online car title loans texas

Online Car Title Loans Texas – Fast Cash When You Need It Most

If you’re looking for quick financial relief in Texas, online car title loans offer a convenient and fast solution. Whether it’s an unexpected medical bill, urgent home repair, or any sudden expense, a car title loan Texas allows you to borrow money using your vehicle as collateral—without giving up your car. With minimal credit checks and same-day approval, these loans provide the flexibility you need to regain financial control. Keep reading to discover how you can unlock instant cash while still driving your car!

How Online Car Title Loans Texas Work

Online car title loans Texas are a simple and efficient way to get emergency cash when you need it. Unlike traditional bank loans that require extensive paperwork and high credit scores, title loans use your car’s equity as security. Here’s how it works:

Step 1: Apply Online in Minutes

You can start the process by filling out a quick online form with basic details about yourself and your vehicle. Most lenders in Texas only require minimal information upfront, making the process hassle-free.

Step 2: Get a Fast Approval

Once you submit your application, lenders review your car’s value, condition, and equity. Since credit history isn’t the main factor, approval happens within minutes—sometimes even seconds!

Step 3: Receive Your Cash

After approval, you’ll get a loan offer based on your car’s worth. Funds can be deposited into your bank account as soon as the same day, allowing you to handle financial emergencies immediately.

With online car title loans in Texas, you keep driving your car while repaying the loan in flexible installments. This convenience makes them a preferred choice for Texans who need cash without long waiting periods.

Benefits of Choosing a Texas Car Title Loan

Why should you consider a car title loan in Texas over other borrowing options? Here are the key advantages:

No Credit Check Required

Unlike traditional loans, online car title loans Texas don’t rely heavily on your credit score. Even if you’ve been denied by banks before, you can still qualify based on your vehicle’s value.

Fast Access to Cash

Emergencies can’t wait. With same-day approvals and direct deposits, you won’t have to wait weeks for funds. Some lenders even offer instant decisions and funding within hours.

Keep Driving Your Car

You retain full use of your vehicle while repaying the loan. As long as you make timely payments, your car stays with you—unlike pawn shops that keep your vehicle until repayment.

Flexible Repayment Plans

Repayment terms are designed to fit your budget. Whether you need a short-term or extended repayment plan, lenders work with you to find a manageable solution.

With these benefits, it’s clear why Texas car title loans are a go-to financial tool for many residents facing unexpected expenses.

Eligibility Requirements for Online Car Title Loans in Texas

Getting a car title loan Texas is easy, but you must meet a few basic criteria:

- Own a Vehicle with Equity – Your car must be fully or mostly paid off (no major outstanding loans).

- Have a Valid Texas ID – Proof of residency and age (18+) are required.

- Provide Proof of Income – Lenders want assurance that you can repay the loan, but even non-traditional income sources (freelancing, gig work, etc.) may qualify.

- Active Auto Insurance – Your vehicle must be insured under your name.

How Much Can You Borrow with a Texas Title Loan?

Loan amounts depend on your car’s market value, condition, and equity. Typically, lenders offer 25% to 50% of your car’s appraised value, ranging from $500 to $50,000 or more.

