details, vehicle information, and loan request. The process takes just minutes, and lenders provide instant pre-approval decisions.

Step 2: Vehicle Inspection & Approval

After pre-approval, a lender verifies your car’s condition and value. Some lenders allow online title loans in California with minimal documentation, while others may require a quick in-person or virtual inspection.

Step 3: Receive Funds & Keep Your Car

Once approved, you’ll get the loan amount electronically—often the same day. You retain full use of your vehicle while repaying the loan. Payments are structured based on your agreement, making California car title loans a flexible financial solution.

Benefits of Online Car Title Loans in California

1. Fast Approval & Same-Day Funding

Unlike traditional loans that take weeks, online title loans in California provide rapid approvals. Many borrowers receive funds within 24 hours—perfect for emergencies.

2. No Credit Check Required

Since your car secures the loan, lenders don’t require strict credit checks. Even with poor credit, you can qualify for California car title loans based on your vehicle’s equity.

3. Keep Driving Your Car

Unlike pawnshops, online car title loans in California let you retain possession of your car while repaying. You only risk losing your vehicle if you default on payments.

4. Flexible Loan Terms

Lenders offer customized repayment plans, allowing you to choose terms that fit your budget. Whether it’s 12, 24, or 36 months, California title loans adapt to your financial situation.

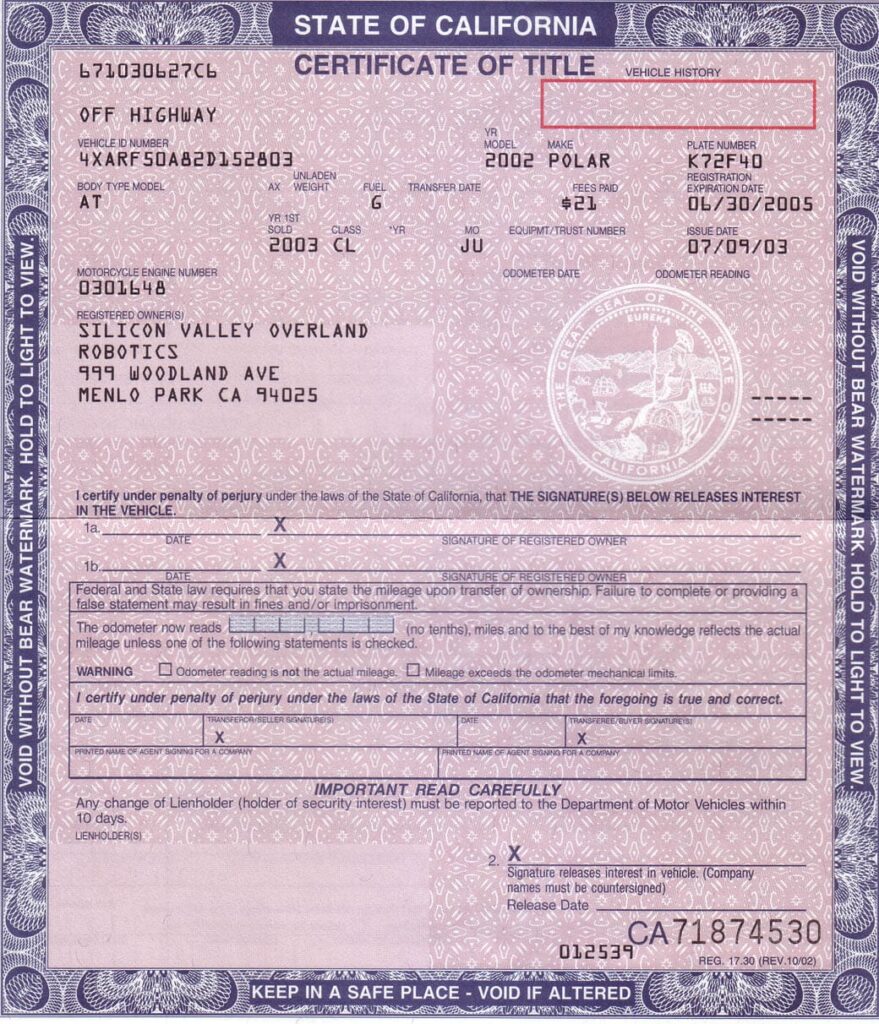

Eligibility Requirements for California Car Title Loans

To qualify for online car title loans in California, you typically need:

✅ A lien-free vehicle title (you own the car outright)

✅ Government-issued ID proving you’re at least 18

✅ Proof of income (employment, benefits, or other sources)

✅ Active auto insurance (some lenders require it)

✅ A valid California residency

There’s no minimum credit score requirement, making California title loans accessible to most borrowers.

How Much Can You Borrow with Online Title Loans in California?

Loan amounts for California car title loans vary based on your car’s market value. Typically, lenders offer:

💰 25% to 50% of your vehicle’s worth (e.g., a $10,000 car could secure a $2,500–$5,000 loan).

💰 Minimum loan amounts start around $1,000.

💰 Maximum loans can reach $50,000+ for high-value vehicles.

Use our free online car title loans California calculator to estimate your borrowing power before applying.

Frequently Asked Questions (FAQs) About Online Car Title Loans in California

1. Can I Get a Title Loan with Bad Credit?

Yes! Online title loans in California don’t require good credit since the loan is secured by your car.

2. How Fast Can I Get Cash from a California Car Title Loan?

Many lenders process applications within hours and fund loans the same day.

3. Do I Need a Job to Qualify?

Not necessarily. Lenders accept alternative income sources like Social Security, disability, or self-employment.

4. What Happens If I Can’t Repay My Loan?

Defaulting may lead to repossession, but lenders often work with borrowers to adjust repayment plans.

5. Are Online Car Title Loans California Safe?

Reputable lenders follow state regulations. Always verify a lender’s license before applying.

Apply for an Online Car Title Loan in California Today!

Need fast cash without the hassle? [Your Company Name] provides quick, reliable California car title loans with competitive rates and transparent terms. Apply now and get approved in minutes—keep your car and get the money you need today!

💻 Visit https://legitvendor.us/

Don’t let financial stress slow you down—drive forward with an online car title loans California solution!

Showing the single result