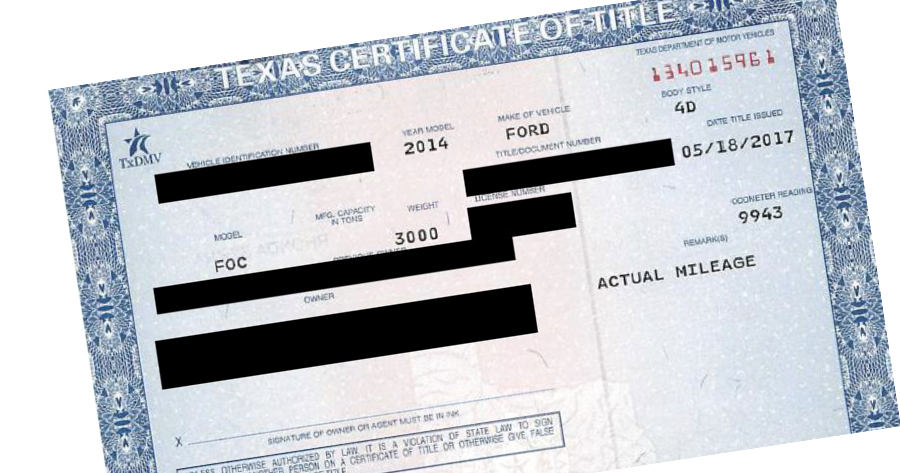

What Documents Do You Need?

- Vehicle title (free of major liens)

- Government-issued ID

- Proof of income (pay stubs, bank statements)

- Proof of residence (utility bill, lease agreement)

- Car insurance documents

With minimal requirements and fast processing, online car title loans Texas make emergency funding accessible.

Risks and Considerations of Texas Car Title Loans

While car title loans Texas provide quick cash, it’s important to understand potential risks:

High-Interest Rates

Title loans often have higher interest rates than traditional loans due to their short-term nature. Always compare lenders to find the best terms.

Repossession Risk

If you default on payments, the lender can legally repossess your vehicle. However, reputable lenders work with borrowers to adjust payment plans before this happens.

Short Repayment Terms

Most title loans require repayment within 30 days to 24 months. If you need a longer term, discuss extended plans with your lender.

How to Avoid Pitfalls

- Only borrow what you can repay.

- Read the contract thoroughly before signing.

- Ask about refinancing options if needed.

- Avoid rolling over loans repeatedly to prevent debt accumulation.

By understanding these risks, you can make an informed decision when applying for online car title loans Texas.

How to Choose the Best Texas Title Loan Lender

Not all lenders are the same. Follow these steps to find a reputable car title loan Texas provider:

Check for State Licensing

Ensure the lender is licensed to operate in Texas and complies with state regulations.

Read Customer Reviews

Look for testimonials and ratings on third-party sites like the Better Business Bureau (BBB) and Trustpilot.

Compare Interest Rates & Fees

Some lenders charge hidden fees. Get quotes from multiple providers to find the lowest rates.

Evaluate Customer Support

A good lender should offer 24/7 support and clear communication.

Look for Flexible Repayment Options

Choose a lender that allows early repayment without penalties or offers payment extensions if needed.

Taking these precautions ensures you secure the best online car title loans Texas with fair terms.

Frequently Asked Questions (FAQs) About Car Title Loans Texas

What is the maximum loan amount I can get with a Texas title loan?

Most lenders offer 25%–50% of your car’s value, with maximums up to $50,000 or more, depending on equity.

How fast can I get cash from a car title loan Texas?

Many lenders approve applications within minutes and deposit funds the same day or next business day.

Is my credit score checked for a Texas title loan?

No, credit checks are not required for most online car title loans Texas—approval is based on your vehicle’s value.

Can I still drive my car with a title loan?

Yes! You keep driving your car as long as you make payments on time.

What happens if I can’t repay my Texas title loan?

Lenders may offer extensions or refinancing. If unpaid, the lender can repossess the vehicle—always communicate financial difficulties early.

Are online car title loans Texas safe?

Yes, as long as you choose a licensed lender with transparent terms and read the agreement carefully.

Final Thoughts: Secure Your Financial Freedom Today

When an emergency strikes, online car title loans Texas provide a lifeline—fast cash without credit hassles. Whether you’re facing medical bills, home repairs, or unexpected expenses, a car title loan in Texas gives you the flexibility to regain control quickly.

Ready to apply? Find a trusted lender, submit your details, and unlock the funds you need—often within hours! Don’t let financial stress hold you back; take action today and get back on track.

🚗 Apply Now for Fast Approval!

Showing the single result